Question: Please help me out@@. Thank you so much Prepare a border and adjustment in Payable. The correction cash receipts should be made to Accounts Receivable)

Please help me out@@. Thank you so much

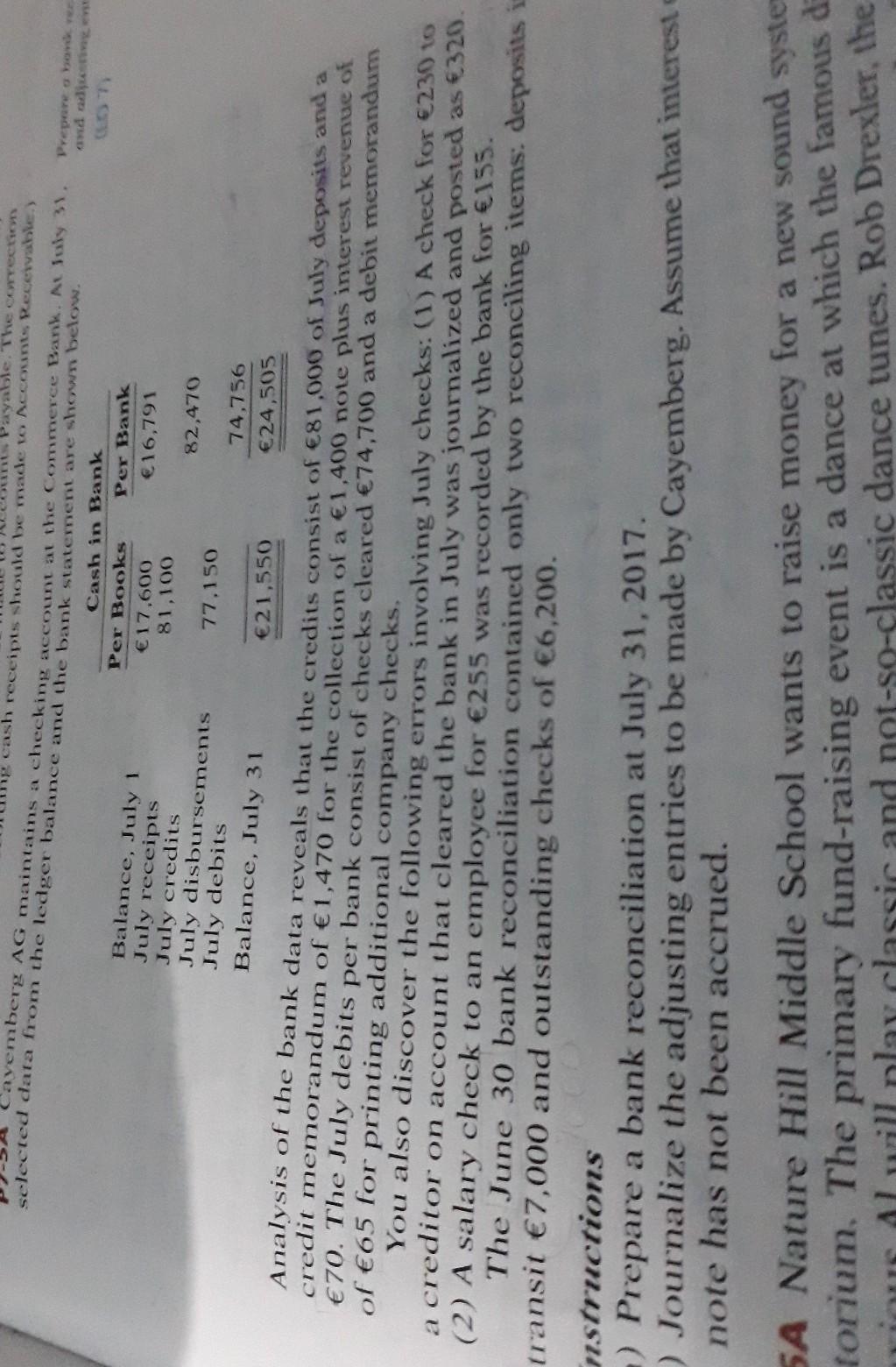

Prepare a border and adjustment in Payable. The correction cash receipts should be made to Accounts Receivable) Cavemberg AG maintains a checking account at the Commerce Bank. At Suly 31. selected data from the ledger balance and the bank statement are shown below. Cash in Bank Per Books Per Bank Balance, July 1 17.600 16,791 July receipts 81,100 July credits 82,470 July disbursements 77,150 July debits 74,756 Balance, July 31 21,550 24,505 Analysis of the bank data reveals that the credits consist of 81.000 of July deposits and a credit memorandum of 1,470 for the collection of a 1,400 note plus interest revenue of 70. The July debits per bank consist of checks cleared 74,700 and a debit memorandum of 65 for printing additional company checks. You also discover the following errors involving July checks: (1) A check for 230 to a creditor on account that cleared the bank in July was journalized and posted as 320. (2) A salary check to an employee for 255 was recorded by the bank for 155. The June 30 bank reconciliation contained only two reconciling items. deposits i transit 7,000 and outstanding checks of 6,200. nstructions - Prepare a bank reconciliation at July 31, 2017 ) Journalize the adjusting entries to be made by Cayemberg. Assume that interest note has not been accrued. 5A Nature Hill Middle School wants to raise money for a new sound system forium. The primary fund-raising event is a dance at which the famous de till nlay classic and not-so-classic dance tunes. Rob Drexler, the LISA Prepare a border and adjustment in Payable. The correction cash receipts should be made to Accounts Receivable) Cavemberg AG maintains a checking account at the Commerce Bank. At Suly 31. selected data from the ledger balance and the bank statement are shown below. Cash in Bank Per Books Per Bank Balance, July 1 17.600 16,791 July receipts 81,100 July credits 82,470 July disbursements 77,150 July debits 74,756 Balance, July 31 21,550 24,505 Analysis of the bank data reveals that the credits consist of 81.000 of July deposits and a credit memorandum of 1,470 for the collection of a 1,400 note plus interest revenue of 70. The July debits per bank consist of checks cleared 74,700 and a debit memorandum of 65 for printing additional company checks. You also discover the following errors involving July checks: (1) A check for 230 to a creditor on account that cleared the bank in July was journalized and posted as 320. (2) A salary check to an employee for 255 was recorded by the bank for 155. The June 30 bank reconciliation contained only two reconciling items. deposits i transit 7,000 and outstanding checks of 6,200. nstructions - Prepare a bank reconciliation at July 31, 2017 ) Journalize the adjusting entries to be made by Cayemberg. Assume that interest note has not been accrued. 5A Nature Hill Middle School wants to raise money for a new sound system forium. The primary fund-raising event is a dance at which the famous de till nlay classic and not-so-classic dance tunes. Rob Drexler, the LISA

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts