Question: Please help me solve for all red boxes exactly as shown. Thank you for your assistance. At December 31, 2022, Sarasota Company reported the following

Please help me solve for all red boxes exactly as shown. Thank you for your assistance.

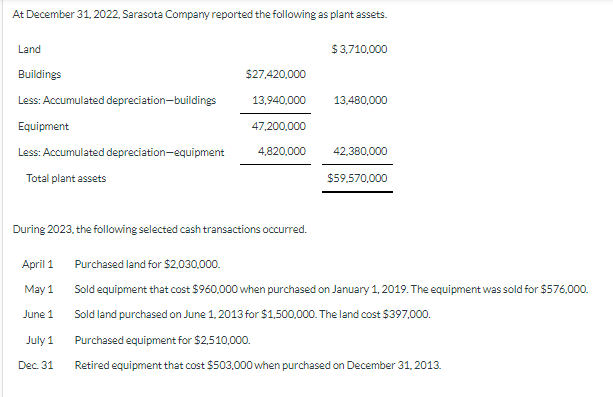

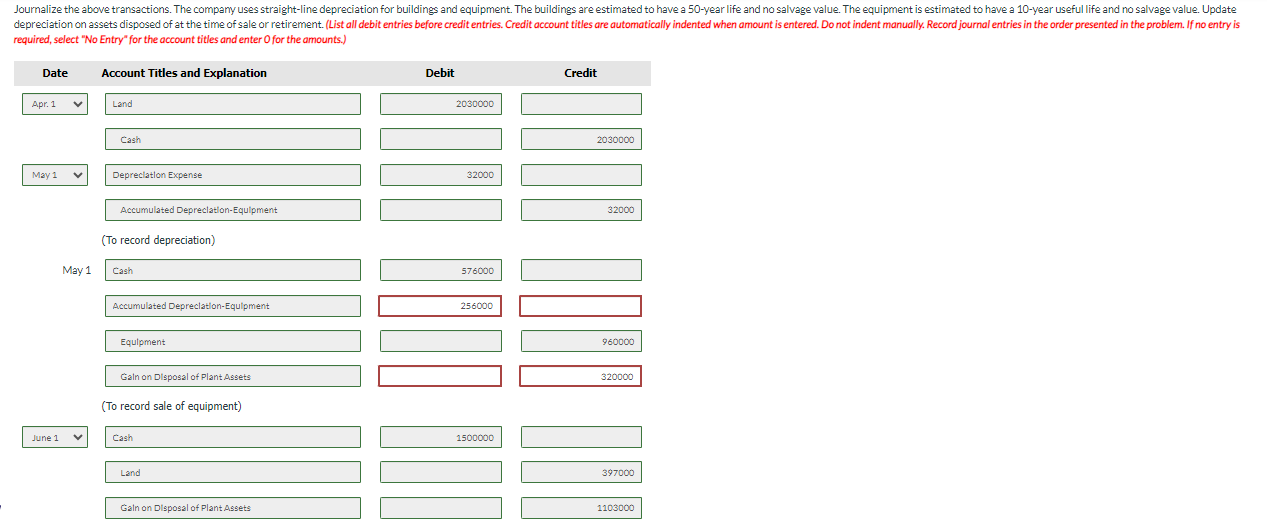

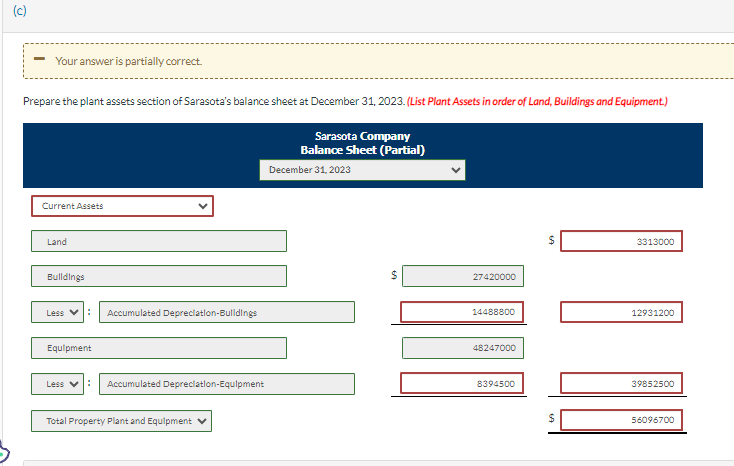

At December 31, 2022, Sarasota Company reported the following as plant assets. During 2023, the following selected cash transactions occurred. April 1 Purchased land for $2,030,000. May 1 Sold equipment that cost $960,000 when purchased on January 1,2019 . The equipment was sold for $576,000. June 1 Sold land purchased on June 1, 2013 for $1,500,000. The land cost $397,000. July 1 Purchased equipment for $2,510,000. Dec. 31 Retired equipment that cost \$503,000 when purchased on December 31, 2013. required, select "No Entry" for the account titles and enter O for the amounts.) (To record depreciation) May 1 Cash Accumulated Depreclation-Equlpment Equlpment Gain on Disposal of Plant Assets (To record sale of equipment) June 1 Cash Land Galn on Disposal of Plant Assets Debit 2030000 32000 576000 256000 \begin{tabular}{r|} \hline 960000 \\ \hline 320000 \\ \hline \end{tabular} (c) - Your answer is partially correct. Prepare the plant assets section of Sarasota's balance sheet at December 31, 2023. (List Plant Assets in order of Land, Buildings and Equipment) Sarasota Company Balance Sheet (Partial) December 31, 2023 Current Assets Land Bulldings Less : Accumulated Depreclation-Bulldings Equipment Less : Accumulated Depreclation-Equlpment Total Property Plant and Equlpment V 48247000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts