Question: please help me solve the 1(b) please. I have already get 1(a). Thanks! 1. Let (X1, X2) be a vector of daily log returns of

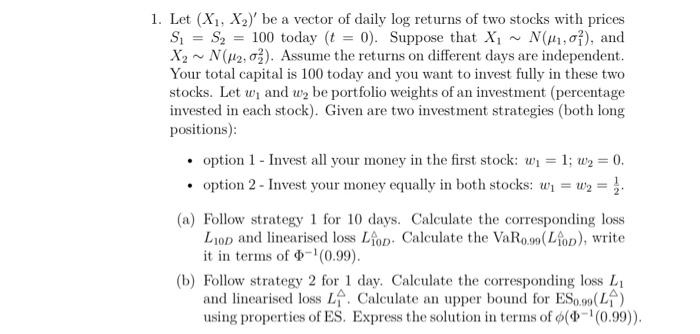

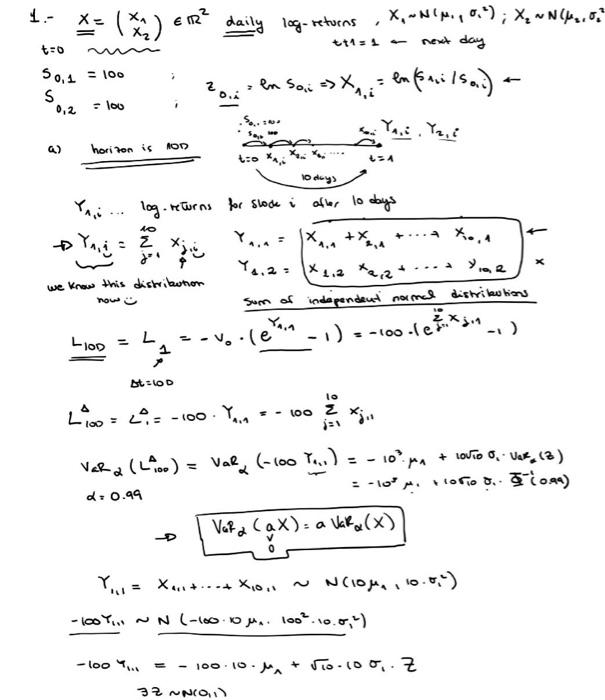

1. Let (X1, X2) be a vector of daily log returns of two stocks with prices S S2 = 100 today (t = 0). Suppose that XN(41,04), and X, N(H2,o). Assume the returns on different days are independent. Your total capital is 100 today and you want to invest fully in these two stocks. Let w, and wy be portfolio weights of an investment (percentage invested in each stock). Given are two investment strategies (both long positions): option 1 - Invest all your money in the first stock: w1 = 1; W2 = 0. option 2 - Invest your money equally in both stocks: w1 = W2 = 3. (a) Follow strategy 1 for 10 days. Calculate the corresponding loss Llop and linearised loss Lion Calculate the VaR0.90 (Liop), write it in terms of 0-0.99). (b) Follow strategy 2 for 1 day. Calculate the corresponding loss L and linearised loss LA. Calculate an upper bound for ES0.40(LA) using properties of ES. Express the solution in terms of 6(0-(0.99)). . 1.- X = n ) em? daily log returns , X-NIN, 0.9); X,wN..." - . No.o ttl=1 next day t=0 . 4 50,1 = 100 S - lou en Son X = enfailsa.i) - = 0,2 S. horizon is 100 to X USA do 10 days Y... log. returns for stock i after 10 days = E X Yang y 4.2 = (x,2 +2,2- we know this distribution Sum of independent normal distributions 1.4 4.4 +X X re Yan Llop = LS-V..le -1).-10..leksion ALSO lo s :00 - : : Y. 100 11 VaRa (L.) = VaR (-100 T...) = 10 + LOVO O VR.() d:0.99 = -100. 1050 d. Ilona) VaRa (ax) = 0 Waka (x) -D Yu- *......*o.. ~ N(Oj, 10.0-) -100 ~ N(-1000 ja 1007.10.0,-) -look- - 1001 10.M + vio 100,7 32 NCO, 1. Let (X1, X2) be a vector of daily log returns of two stocks with prices S S2 = 100 today (t = 0). Suppose that XN(41,04), and X, N(H2,o). Assume the returns on different days are independent. Your total capital is 100 today and you want to invest fully in these two stocks. Let w, and wy be portfolio weights of an investment (percentage invested in each stock). Given are two investment strategies (both long positions): option 1 - Invest all your money in the first stock: w1 = 1; W2 = 0. option 2 - Invest your money equally in both stocks: w1 = W2 = 3. (a) Follow strategy 1 for 10 days. Calculate the corresponding loss Llop and linearised loss Lion Calculate the VaR0.90 (Liop), write it in terms of 0-0.99). (b) Follow strategy 2 for 1 day. Calculate the corresponding loss L and linearised loss LA. Calculate an upper bound for ES0.40(LA) using properties of ES. Express the solution in terms of 6(0-(0.99)). . 1.- X = n ) em? daily log returns , X-NIN, 0.9); X,wN..." - . No.o ttl=1 next day t=0 . 4 50,1 = 100 S - lou en Son X = enfailsa.i) - = 0,2 S. horizon is 100 to X USA do 10 days Y... log. returns for stock i after 10 days = E X Yang y 4.2 = (x,2 +2,2- we know this distribution Sum of independent normal distributions 1.4 4.4 +X X re Yan Llop = LS-V..le -1).-10..leksion ALSO lo s :00 - : : Y. 100 11 VaRa (L.) = VaR (-100 T...) = 10 + LOVO O VR.() d:0.99 = -100. 1050 d. Ilona) VaRa (ax) = 0 Waka (x) -D Yu- *......*o.. ~ N(Oj, 10.0-) -100 ~ N(-1000 ja 1007.10.0,-) -look- - 1001 10.M + vio 100,7 32 NCO

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts