Question: Please help me .. Please help me .. Please help me .. Please help me .. PART A 2017 (RM) 56,000 26,000 135,000 92,000 300,000

Please help me .. Please help me .. Please help me .. Please help me ..

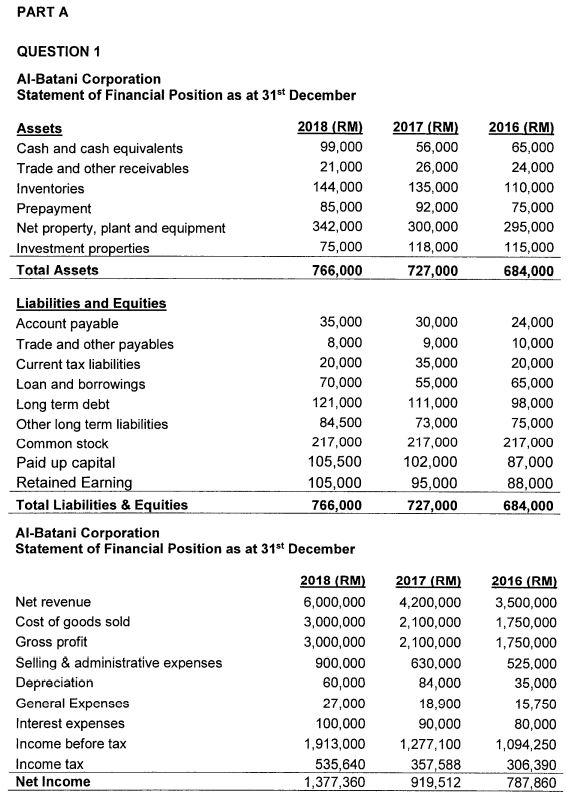

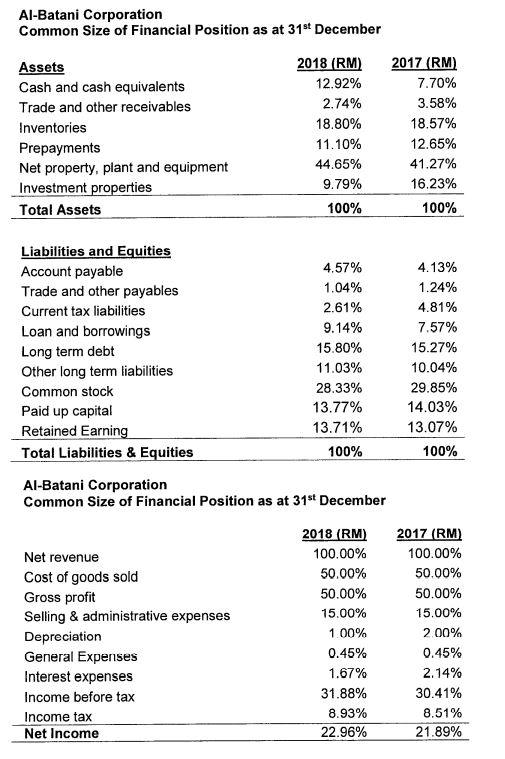

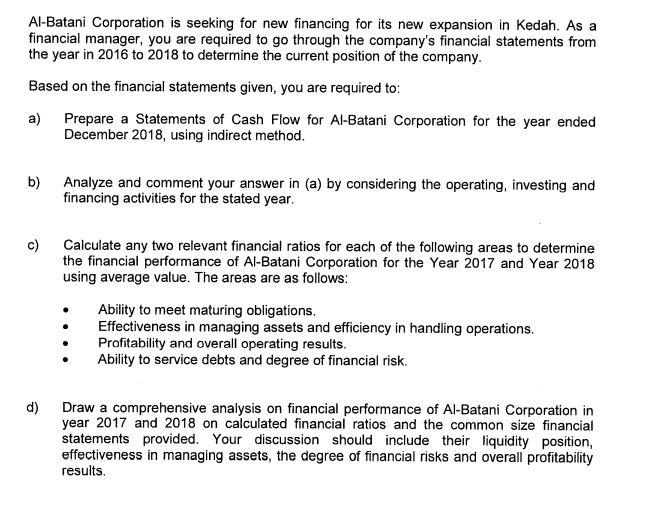

PART A 2017 (RM) 56,000 26,000 135,000 92,000 300,000 118,000 727,000 2016 (RM) 65,000 24,000 110,000 75,000 295,000 115,000 684,000 QUESTION 1 Al-Batani Corporation Statement of Financial Position as at 31st December Assets 2018 (RM) Cash and cash equivalents 99,000 Trade and other receivables 21,000 Inventories 144,000 Prepayment 85,000 Net property, plant and equipment 342,000 Investment properties 75,000 Total Assets 766,000 Liabilities and Equities Account payable 35,000 Trade and other payables 8,000 Current tax liabilities 20,000 Loan and borrowings 70,000 Long term debt 121,000 Other long term liabilities 84,500 Common stock 217,000 Paid up capital 105,500 Retained Earning 105,000 Total Liabilities & Equities 766,000 Al-Batani Corporation Statement of Financial Position as at 31st December 2018 (RM) Net revenue 6,000,000 Cost of goods sold 3,000,000 Gross profit 3,000,000 Selling & administrative expenses 900,000 Depreciation 60,000 General Expenses 27,000 Interest expenses 100,000 Income before tax 1,913,000 Income tax 535,640 Net Income 1,377,360 30,000 9,000 35,000 55,000 111,000 73,000 217,000 102,000 95,000 727,000 24,000 10,000 20,000 65,000 98,000 75,000 217,000 87,000 88,000 684,000 2017 (RM) 4,200,000 2,100,000 2,100,000 630,000 84,000 18,900 90,000 1,277,100 357,588 919,512 2016 (RM) 3,500,000 1,750,000 1,750,000 525,000 35,000 15,750 80,000 1,094,250 306,390 787,860 Al-Batani Corporation Common Size of Financial Position as at 31st December Assets Cash and cash equivalents Trade and other receivables Inventories Prepayments Net property, plant and equipment Investment properties Total Assets 2018 (RM) 12.92% 2.74% 18.80% 11.10% 44.65% 9.79% 100% 2017 (RM) 7.70% 3.58% 18.57% 12.65% 41.27% 16.23% 100% Liabilities and Equities Account payable Trade and other payables Current tax liabilities Loan and borrowings Long term debt Other long term liabilities Common stock Paid up capital Retained Earning Total Liabilities & Equities 4.57% 1.04% 2.61% 9.14% 15.80% 11.03% 28.33% 13.77% 13.71% 100% 4.13% 1.24% 4.81% 7.57% 15.27% 10.04% 29.85% 14.03% 13.07% 100% Al-Batani Corporation Common Size of Financial Position as at 31st December Net revenue Cost of goods sold Gross profit Selling & administrative expenses Depreciation General Expenses Interest expenses Income before tax Income tax Net Income 2018 (RM) 100.00% 50.00% 50.00% 15.00% 1.00% 0.45% 1.67% 31.88% 8.93% 22.96% 2017 (RM) 100.00% 50.00% 50.00% 15.00% 2.00% 0.45% 2.14% 30.41% 8.51% 21.89% Al-Batani Corporation is seeking for new financing for its new expansion in Kedah. As a financial manager, you are required to go through the company's financial statements from the year in 2016 to 2018 to determine the current position of the company. Based on the financial statements given, you are required to: a) Prepare a Statements of Cash Flow for Al-Batani Corporation for the year ended December 2018, using indirect method. b) Analyze and comment your answer in (a) by considering the operating, investing and financing activities for the stated year. c) Calculate any two relevant financial ratios for each of the following areas to determine the financial performance of Al-Batani Corporation for the Year 2017 and Year 2018 using average value. The areas are as follows: Ability to meet maturing obligations. Effectiveness in managing assets and efficiency in handling operations. Profitability and overall operating results. Ability to service debts and degree of financial risk. d) Draw a comprehensive analysis on financial performance of Al-Batani Corporation in year 2017 and 2018 on calculated financial ratios and the common size financial statements provided. Your discussion should include their liquidity position, effectiveness in managing assets, the degree of financial risks and overall profitability results

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts