Question: Please help me solve this 1) Consider two securities that pay risk-free cash flows over the next two years and that have the current market

Please help me solve this

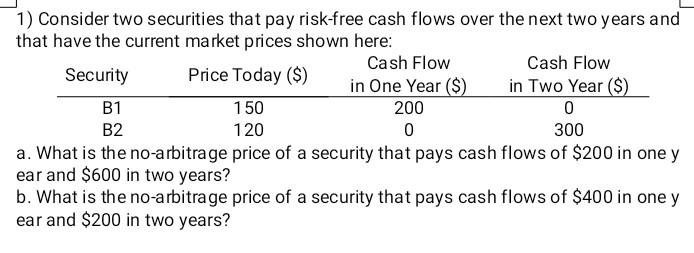

1) Consider two securities that pay risk-free cash flows over the next two years and that have the current market prices shown here: Cash Flow Cash Flow Security Price Today ($) in One Year ($) in Two Year ($) B1 150 200 0 B2 120 0 300 a. What is the no-arbitrage price of a security that pays cash flows of $200 in one y ear and $600 in two years? b. What is the no-arbitrage price of a security that pays cash flows of $400 in one y ear and $200 in two years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts