Question: Please help me solve I will leave a thumbs up!! NatNah, a builder of acoustic accessories, has no debt and an equity cost of capital

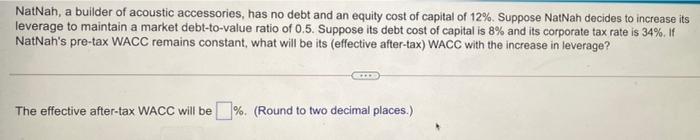

NatNah, a builder of acoustic accessories, has no debt and an equity cost of capital of 12%. Suppose NatNah decides to increase its leverage to maintain a market debt-to-value ratio of 0.5. Suppose its debt cost of capital is 8% and its corporate tax rate is 34%. If NatNah's pre-tax WACC remains constant, what will be its (effective after-tax) WACC with the increase in leverage? The effective after-tax WACC will be % (Round to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts