Question: Please help me . Please please please Question 3 (14 points) Question 23 (7+7=14 marks) Part 1: Jack Ltd owns all the share capital of

Please help me . Please please please

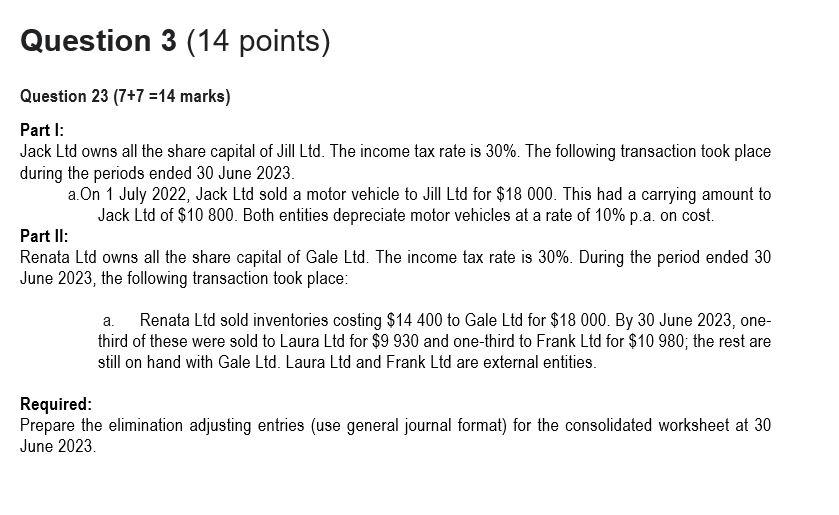

Question 3 (14 points) Question 23 (7+7=14 marks) Part 1: Jack Ltd owns all the share capital of Jill Ltd. The income tax rate is 30%. The following transaction took place during the periods ended 30 June 2023. a.On 1 July 2022, Jack Ltd sold a motor vehicle to Jill Ltd for $18 000. This had a carrying amount to Jack Ltd of $10 800. Both entities depreciate motor vehicles at a rate of 10% p.a. on cost. Part II: Renata Ltd owns all the share capital of Gale Ltd. The income tax rate is 30%. During the period ended 30 June 2023, the following transaction took place: a. Renata Ltd sold inventories costing $14 400 to Gale Ltd for $18 000. By 30 June 2023, one- third of these were sold to Laura Ltd for $9 930 and one-third to Frank Ltd for $10 980; the rest are still on hand with Gale Ltd. Laura Ltd and Frank Ltd are external entities. Required: Prepare the elimination adjusting entries (use general journal format) for the consolidated worksheet at 30 June 2023

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts