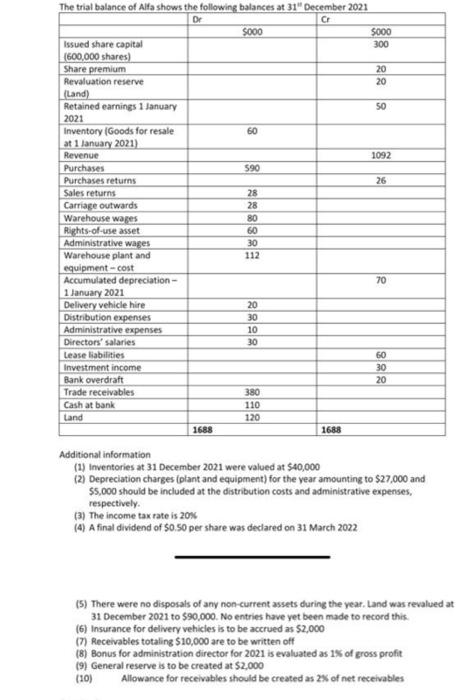

Question: please help me prepare a change in equity statement please help me prepare balance sheet, statement of profit and loss and statement of change in

Additional information (1) Inventories at 31 December 2021 were valued at 540,000 (2) Depreciation charges (plant and equipment) for the year amounting to $27,000 and $5,000 should be included at the distribution costs and administrative expenses, respectively. (3) The income tax rate is 2014 (4) A final dividend of 50.50 per share was declared on 31 March 2022 (5) There were no disposals of any non-current assets during the year. Land was revalued at 31 December 2021 to $90,000. No entries have yet been made to record this. (6) insurance for delivery vehicles is to be accrued as $2,000 (7) Receivables totaling $10,000 are to be written off (8) Bonus for administration director for 2021 is evaluated as 15 of gross profit (9) General reserve is to be created at $2,000 (10) Allowance for receivables should be created as 2% of net receivables Additional information (1) Inventories at 31 December 2021 were valued at 540,000 (2) Depreciation charges (plant and equipment) for the year amounting to $27,000 and $5,000 should be included at the distribution costs and administrative expenses, respectively. (3) The income tax rate is 2014 (4) A final dividend of 50.50 per share was declared on 31 March 2022 (5) There were no disposals of any non-current assets during the year. Land was revalued at 31 December 2021 to $90,000. No entries have yet been made to record this. (6) insurance for delivery vehicles is to be accrued as $2,000 (7) Receivables totaling $10,000 are to be written off (8) Bonus for administration director for 2021 is evaluated as 15 of gross profit (9) General reserve is to be created at $2,000 (10) Allowance for receivables should be created as 2% of net receivables

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts