Question: Please help me solve the rest of this problem from my text book. I am stuck! :( St. Josephs Hospital began operations in December 2019

Please help me solve the rest of this problem from my text book. I am stuck! :(

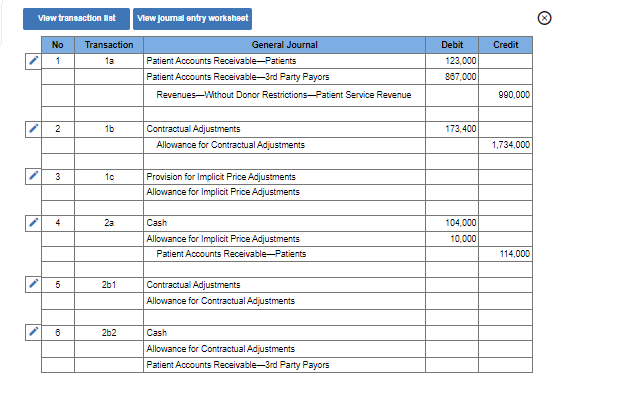

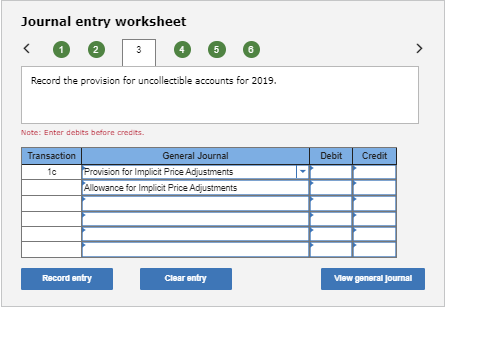

St. Josephs Hospital began operations in December 2019 and had patient service revenues totaling $990,000 (based on customary rates) for the month. Of this, $123,000 is billed to patients, representing their insurance deductibles and copayments. The balance is billed to third-party payors, including insurance companies and government health care agencies. St. Josephs estimates that 20 percent of these third-party payor charges will be deducted by contractual adjustment. The hospitals fiscal year ends on December 31. Required: 1. Prepare the journal entries for December 2019. Assume 15 percent of the amounts billed to patients will be reduced through implicit price adjustments. 2. Prepare the journal entries for 2020 assuming the following:

- $104,000 is collected from the patients during the year and $10,000 of price adjustments are granted to individuals.

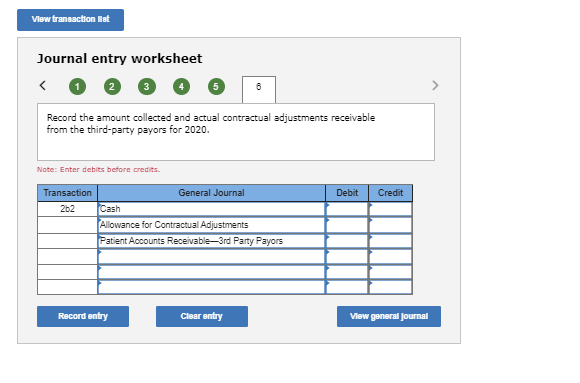

- Actual contractual adjustments total $196,000. The remaining receivable from third-party payors is collected.

(If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.)

Vew traneaction llat Vew joumal entry workaheat \begin{tabular}{|c|c|c|c|c|c|} \hline & No & Transaction & General Journal & Debit & Credit \\ \hline \multirow[t]{3}{*}{} & 1 & 1a & Patient Accounts Receivable-Patients & 123,000 & \\ \hline & & & Patient Accounts Receivable-3rd Party Payors & 867,000 & \\ \hline & & & Revenues-Without Donor Restrictions-Patient Service Revenue & & 990,000 \\ \hline \multirow[t]{2}{*}{>} & 2 & 1b & Contractual Adjustments & 173,400 & \\ \hline & & & Allowance for Contractual Adjustments & & 1,734,000 \\ \hline \multirow[t]{2}{*}{>} & 3 & 10 & Provision for Implicit Price Adjustments & & \\ \hline & & & Allowance for Implicit Price Adjustments & & \\ \hline \multirow[t]{3}{*}{>} & 4 & 2a & Cash & 104,000 & \\ \hline & & & Allowance for Implicit Price Adjustments & 10,000 & \\ \hline & & & Patient Accounts Receivable-Patients & & 114,000 \\ \hline \multirow[t]{2}{*}{>} & 5 & 2b1 & Contractual Adjustments & & \\ \hline & & & Allowance for Contractual Adjustments & & \\ \hline \multirow[t]{3}{*}{} & 6 & 2b2 & Cash & & \\ \hline & & & Allowance for Contractual Adjustments & & \\ \hline & & & Patient Accounts Receivable-3rd Party Payors & & \\ \hline \end{tabular} Journal entry worksheet 1 (5) 6 Record the provision for uncollectible accounts for 2019. Note: Enter debits before credits. Journal entry worksheet (1) 2 (3) 4 (4) 5 Record the amount collected and actual contractual adjustments receivable from the third-party payors for 2020 . Note: Enter debits before credits

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts