Question: Please help me put these into a cash flow from operating activities using the indirect method for probelm 25 and the direct method for problem

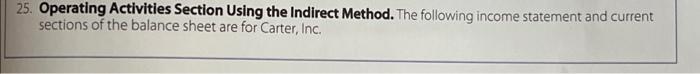

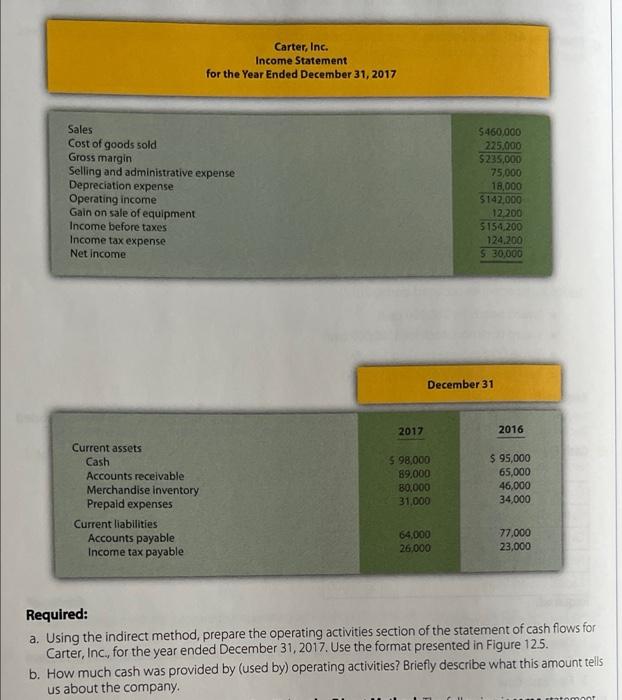

25. Operating Activities Section Using the Indirect Method. The following income statement and current sections of the balance sheet are for Carter, Inc. Carter, Inc. Income Statement for the Year Ended December 31, 2017 Sales Cost of goods sold Gross margin Selling and administrative expense Depreciation expense Operating income Gain on sale of equipment Income before taxes Income tax expense Net income Current assets Cash Current liabilities $460,000 225,000 $235,000 75,000 18,000 $142,000 12,200 $154,200 124.200 $ 30,000 December 31 2017 2016 $ 98,000 $ 95,000 Accounts receivable 89,000 65,000 80,000 46,000 Merchandise inventory Prepaid expenses 31,000 34,000 Accounts payable 64,000 77,000 Income tax payable 26,000 23,000 Required: a. Using the indirect method, prepare the operating activities section of the statement of cash flows for Carter, Inc., for the year ended December 31, 2017. Use the format presented in Figure 12.5. b. How much cash was provided by (used by) operating activities? Briefly describe what this amount tells us about the company. mont 26. (Appendix) Operating Activities Section Using the Direct Method. The following income statement and current sections of the balance sheet are for Carter, Inc. (this is the same information as the previous exercise). Carter, Inc. Income Statement for the Year Ended December 31, 2017 Sales Cost of goods sold Gross margin Selling and administrative expense Depreciation expense Operating income Gain on sale of equipment Income before taxes Income tax expense Net income 2017 2016 Current assets Cash $ 98,000 $ 95,000 Accounts receivable 89,000 65,000 80,000 46,000 Merchandise inventory Prepaid expenses 31,000 34,000 64,000 77,000 Accounts payable Income tax payable 26,000 23,000 Required: a. Using the direct method, prepare the operating activities section of the statement of cash flows for Carter, Inc., for the year ended December 31, 2017. Use the format presented in Figure 12.12. b. How much cash was provided by (used by) operating activities? Briefly describe what this amount tells us about the company.. Current liabilities $460,000 225,000 $235,000 75,000 18,000 $142,000 12,200 $154,200 124,200 $ 30,000 December 31

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts