Question: Please help me solve. If answer provided is wrong I will contact Chegg and make sure your account is BANNED. I pay for this service.

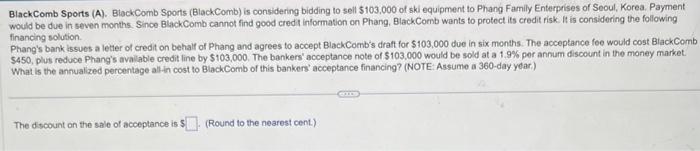

BlackComb Sports (A). BlackComb Sports (BlackComb) is considering bidding to sell $103,000 of ski equipment to Phang Family Enterprises of Seoul, Korea. Payment would be due in seven months. Since BlackComb cannot find good cred intormation on Phang. BlackComb wants to protect its credit risk. It is considering the following. financing solution. Phang's bank tssues a letter of credit on behalf of Phang and agrees to accept BlackComb's draft for $103,000 due in six months. The acceptance foe would cost BlackComb $450, plus reduce Phang's avallable credit line by $103,000. The bankers' acceptance note of $103,000 would be sold at a 1.9% per annum discount in the money market. What is the annualized percentage all-fn cost to BlackComb of this bankers' acceptance financing? (NOTE: Assume a 360 -day year.) The discount on the sale of acceptance is (Round to the nearest cent)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts