Question: Please help me . Please . safe me . I will give good upvote .. Chung Sdn. Bhd. is considering to purchase a new welding

Please help me . Please . safe me . I will give good upvote ..

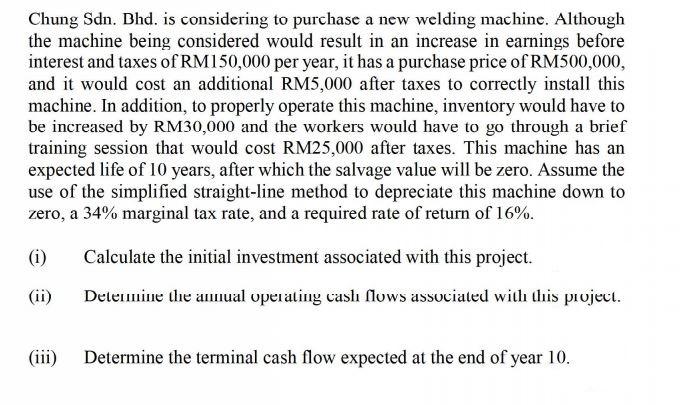

Chung Sdn. Bhd. is considering to purchase a new welding machine. Although the machine being considered would result in an increase in earnings before interest and taxes of RM150,000 per year, it has a purchase price of RM500,000, and it would cost an additional RM5,000 after taxes to correctly install this machine. In addition, to properly operate this machine, inventory would have to be increased by RM30,000 and the workers would have to go through a brief training session that would cost RM25,000 after taxes. This machine has an expected life of 10 years, after which the salvage value will be zero. Assume the use of the simplified straight-line method to depreciate this machine down to zero, a 34% marginal tax rate, and a required rate of return of 16%. (1) Calculate the initial investment associated with this project. (ii) Determine the annual operating casl lows associated with this project. (iii) Determine the terminal cash flow expected at the end of year 10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts