Question: Please help me . Please safe me .. I will give upvote . Nina Cosmetics is considering a project with a series of positive cash

Please help me . Please safe me .. I will give upvote .

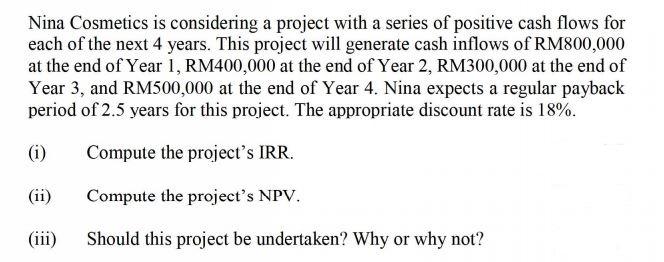

Nina Cosmetics is considering a project with a series of positive cash flows for each of the next 4 years. This project will generate cash inflows of RM800,000 at the end of Year 1, RM400,000 at the end of Year 2, RM300,000 at the end of Year 3, and RM500,000 at the end of Year 4. Nina expects a regular payback period of 2.5 years for this project. The appropriate discount rate is 18%. (i) Compute the project's IRR. (ii) Compute the project's NPV. (iii) Should this project be undertaken? Why or why not

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts