Question: Please help me solve these questions would really appreciate it!! Fallow Corporation has two separate profit centers. The following information is available for the most

Please help me solve these questions would really appreciate it!!

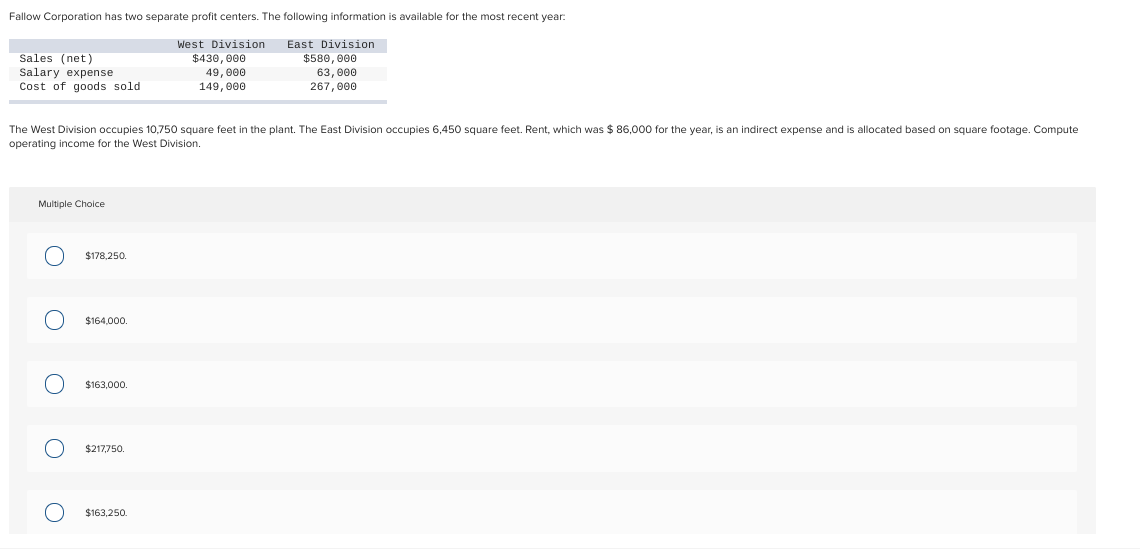

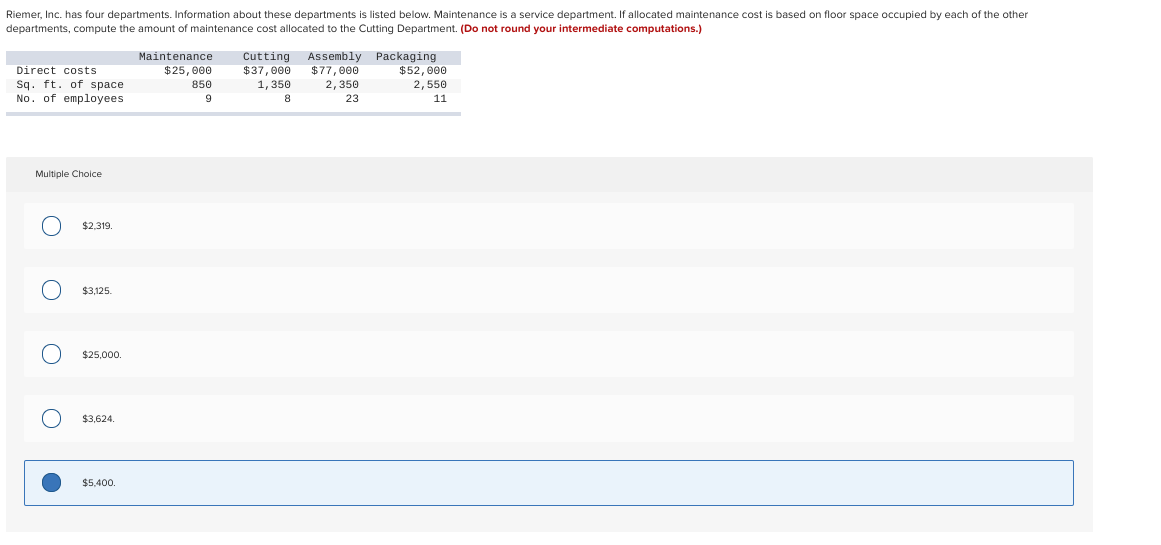

Fallow Corporation has two separate profit centers. The following information is available for the most recent year: West Division East Division Sales (net) $430, 090 $580, 090 Salary expense 49, 090 63, 090 Cost of goods sold 149, 090 267,090 The West Division occupies 10,750 square feet in the plant. The East Division occupies 6,450 square feet. Rent, which was $ 86,000 for the year, is an indirect expense and is allocated based on square footage. Compute operating income for the West Division. Multiple Choice O $178.250. O $164.000. O $163,000. O $217,750. O $163,250.Riemer, Inc. has four departments. Information about these departments is listed below. Maintenance is a service department. If allocated maintenance cost is based on floor space occupied by each of the other departments, compute the amount of maintenance cost allocated to the Cutting Department. (Do not round your intermediate computations.) Maintenance Cutting Assembly Packaging Direct costs $25,090 $37,090 $77, 090 $52, 090 Sq. ft. of space 850 1, 350 2, 350 2, 550 No. of employees 8 23 11 Multiple Choice O $2.319. O $3,125. O $25,000. O $3,624. $5,400

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts