Question: Please help me Question 2 (25 marks) On 1 January 2020, Ceria Sdn Bhd acquired 70% of the ordinary share capital of Daya Sdn Bhd,

Please help me

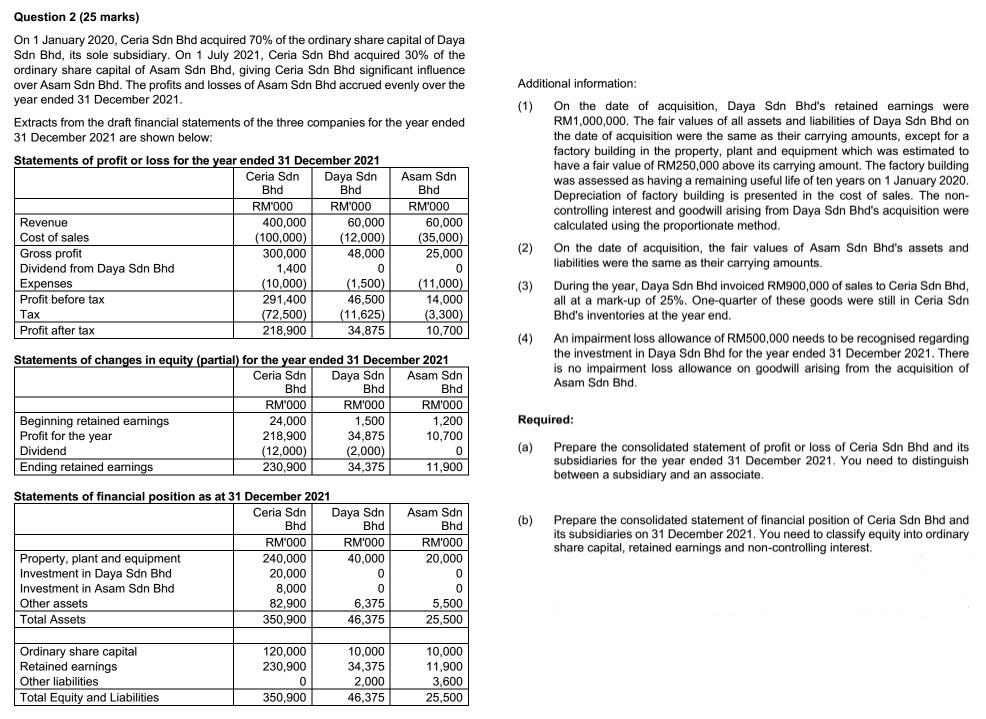

Question 2 (25 marks) On 1 January 2020, Ceria Sdn Bhd acquired 70% of the ordinary share capital of Daya Sdn Bhd, its sole subsidiary. On 1 July 2021, Ceria Sdn Bhd acquired 30% of the ordinary share capital of Asam Sdn Bhd, giving Ceria Sdn Bhd significant influence over Asam Sdn Bhd. The profits and losses of Asam Sdn Bhd accrued evenly over the year ended 31 December 2021. Additional information: liabilities were the same as their carrying amounts. (3) During the year, Daya Sdn Bhd invoiced RM900,000 of sales to Ceria Sdn Bhd, all at a mark-up of 25%. One-quarter of these goods were still in Ceria Sdn Bhd's inventories at the year end. (4) An impairment loss allowance of RM500,000 needs to be recognised regarding Statamente nf channee in anuitu (nartiall for the vear anded 31 Neramhar 2021 the investment in Daya Sdn Bhd for the year ended 31 December 2021. There is no impairment loss allowance on goodwill arising from the acquisition of Asam Sdn Bhd. Required: (a) Prepare the consolidated statement of profit or loss of Ceria Sdn Bhd and its subsidiaries for the year ended 31 December 2021. You need to distinguish between a subsidiary and an associate. Statomante af finanrial nneition se at 21 nacomhar 301 (b) Prepare the consolidated statement of financial position of Ceria Sdn Bhd and its subsidiaries on 31 December 2021. You need to classify equity into ordinary share capital, retained earnings and non-controlling interest. Question 2 (25 marks) On 1 January 2020, Ceria Sdn Bhd acquired 70% of the ordinary share capital of Daya Sdn Bhd, its sole subsidiary. On 1 July 2021, Ceria Sdn Bhd acquired 30% of the ordinary share capital of Asam Sdn Bhd, giving Ceria Sdn Bhd significant influence over Asam Sdn Bhd. The profits and losses of Asam Sdn Bhd accrued evenly over the year ended 31 December 2021. Additional information: liabilities were the same as their carrying amounts. (3) During the year, Daya Sdn Bhd invoiced RM900,000 of sales to Ceria Sdn Bhd, all at a mark-up of 25%. One-quarter of these goods were still in Ceria Sdn Bhd's inventories at the year end. (4) An impairment loss allowance of RM500,000 needs to be recognised regarding Statamente nf channee in anuitu (nartiall for the vear anded 31 Neramhar 2021 the investment in Daya Sdn Bhd for the year ended 31 December 2021. There is no impairment loss allowance on goodwill arising from the acquisition of Asam Sdn Bhd. Required: (a) Prepare the consolidated statement of profit or loss of Ceria Sdn Bhd and its subsidiaries for the year ended 31 December 2021. You need to distinguish between a subsidiary and an associate. Statomante af finanrial nneition se at 21 nacomhar 301 (b) Prepare the consolidated statement of financial position of Ceria Sdn Bhd and its subsidiaries on 31 December 2021. You need to classify equity into ordinary share capital, retained earnings and non-controlling interest

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts