Question: please help me solve the following 5!! please only attempt if you can solve all 5! thank you so much for your time, will rate!

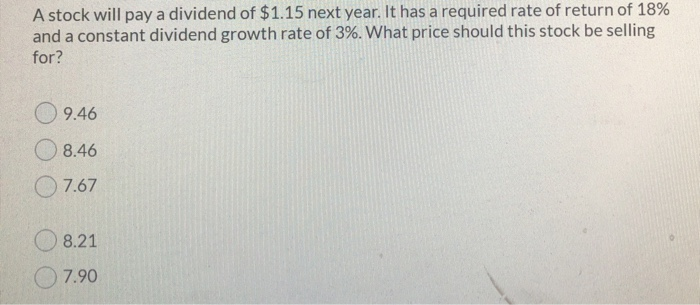

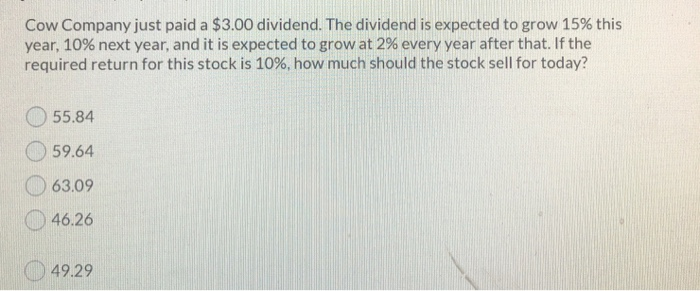

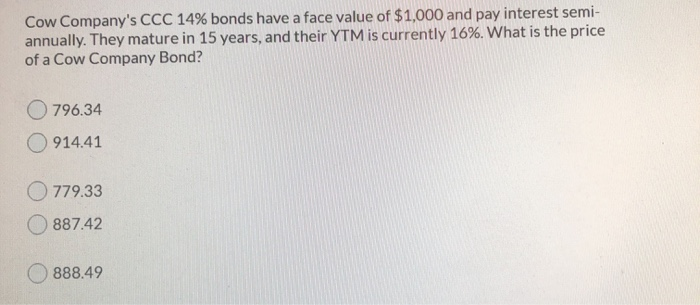

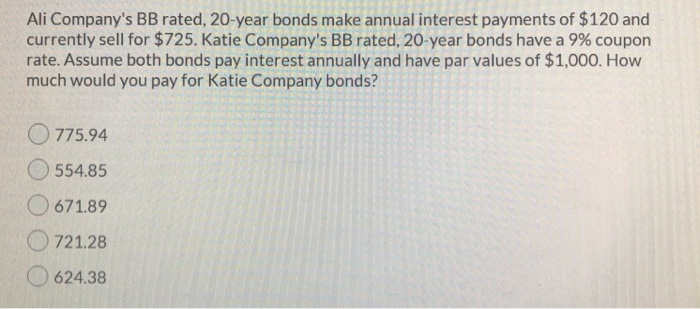

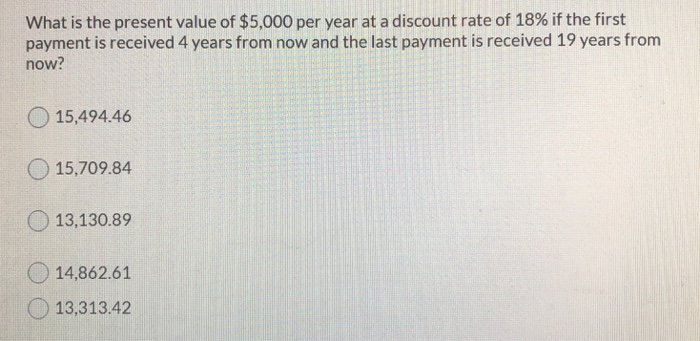

A stock will pay a dividend of $1.15 next year. It has a required rate of return of 18% and a constant dividend growth rate of 3%. What price should this stock be selling for? 09.46 8.46 O 7.67 O 8.21 7.90 Cow Company just paid a $3.00 dividend. The dividend is expected to grow 15% this year, 10% next year, and it is expected to grow at 2% every year after that. If the required return for this stock is 10%, how much should the stock sell for today? O 55.84 59.64 O 63.09 46.26 49.29 Cow Company's CCC 14% bonds have a face value of $1,000 and pay interest semi- annually. They mature in 15 years, and their YTM is currently 16%. What is the price of a Cow Company Bond? O 796.34 O914.41 779.33 887.42 888.49 What is the present value of $5,000 per year at a discount rate of 18% if the first payment is received 4 years from now and the last payment is received 19 years from now? O 15,494.46 15,709.84 13,130.89 14,862.61 13,313.42

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts