Question: PLEASE HELP ME OUT HERE-BE SPECIFIC 2. Thanks- Alderman Labs performs a specialty lab test for local companies for $48 per test. For the upcoming

PLEASE HELP ME OUT HERE-BE SPECIFIC

2. Thanks-

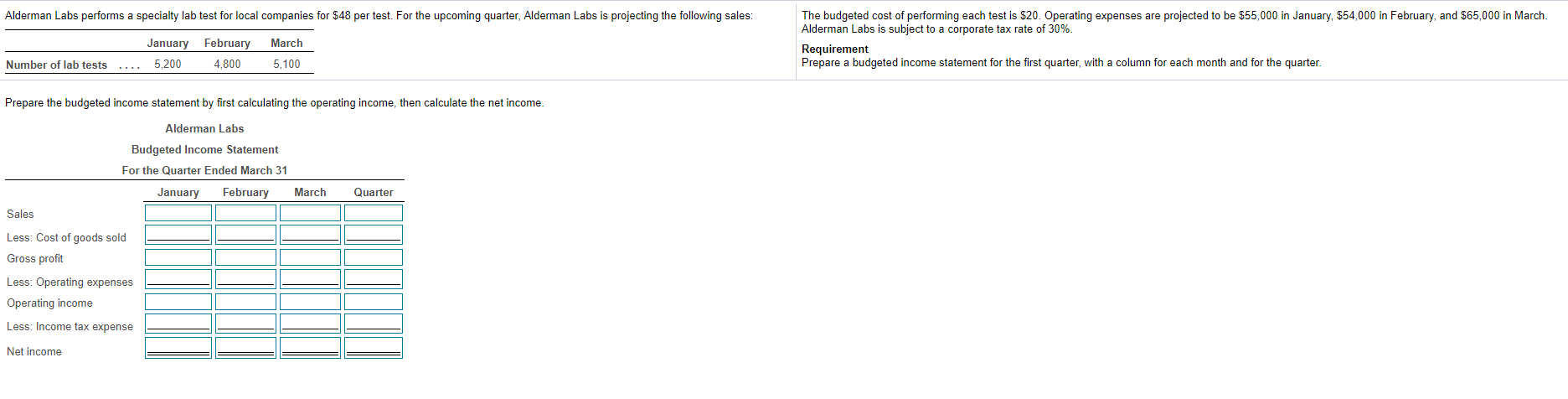

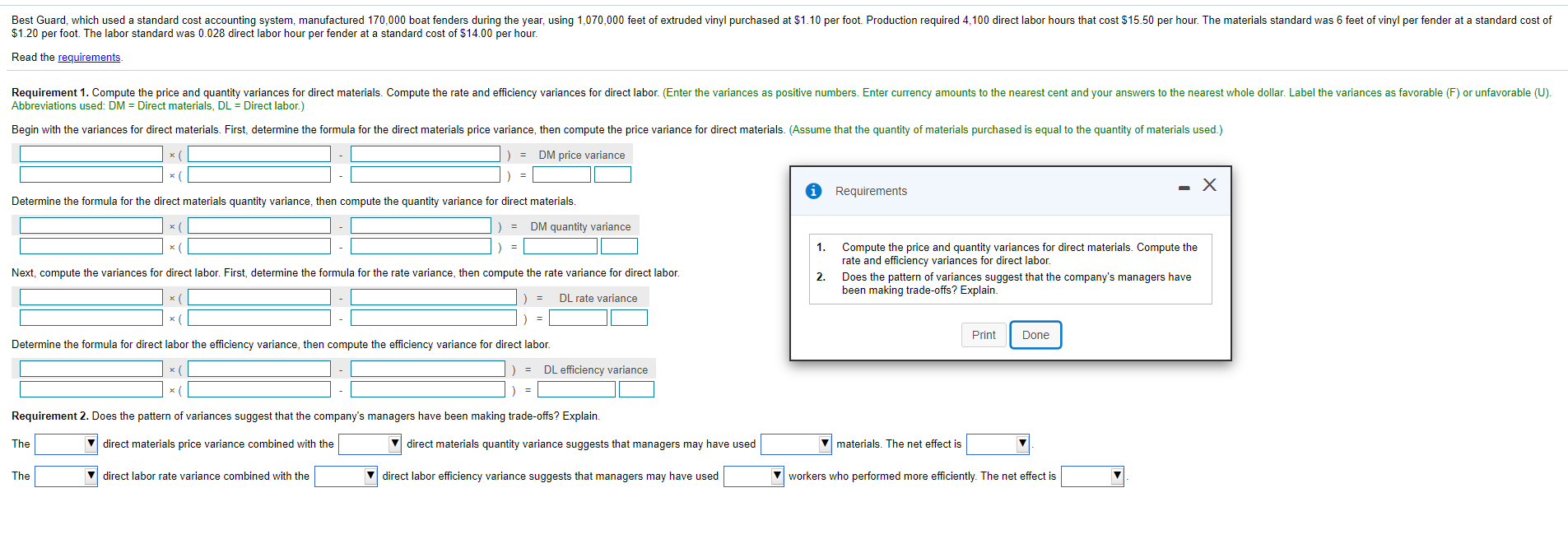

Alderman Labs performs a specialty lab test for local companies for $48 per test. For the upcoming quarter, Alderman Labs is projecting the following sales: March January February 5,200 4,800 The budgeted cost of performing each test is $20. Operating expenses are projected to be $55,000 in January, $54,000 in February, and $65,000 in March. Alderman Labs is subject to a corporate tax rate of 30%. Requirement Prepare a budgeted income statement for the first quarter, with a column for each month and for the quarter. Number of lab tests 5.100 Prepare the budgeted income statement by first calculating the operating income, then calculate the net income. Alderman Labs Budgeted Income Statement For the Quarter Ended March 31 January February March Quarter Sales Less: Cost of goods sold Gross profit Less: Operating expenses Operating income Less: Income tax expense Net income Best Guard, which used a standard cost accounting system, manufactured 170,000 boat fenders during the year, using 1,070,000 feet of extruded vinyl purchased at $1.10 per foot. Production required 4.100 direct labor hours that cost $15.50 per hour. The materials standard was 6 feet of vinyl per fender at a standard cost of $1.20 per foot. The labor standard was 0.028 direct labor hour per fender at a standard cost of $14.00 per hour. Read the requirements. Requirement 1. Compute the price and quantity variances for direct materials. Compute the rate and efficiency variances for direct labor. (Enter the variances as positive numbers. Enter currency amounts to the nearest cent and your answers to the nearest whole dollar. Label the variances as favorable (F) or unfavorable (U). Abbreviations used: DM = Direct materials, DL = Direct labor.) Begin with the variances for direct materials. First, determine the formula for the direct materials price variance, then compute the price variance for direct materials. Assume that the quantity of materials purchased is equal to the quantity of materials used.) = DM price variance Requirements -X Determine the formula for the direct materials quantity variance, then compute the quantity variance for direct materials DM quantity variance 1. Next, compute the variances for direct labor. First, determine the formula for the rate variance, then compute the rate variance for direct labor. Compute the price and quantity variances for direct materials. Compute the rate and efficiency variances for direct labor. Does the pattern of variances suggest that the company's managers have been making trade-offs? Explain. 2. DL rate variance = Print Done Determine the formula for direct labor the efficiency variance, then compute the efficiency variance for direct labor. = DL efficiency variance Requirement 2. Does the pattern of variances suggest that the company's managers have been making trade-offs? Explain. The direct materials price variance combined with the direct materials quantity variance suggests that managers may have used materials. The net effect is The direct labor rate variance combined with the direct labor efficiency variance suggests that managers may have used workers who performed more efficiently. The net effect is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts