Question: Please help me solve l) and m) (Will provide a thumbs up!) 3. Pricing Securities Consider two securities A and B. A pays an expected

Please help me solve l) and m)

(Will provide a thumbs up!)

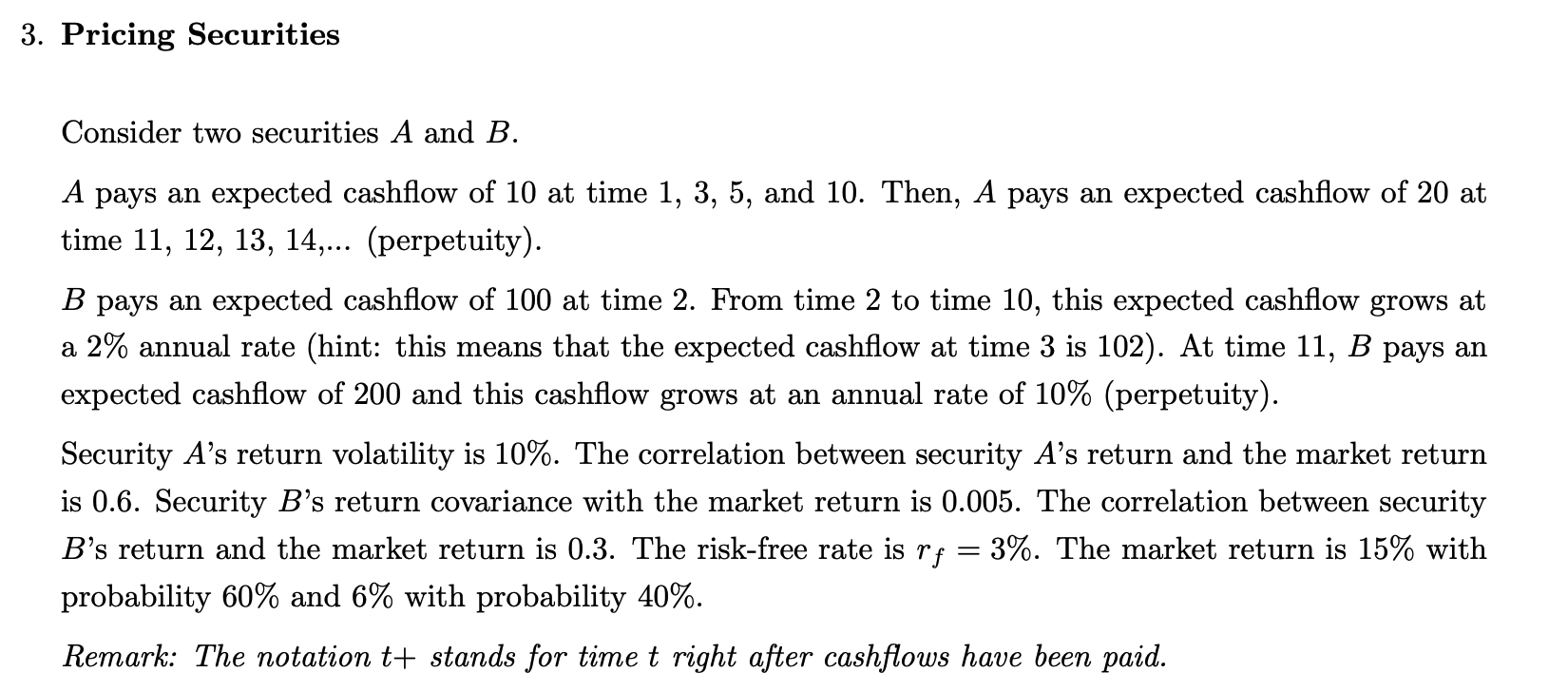

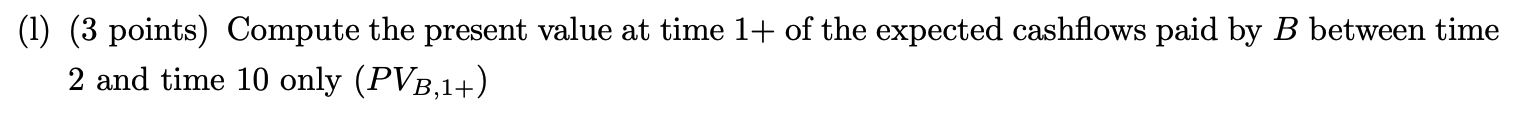

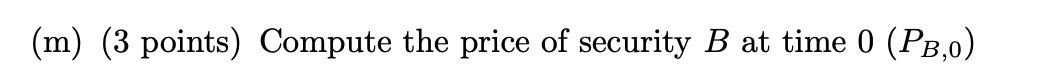

3. Pricing Securities Consider two securities A and B. A pays an expected cashflow of 10 at time 1,3,5, and 10 . Then, A pays an expected cashflow of 20 at time 11,12,13,14, (perpetuity). B pays an expected cashflow of 100 at time 2 . From time 2 to time 10, this expected cashflow grows at a 2% annual rate (hint: this means that the expected cashflow at time 3 is 102). At time 11, B pays an expected cashflow of 200 and this cashflow grows at an annual rate of 10% (perpetuity). Security A 's return volatility is 10%. The correlation between security A 's return and the market return is 0.6. Security B's return covariance with the market return is 0.005. The correlation between security B 's return and the market return is 0.3. The risk-free rate is rf=3%. The market return is 15% with probability 60% and 6% with probability 40%. Remark: The notation t+ stands for time t right after cashflows have been paid. (1) ( 3 points) Compute the present value at time 1+ of the expected cashflows paid by B between time 2 and time 10 only (PVB,1+) (m) (3 points) Compute the price of security B at time 0(PB,0)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts