Question: Please help me solve NPV & NPV Index Practice - Kumasi Corporation Kumasi Corporation is considering investing in a new piece of equipment and has

Please help me solve

Please help me solve

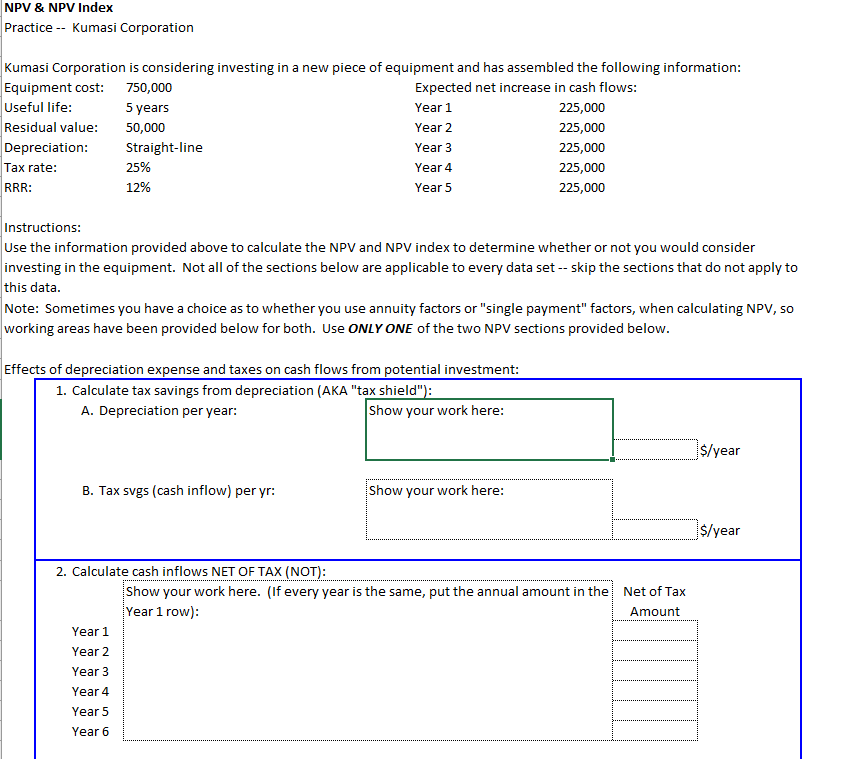

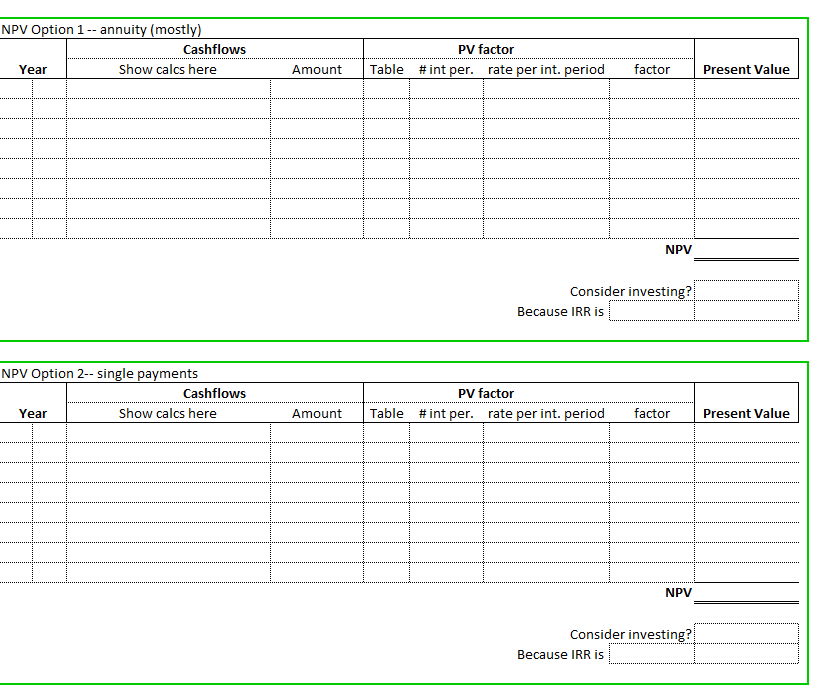

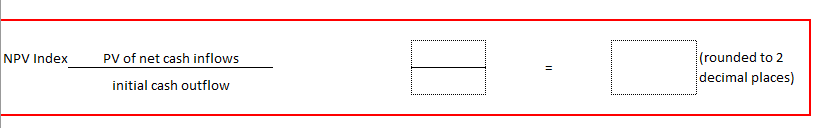

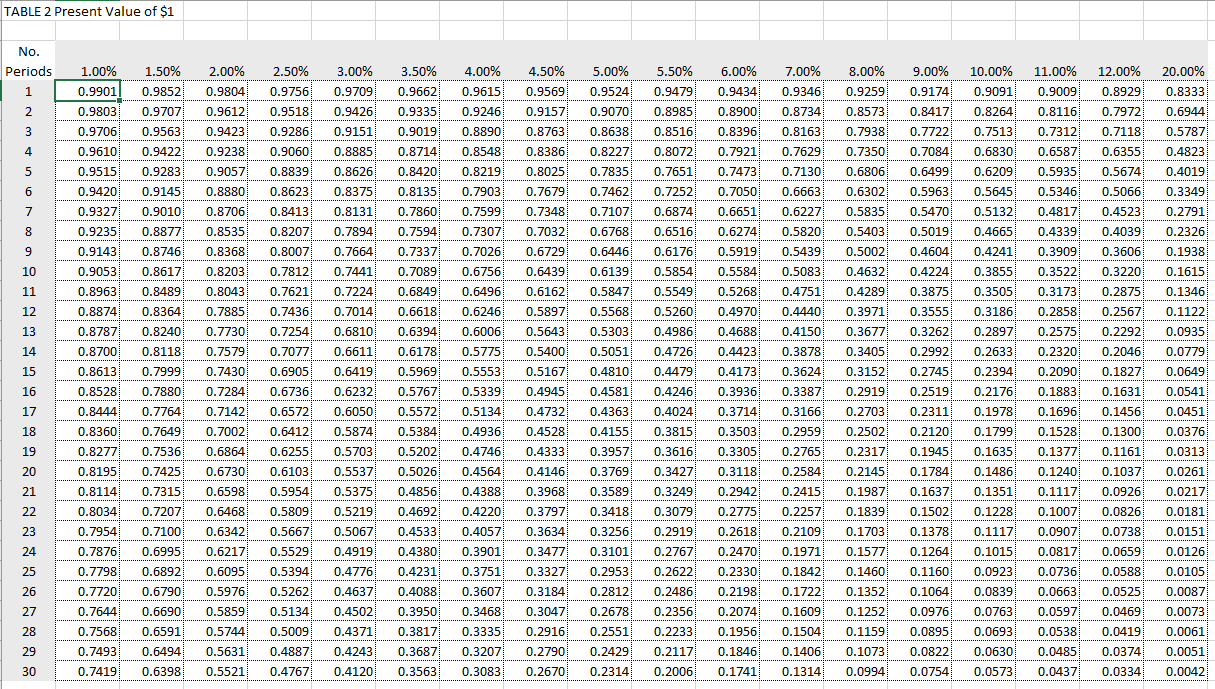

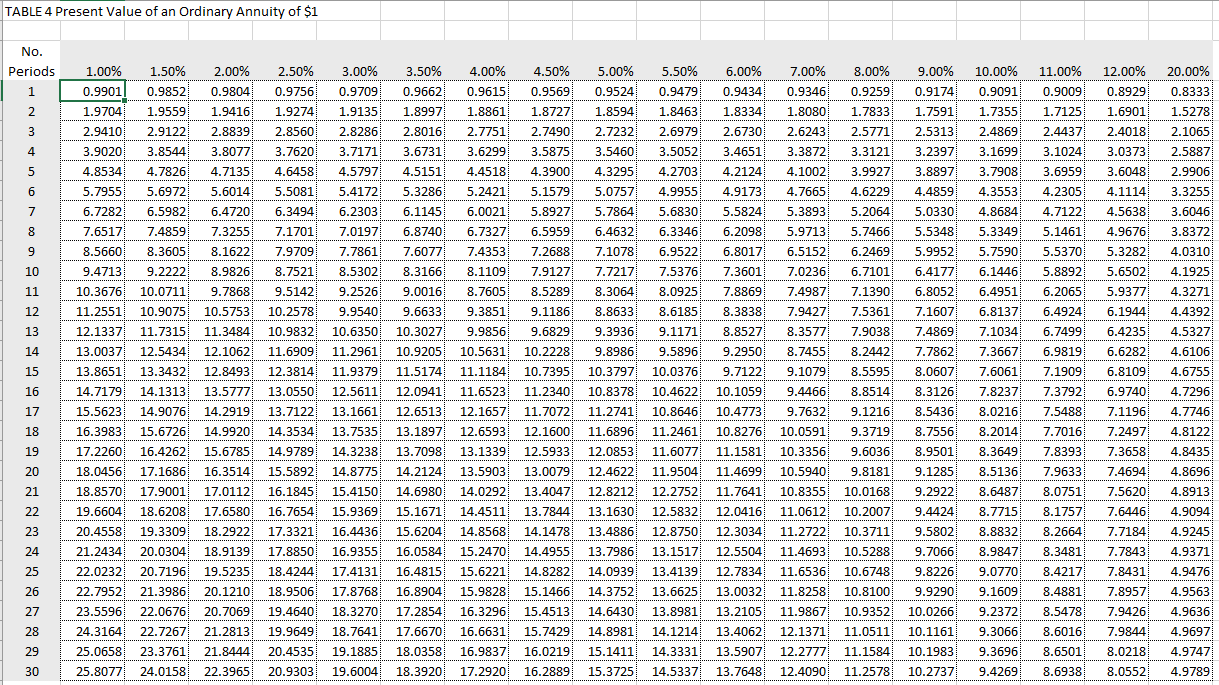

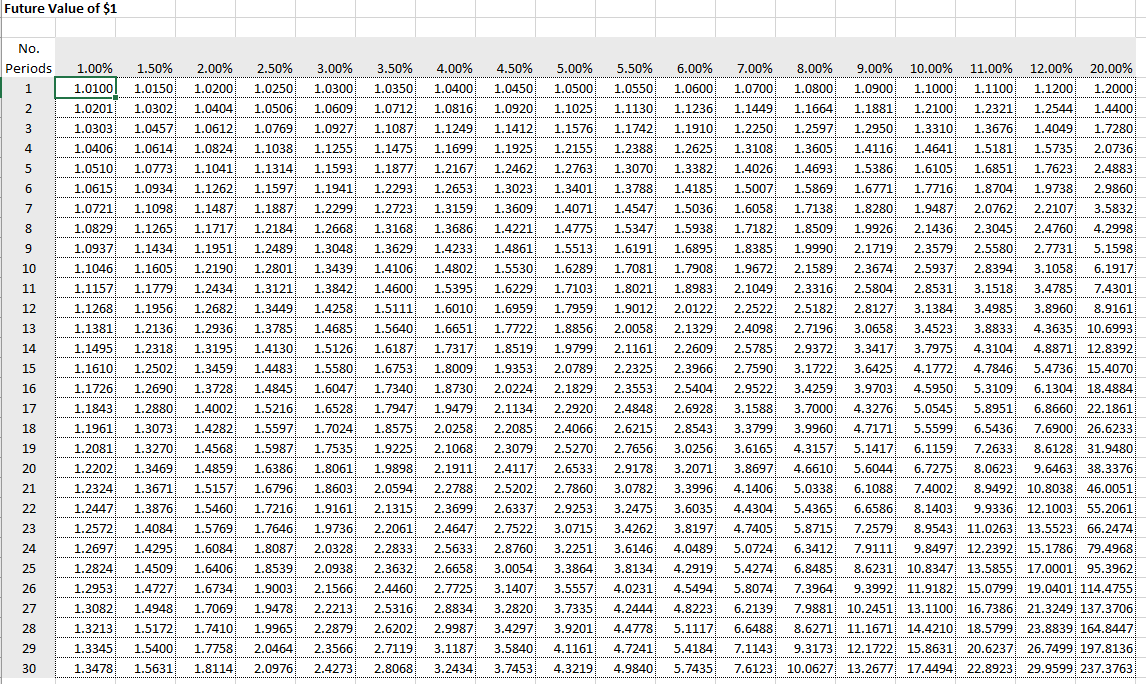

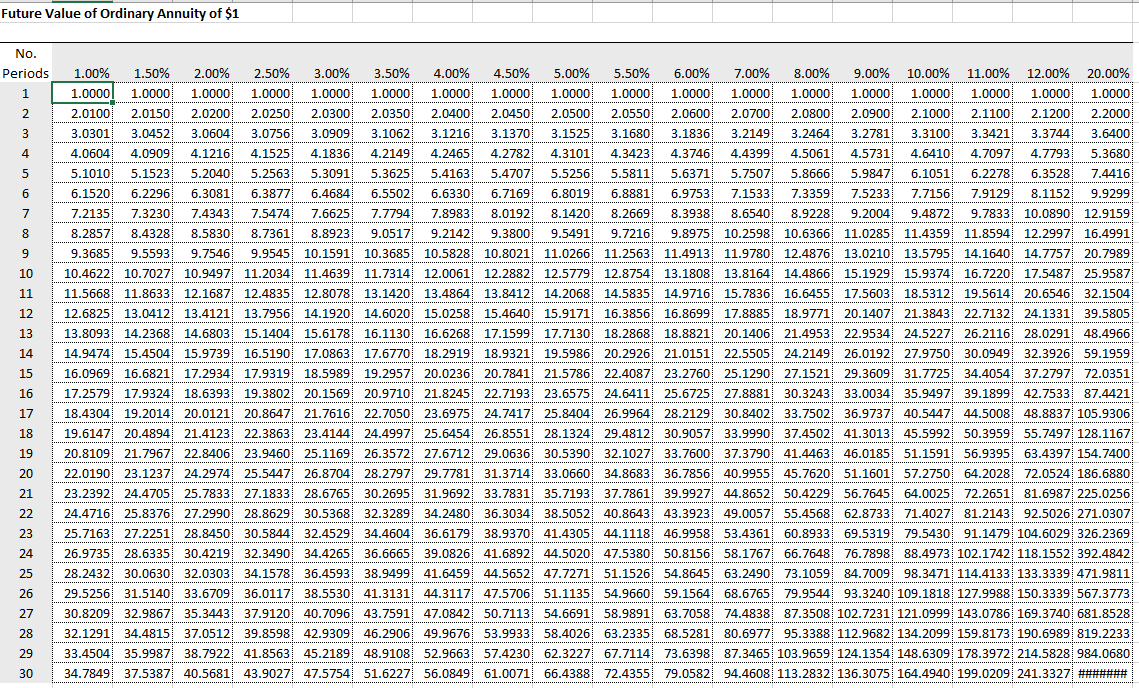

NPV \& NPV Index Practice - Kumasi Corporation Kumasi Corporation is considering investing in a new piece of equipment and has assembled the following information: Instructions: Use the information provided above to calculate the NPV and NPV index to determine whether or not you would consider investing in the equipment. Not all of the sections below are applicable to every data set - skip the sections that do not apply to this data. Note: Sometimes you have a choice as to whether you use annuity factors or "single payment" factors, when calculating NPV, so working areas have been provided below for both. Use ONLY ONE of the two NPV sections provided below. NPV Option 1 - annuity (mostly) Chashflows NPV Option 2- single payments Year NPV Index PV of net cash inflows initial cash outflow (rounded to 2 decimal places) TABLE 2 Present Value of \$1 No. TABLE 4 Present Value of an Ordinary Annuity of $1 No. Future Value of $1 No. Periods Future Value of Ordinary Annuity of \$1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts