Question: please help me solve for speakers in Req A1. the answer is not 23.1 or 23.2. thank you so much again! lased on the CFO's

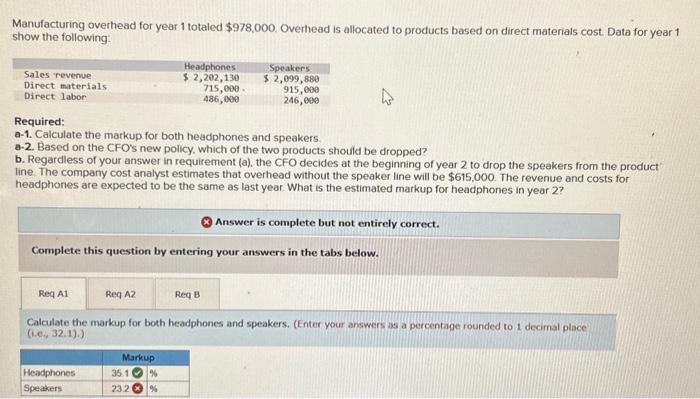

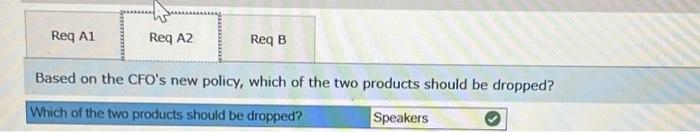

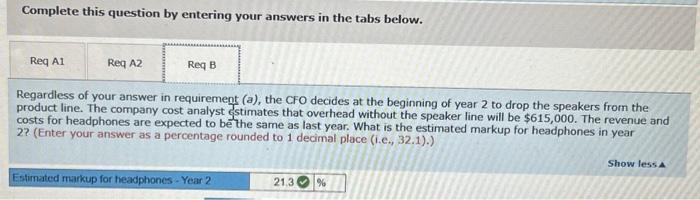

lased on the CFO's new policy, which of the two products should be dropped? Manufacturing overhead for year 1 totaled $978,000. Overhead is allocated to products based on direct materials cost. Data for year 1 show the following: Required: a-1. Calculate the markup for both headphones and speakers. a-2. Based on the CFO's new policy, which of the two products should be dropped? b. Regardless of your answer in requirement (a), the CFO decides at the beginning of year 2 to drop the speakers from the product line. The company cost analyst estimates that overhead without the speaker line will be $615,000. The revenue and costs for headphones are expected to be the same as last year. What is the estimated markup for headphones in year 2 ? Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Calculate the markup for both headphones and speakers. (Enter your answers ws a percentage rounded to 1 decimal place (1.6,32.1). Complete this question by entering your answers in the tabs below. Regardless of your answer in requirement (a), the CFO decides at the beginning of year 2 to drop the speakers from the product line. The company cost analyst fstimates that overhead without the speaker line will be $615,000. The revenue and costs for headphones are expected to be the same as last year. What is the estimated markup for headphones in year 2? (Enter your answer as a percentage rounded to 1 decimal place (i.e., 32.1).)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts