Question: Please help me out with this case CASE 7-2 Cosmetics Giants Segment the Global Cosmetics Market The world's best-known cosmetics companies are setting their sights

Please help me out with this case

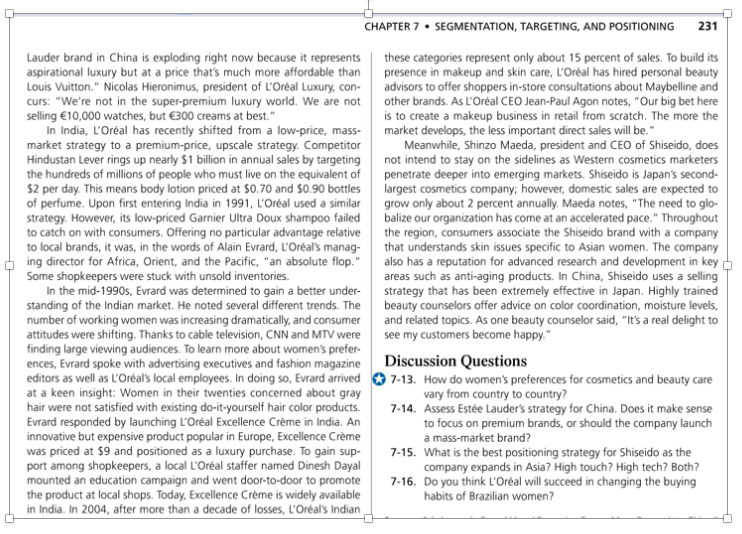

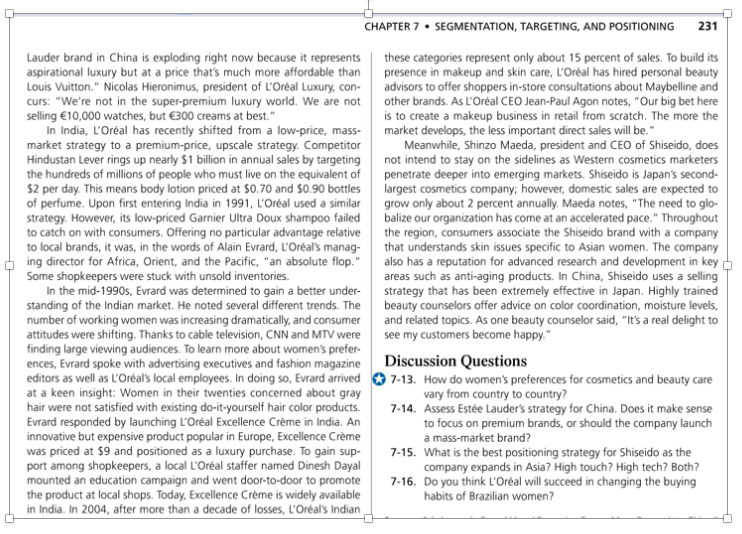

CASE 7-2 Cosmetics Giants Segment the Global Cosmetics Market The world's best-known cosmetics companies are setting their sights on a lucrative new market segment: the emerging mid- dle classes in countries such as Brazil, Russia, India, and China. For example, the Chinese spent $10.3 billion on cosmetics and toiletries in 2005; that figure has doubled in the last few years. Not surprisingly, marketers at L'Oral, Procter & Gamble, Shiseido, and Este Lauder Companies are moving quickly. William Lauder, president and CEO of Este Lauder, calls China a "$100 billion opportunity." Noting that there is no "one-size-fits-all" ideal of beauty, COS- metics marketers pride themselves on sensitivity to local cultural preferences. As Jean-Paul Agon, chief executive of L'Oral, explains, "We have different customers. Each customer is free to have her own aspirations. Our intention is just to respond as well as possible to each customer aspiration. Some want to be gorgeous, some want to be natural, and we just have to offer them the best quality and the best product to satisfy their wishes and their dreams." For example, many Asian women use whitening creams to lighten and brighten their complexions; in China, white skin is associated with wealth. L'Oral responded by creating White Perfect; Shiseido offers Aupres White. compact foundation rather than a liquid. Humidity here is much higher and the emphasis is on long-lasting coverage. Armed with this knowledge, L'Oral devotes more development time to compacts rather than liquids. The researchers have also learned that the typical Japanese woman cleanses her face twice a day. in China, L'Oral and its competitors have an opportunity to educate women about cosmetics, which were banned prior to 1982. Each year, L'Oral observes and films 6,000 Chinese women applying and removing makeup. Alice Laurent, L'Oral's skincare development manager in Shanghai, says. "In China, the number of products used in the morning and the evening is 2.2." At its Shanghai Innovation Centre, L'Oral is also studying how to incorporate traditional Chinese medicine into new product lines. L'Oral offers a wide range of products in China, including both mass-market and premium brands. The company pursues a localiza- tion product strategy, with more than 80 percent of its Asian products developed specifically for the region. L'Oral's Lancme luxury brand is typically sold in exclusive shopping districts that have upscale shops and luxury malls. L'Oral has also capitalized on the opportunity to target a new demographic: Chinese men. The Chinese market for men's skincare products is growing much faster than the market for women's skincare. Many of the purchases are made by women during shopping trips when couples go out together. Increasing numbers of Chinese men view appearance as a key to success, with skincare prod- ucts playing an important role in male grooming. Although mass-market cosmetic lines are exhibiting slow growth, the demand for luxury cosmetics is growing rapidly. This is especially true outside of China's main metropolitan centers. Consumers in Tier "You can't just import cosmetics here. Companies have to understand what beauty means to Chinese women and what they look for, and product offerings and communication have to be adjusted accordingly. It's a lot harder than selling shampoo or skin care." -Daisy Ching, regional group account director for Procter & Gamble, Grey Global Group Market research is critical to understanding women's prefer ences in different parts of the world. According to Eric Bone, head of L'Oral's Tokyo Research Center, "Japanese women prefer to use LOREAL PARIS es sur ILIUL JULIUS wy r us , vus these cities represent only about 9 percent of China's population. As these markets become saturated, L'Oral and other cosmetics marketers are targeting Tier 2 provincial capitals such as Nanjing. Tier 3 cities such as Zhenjiang are typically prefectural centers: China has approximately 260 such cities, with a combined population of more than 200 million people. An additional 300 million people live in Tier 4 and Tier 5 cities. Notes Stphane Rinderknech, a L'Oral general manager based in China, "Three-quarters of China's urban population live outside Tier-One and Tier-Two cities and they account for two- thirds of retail sales." Este Lauder's focus is on expensive prestige brands such as Este Lauder, Clinique, and MAC, which are sold through upmarket depart- ment stores. Like its competitors, Lauder is achieving growth in China by targeting new cities. As a company spokesperson explained, "More of Este Lauder's growth is expected to come from expansion and awareness-building in tier-two and three cities as tier-one cities begin to mature." One research analyst cautions that Este Lauder's targeting and positioning may be too narrow for China. According to Access Asia, Este Lauder "is in danger of becoming too exclusively placed at the top end of the market and it may have to reposition itself more in the mass market to compete for a larger part of the Chinese market." Este Lauder's Carol Shen disagrees with that assessment. She views her company's brands as aspirational. "Chinese consumers are price sensitive but at the same time are willing to invest in products that are relatively expensive versus their income levels because they are so confident about the future," she says. Shen's views are shared by other industry leaders. As CEO William Lauder explains, "The Este KEA Exhibit 7-11 L'Oral is expanding distribution in China. After successful market tests at Walmart and Carrefour stores, L'Oral Paris, Maybelline, Garnier, and other brands are now available in retail stores as well as Chinese supermarkets. In 2006, L'Oral China launched a new advertis- ing campaign for the Mininurse Professional UV cosmetics line targeting women 18 years of age to 25 years of age. The ads communicate the brand's core benefits: UV protection, daytime skin whitening action, and nighttime hydrating action Source: AP Images CHAPTER 7. SEGMENTATION, TARGETING, AND POSITIONING 231 Lauder brand in China is exploding right now because it represents aspirational luxury but at a price that's much more affordable than Louis Vuitton." Nicolas Hieronimus, president of L'Oral Luxury, con curs: "We're not in the super-premium luxury world. We are not selling 10,000 watches, but 300 creams at best." In India, L'Oral has recently shifted from a low-price, mass- market strategy to a premium-price, upscale strategy. Competitor Hindustan Lever rings up nearly $1 billion in annual sales by targeting the hundreds of millions of people who must live on the equivalent of $2 per day. This means body lotion priced at $0.70 and $0.90 bottles of perfume. Upon first entering India in 1991, L'Oral used a similar strategy. However, its low-priced Garnier Ultra Doux shampoo failed to catch on with consumers. Offering no particular advantage relative to local brands, it was, in the words of Alain Evrard, L'Oral's manag- ing director for Africa, Orient, and the Pacific, "an absolute flop." Some shopkeepers were stuck with unsold inventories. In the mid-1990s, Evrard was determined to gain a better under- standing of the Indian market. He noted several different trends. The number of working women was increasing dramatically, and consumer attitudes were shifting. Thanks to cable television, CNN and MTV were finding large viewing audiences. To learn more about women's prefer- ences, Evrard spoke with advertising executives and fashion magazine editors as well as L'Oral's local employees. In doing so, Evrard arrived at a keen insight: Women in their twenties concerned about gray hair were not satisfied with existing do-it-yourself hair color products. Evrard responded by launching L'Oral Excellence Crme in India. An innovative but expensive product popular in Europe, Excellence Crme was priced at $9 and positioned as a luxury purchase. To gain sup- port among shopkeepers, a local L'Oral staffer named Dinesh Dayal mounted an education campaign and went door-to-door to promote the product at local shops. Today, Excellence Crme is widely available in India. In 2004, after more than a decade of losses, L'Oral's Indian these categories represent only about 15 percent of sales. To build its presence in makeup and skin care, L'Oral has hired personal beauty advisors to offer shoppers in-store consultations about Maybelline and other brands. As L'Oral CEO Jean-Paul Agon notes, "Our big bet here is to create a makeup business in retail from scratch. The more the market develops, the less important direct sales will be." Meanwhile, Shinzo Maeda, president and CEO of Shiseido, does not intend to stay on the sidelines as Western cosmetics marketers penetrate deeper into emerging markets. Shiseido is Japan's second- largest cosmetics company, however, domestic sales are expected to grow only about 2 percent annually. Maeda notes, "The need to glo- balize our organization has come at an accelerated pace." Throughout the region, consumers associate the Shiseido brand with a company that understands skin issues specific to Asian w also has a reputation for advanced research and development in key areas such as anti-aging products. In China, Shiseido uses a selling strategy that has been extremely effective in Japan. Highly trained beauty counselors offer advice on color coordination, moisture levels, and related topics. As one beauty counselor said, "It's a real delight to see my customers become happy." Discussion Questions 7-13. How do women's preferences for cosmetics and beauty care vary from country to country? 7-14. Assess Este Lauder's strategy for China. Does it make sense to focus on premium brands, or should the company launch a mass-market brand? 7-15. What is the best positioning strategy for Shiseido as the company expands in Asia? High touch? High tech? Both? 7-16. Do you think L'Oral will succeed in changing the buying habits of Brazilian women? . , , : operations became profitable. Brazil is another important market for the global cosmetics giants. On a per capita basis, Brazilian women spend more on beauty products than their counterparts elsewhere. Overall, Brazil is the third- largest global cosmetics market, after the United States and Japan. Natura Cosmticos, a Brazilian company, and Avon are market-share leaders here, traditionally, Brazilians have bought their cosmetics from sales representatives who go door-to-door. This creates a challenge for L'Oral and other companies that distribute their products through department stores, drug stores, and pharmacies. Although L'Oral has operated in Brazil for decades, the focus has been on hair care products. Worldwide, makeup and skin care represent about 50 percent of L'Oral's sales; by contrast, in Brazil Sources: Scheherazade Daneshkhu, "Cosmetics Groups Move Deeper into China," Financial Times (April 23, 2013), p. 15, Christina Passariello. "To L'Oral, Brazil's Women Need Fresh Style of Shopping. The Wall Street Journal Canuary 21, 2011). p. B1: Patti Waldemeir, "L'Oral Changes the face of Men in China, Financial Times (May 29, 2010). p. 17; Miki Tanikawa, "A Personal Touch Counts in Cosmetics," The New York Times (February 17, 2009), p. 34: Passariello, "L'Oral Net Gets New-Market Lift, The Wall Street Journal (February 14, 2008). p. C7; Ellen Byron, "Beauty, Prestige, and Worry Lines," The Wall Street Journal (August 20, 2007), p. B3, Passariello, "Beauty Fix Behind L'Oral's Makeover in India: Going Upscale." The Wall Street Journal Uuly 13, 2007), pp. A1, A14 Beatrice Adams, "Big Brands Are Watching You," Financial Times (November 4/5, 2006). p. W18, Adam Jones, "How to Make Up Demand," Financial Times (October 3, 2006). p. 8; Lauren Foster and Andrew Yeh, "Este Lauder Puts on a New Face, Financial Times (March 23, 2006). p. 7Laurel Wentz, "P&G Launches Cover Girl in China, Advertising Age (October 31, 2005). p. 22: Rebecca Rose,"Global Diversity Gets All Cosmetic, Financial Times (April 11/12, 2004), p. W11