Question: Please help me solve these questions on Excel with formula. Problem 4: Suppose that the price of gold at close of trading yesterday was $500

Please help me solve these questions on Excel with formula.

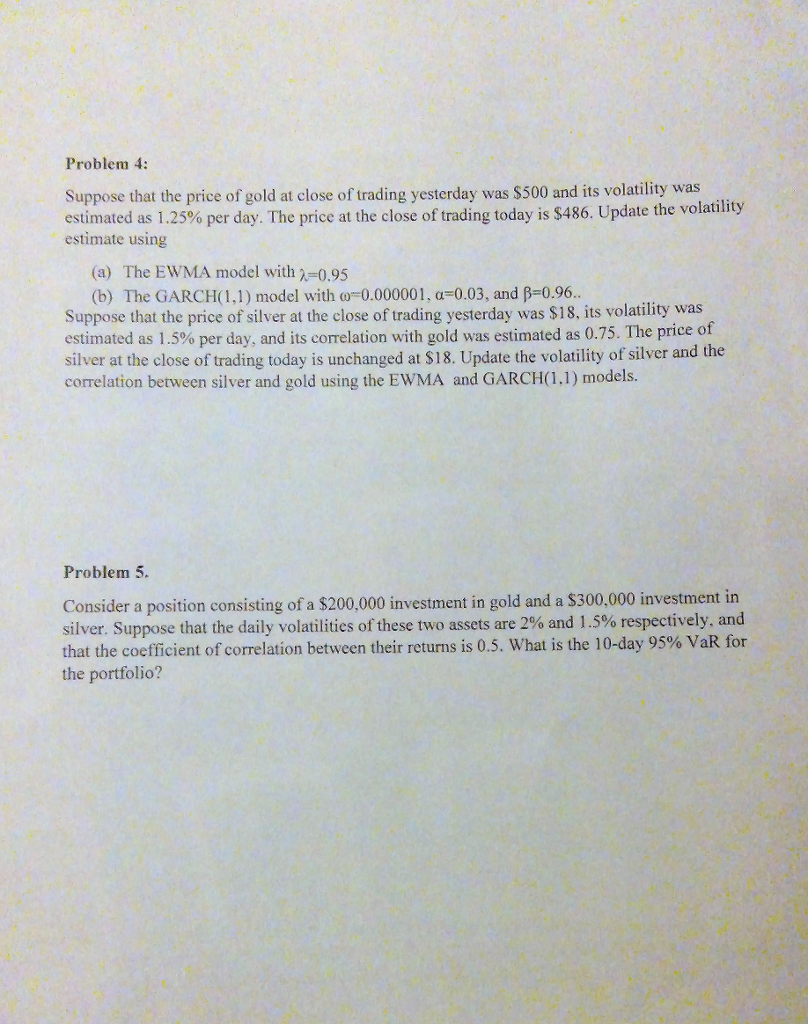

Problem 4: Suppose that the price of gold at close of trading yesterday was $500 and its volatility was estimated as 1.25% per day. The price at the close of trading today is $486. Update the volatility estimate using (a) The EWMA model with -095 (b) The GARCH( 1,1) model with ?-0.000001, ?-0.03, and ?-0.96. Suppose that the price of silver at the close of trading yesterday was $18, its volatility was estimated as 1.5% per day, and its correlation with gold was estimated as 0.75. The price of silver at the close of trading today is unchanged at $18. Update the volatility of silver and the correlation between silver and gold using the EWMA and GARCH(1.1) models. Problem 5 Consider a position consisting of a $200,000 investment in gold and a $300,000 investment in silver. Suppose that the daily volatilities of these two assets are 2% and 1.5% respectively, and that the coefficient of correlation between their returns is 0.5, what is the 10-day 95% VaR for the portfolio? Problem 4: Suppose that the price of gold at close of trading yesterday was $500 and its volatility was estimated as 1.25% per day. The price at the close of trading today is $486. Update the volatility estimate using (a) The EWMA model with -095 (b) The GARCH( 1,1) model with ?-0.000001, ?-0.03, and ?-0.96. Suppose that the price of silver at the close of trading yesterday was $18, its volatility was estimated as 1.5% per day, and its correlation with gold was estimated as 0.75. The price of silver at the close of trading today is unchanged at $18. Update the volatility of silver and the correlation between silver and gold using the EWMA and GARCH(1.1) models. Problem 5 Consider a position consisting of a $200,000 investment in gold and a $300,000 investment in silver. Suppose that the daily volatilities of these two assets are 2% and 1.5% respectively, and that the coefficient of correlation between their returns is 0.5, what is the 10-day 95% VaR for the portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts