Question: Please help me. Please safe me . Urgent . I will gv upvote please help me Farman Enterprise has sales of 150,000 units at RM2.00

Please help me. Please safe me . Urgent . I will gv upvote please help me

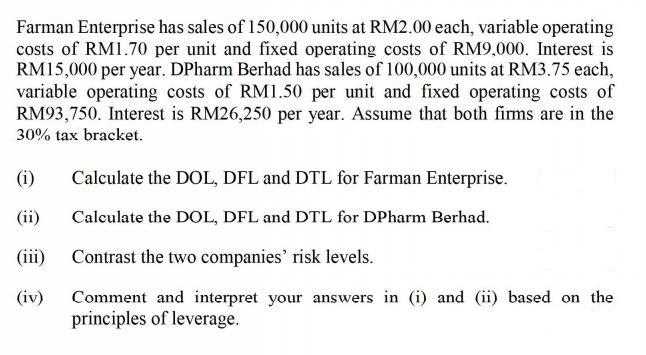

Farman Enterprise has sales of 150,000 units at RM2.00 each, variable operating costs of RM1.70 per unit and fixed operating costs of RM9,000. Interest is RM15,000 per year. DPharm Berhad has sales of 100,000 units at RM3.75 each, variable operating costs of RM1.50 per unit and fixed operating costs of RM93,750. Interest is RM26,250 per year. Assume that both firms are in the 30% tax bracket. (i) Calculate the DOL, DFL and DTL for Farman Enterprise. Calculate the DOL, DFL and DTL for DPharm Berhad. (ii) (iv) Contrast the two companies' risk levels. Comment and interpret your answers in (i) and (ii) based on the principles of leverage

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts