Question: Please help me Question 3 (25 marks) Part(a) Perdana Sdn Bhd had several subsidiary companies. Extracts from the group's consolidated financial statements for the year

Please help me

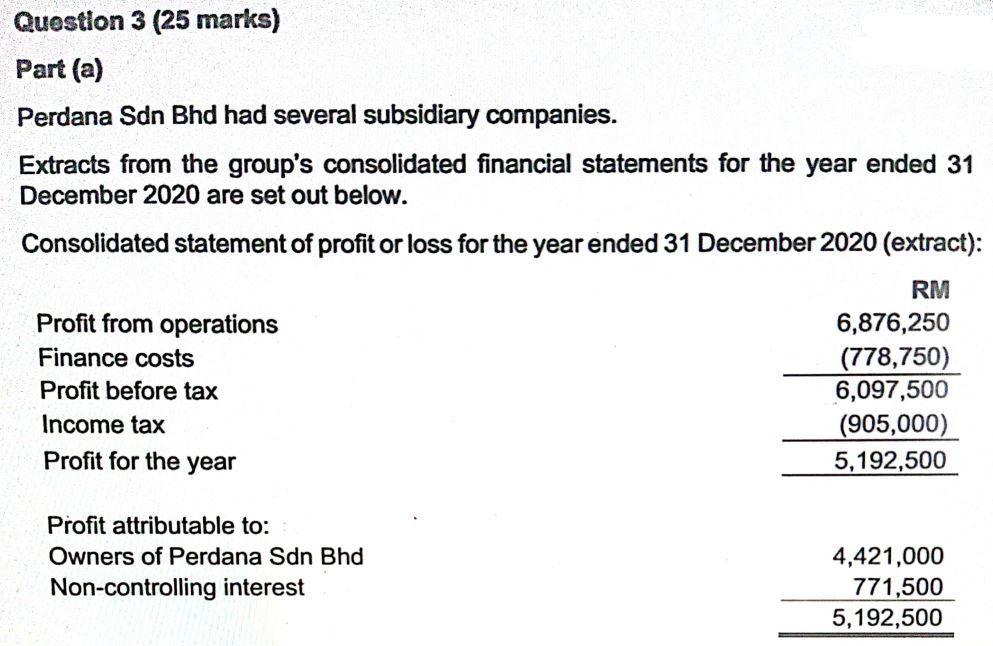

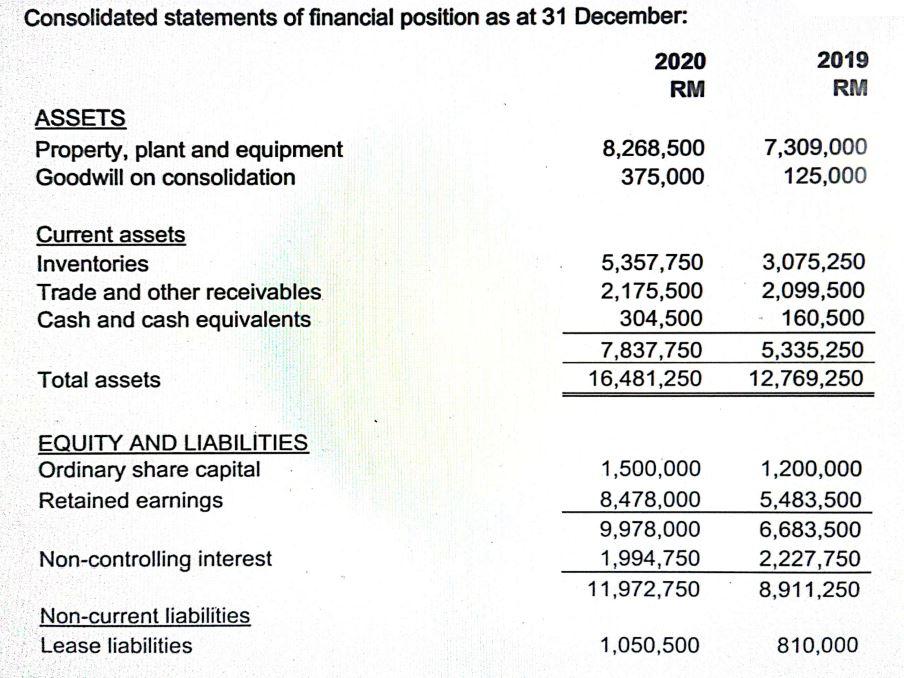

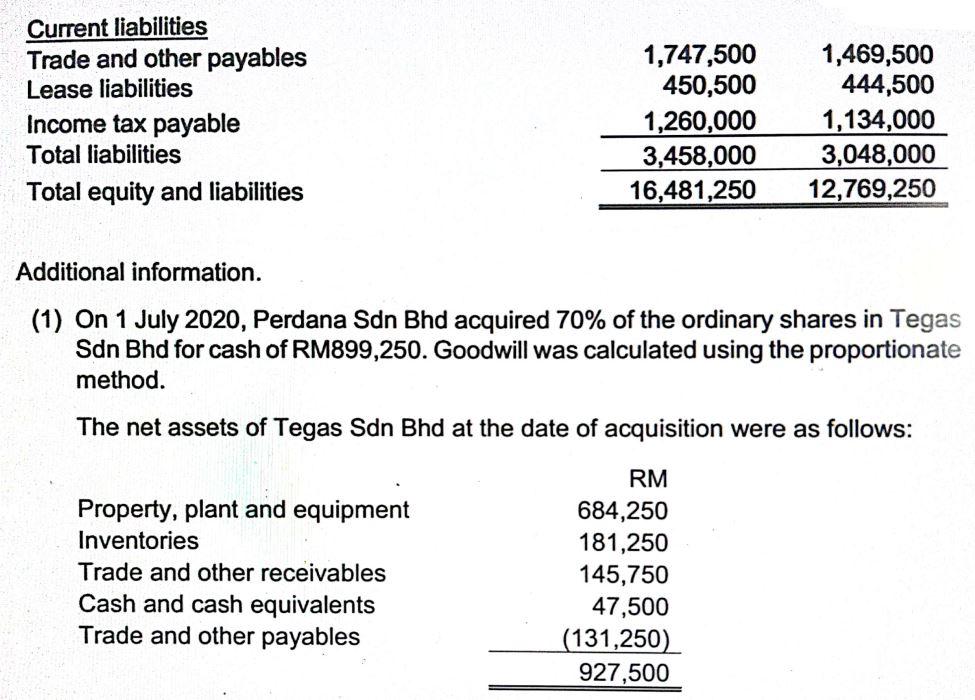

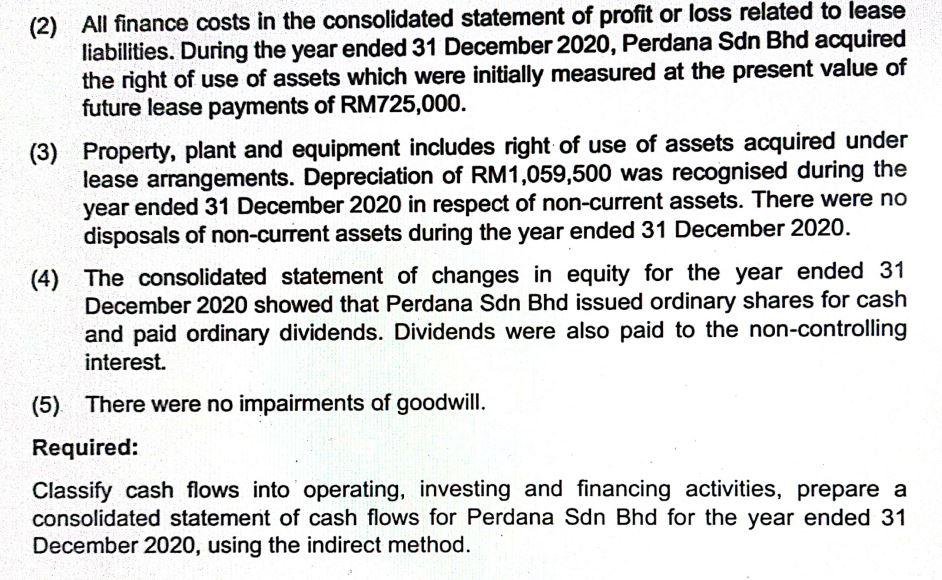

Question 3 (25 marks) Part(a) Perdana Sdn Bhd had several subsidiary companies. Extracts from the group's consolidated financial statements for the year ended 31 December 2020 are set out below. Consolidated statement of profit or loss for the year ended 31 December 2020 (extract): RM Profit from operations 6,876,250 Finance costs (778,750) Profit before tax 6,097,500 Income tax (905,000) Profit for the year 5,192,500 Profit attributable to: Owners of Perdana Sdn Bhd Non-controlling interest 4,421,000 771,500 5,192,500 Consolidated statements of financial position as at 31 December: 2020 RM 2019 RM ASSETS Property, plant and equipment Goodwill on consolidation 8,268,500 375,000 7,309,000 125,000 Current assets Inventories Trade and other receivables Cash and cash equivalents 5,357,750 2,175,500 304,500 7,837,750 16,481,250 3,075,250 2,099,500 160,500 5,335,250 12,769,250 Total assets EQUITY AND LIABILITIES Ordinary share capital Retained earnings 1,500,000 8,478,000 9,978,000 1,994,750 11,972,750 1,200,000 5,483,500 6,683,500 2,227,750 8,911,250 Non-controlling interest Non-current liabilities Lease liabilities 1,050,500 810,000 Current liabilities Trade and other payables Lease liabilities Income tax payable Total liabilities Total equity and liabilities 1,747,500 450,500 1,260,000 3,458,000 16,481,250 1,469,500 444,500 1,134,000 3,048,000 12,769,250 Additional information. (1) On 1 July 2020, Perdana Sdn Bhd acquired 70% of the ordinary shares in Tegas Sdn Bhd for cash of RM899,250. Goodwill was calculated using the proportionate method. The net assets of Tegas Sdn Bhd at the date of acquisition were as follows: Property, plant and equipment Inventories Trade and other receivables Cash and cash equivalents Trade and other payables RM 684,250 181,250 145,750 47,500 (131,250) 927,500 (2) All finance costs in the consolidated statement of profit or loss related to lease liabilities. During the year ended 31 December 2020, Perdana Sdn Bhd acquired the right of use of assets which were initially measured at the present value of future lease payments of RM725,000. (3) Property, plant and equipment includes right of use of assets acquired under lease arrangements. Depreciation of RM1,059,500 was recognised during the year ended 31 December 2020 in respect of non-current assets. There were no disposals of non-current assets during the year ended 31 December 2020. (4) The consolidated statement of changes in equity for the year ended 31 December 2020 showed that Perdana Sdn Bhd issued ordinary shares for cash and paid ordinary dividends. Dividends were also paid to the non-controlling interest. (5) There were no impairments of goodwill. Required: Classify cash flows into operating, investing and financing activities, prepare a consolidated statement of cash flows for Perdana Sdn Bhd for the year ended 31 December 2020, using the indirect method. Question 3 (25 marks) Part(a) Perdana Sdn Bhd had several subsidiary companies. Extracts from the group's consolidated financial statements for the year ended 31 December 2020 are set out below. Consolidated statement of profit or loss for the year ended 31 December 2020 (extract): RM Profit from operations 6,876,250 Finance costs (778,750) Profit before tax 6,097,500 Income tax (905,000) Profit for the year 5,192,500 Profit attributable to: Owners of Perdana Sdn Bhd Non-controlling interest 4,421,000 771,500 5,192,500 Consolidated statements of financial position as at 31 December: 2020 RM 2019 RM ASSETS Property, plant and equipment Goodwill on consolidation 8,268,500 375,000 7,309,000 125,000 Current assets Inventories Trade and other receivables Cash and cash equivalents 5,357,750 2,175,500 304,500 7,837,750 16,481,250 3,075,250 2,099,500 160,500 5,335,250 12,769,250 Total assets EQUITY AND LIABILITIES Ordinary share capital Retained earnings 1,500,000 8,478,000 9,978,000 1,994,750 11,972,750 1,200,000 5,483,500 6,683,500 2,227,750 8,911,250 Non-controlling interest Non-current liabilities Lease liabilities 1,050,500 810,000 Current liabilities Trade and other payables Lease liabilities Income tax payable Total liabilities Total equity and liabilities 1,747,500 450,500 1,260,000 3,458,000 16,481,250 1,469,500 444,500 1,134,000 3,048,000 12,769,250 Additional information. (1) On 1 July 2020, Perdana Sdn Bhd acquired 70% of the ordinary shares in Tegas Sdn Bhd for cash of RM899,250. Goodwill was calculated using the proportionate method. The net assets of Tegas Sdn Bhd at the date of acquisition were as follows: Property, plant and equipment Inventories Trade and other receivables Cash and cash equivalents Trade and other payables RM 684,250 181,250 145,750 47,500 (131,250) 927,500 (2) All finance costs in the consolidated statement of profit or loss related to lease liabilities. During the year ended 31 December 2020, Perdana Sdn Bhd acquired the right of use of assets which were initially measured at the present value of future lease payments of RM725,000. (3) Property, plant and equipment includes right of use of assets acquired under lease arrangements. Depreciation of RM1,059,500 was recognised during the year ended 31 December 2020 in respect of non-current assets. There were no disposals of non-current assets during the year ended 31 December 2020. (4) The consolidated statement of changes in equity for the year ended 31 December 2020 showed that Perdana Sdn Bhd issued ordinary shares for cash and paid ordinary dividends. Dividends were also paid to the non-controlling interest. (5) There were no impairments of goodwill. Required: Classify cash flows into operating, investing and financing activities, prepare a consolidated statement of cash flows for Perdana Sdn Bhd for the year ended 31 December 2020, using the indirect method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts