Question: please help me solve the following 5!! please only attempt if you can solve all 5! thank you so much for your time, will rate!

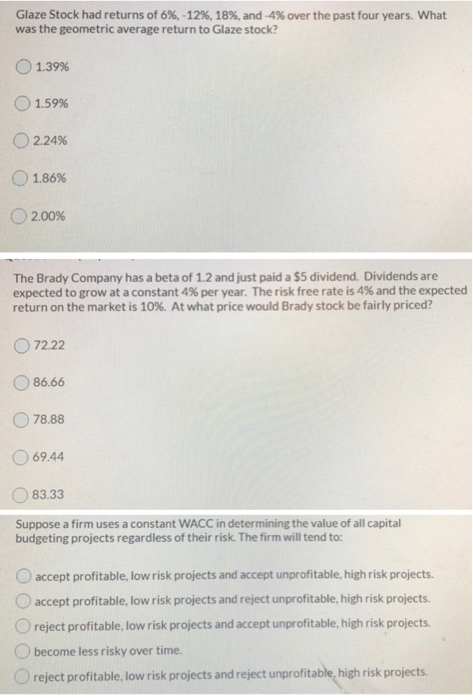

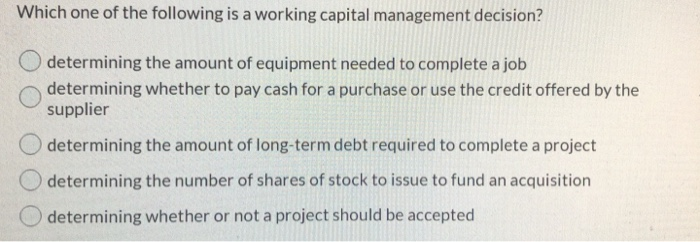

Glaze Stock had returns of 6%, -12%, 18%, and -4% over the past four years. What was the geometric average return to Glaze stock? 1.39% 1.59% 2.24% 1.86% 2.00% The Brady Company has a beta of 1.2 and just paid a $5 dividend. Dividends are expected to grow at a constant 4% per year. The risk free rate is 4% and the expected return on the market is 10%. At what price would Brady stock be fairly priced? 72.22 86.66 78.88 69.44 83.33 Suppose a firm uses a constant WACC in determining the value of all capital budgeting projects regardless of their risk. The firm will tend to: accept profitable, low risk projects and accept unprofitable, high risk projects. accept profitable, low risk projects and reject unprofitable, high risk projects. reject profitable, low risk projects and accept unprofitable, high risk projects. Obecome less risky over time. reject profitable, low risk projects and reject unprofitable, high risk projects. Which one of the following is a working capital management decision? determining the amount of equipment needed to complete a job determining whether to pay cash for a purchase or use the credit offered by the supplier Odetermining the amount of long-term debt required to complete a project O determining the number of shares of stock to issue to fund an acquisition determining whether or not a project should be accepted On a common-size balance sheet O accounts payable is divided by current assets O COGS is divided by total liabilities O current liabilities is divided by current assets O capital leases is divided by total assets. COGS is divided by total assets

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts