Question: Please help me solve this complex journal entry and variance problem ASAP! I will leave a like. Thank you so much! Record the variable manufacturing

Please help me solve this complex journal entry and variance problem ASAP! I will leave a like. Thank you so much!

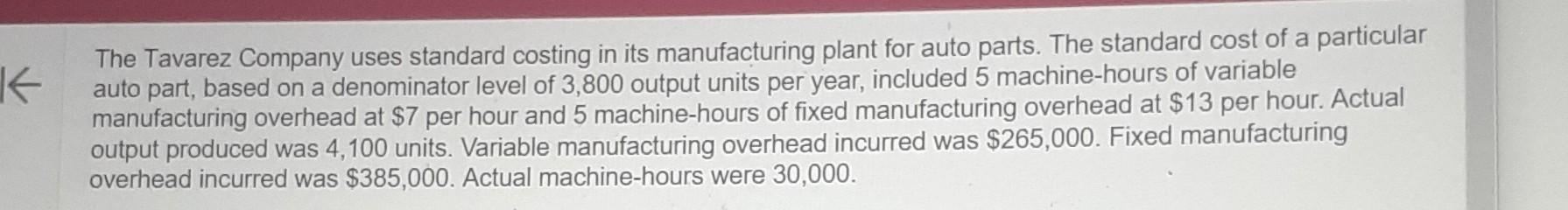

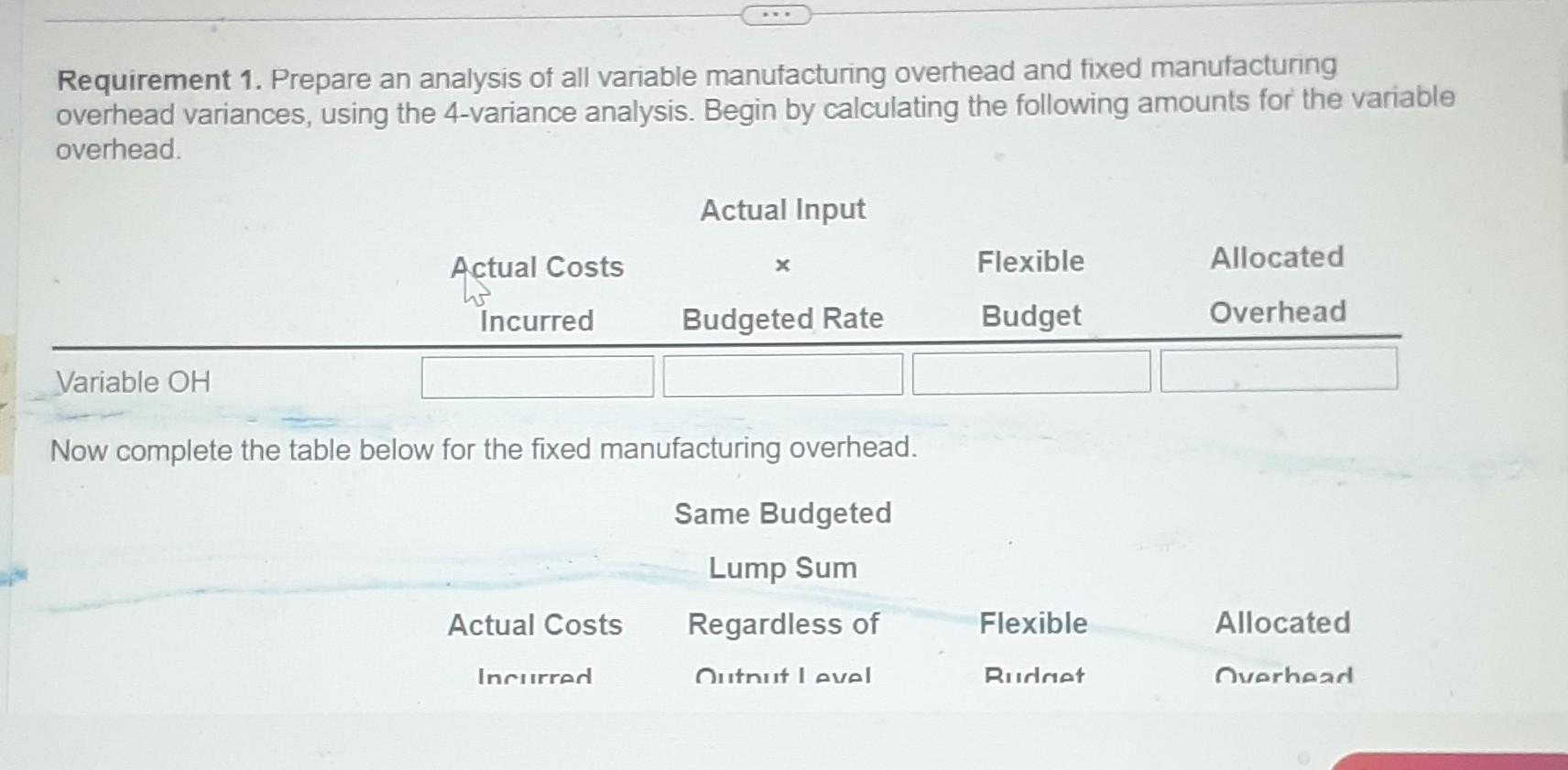

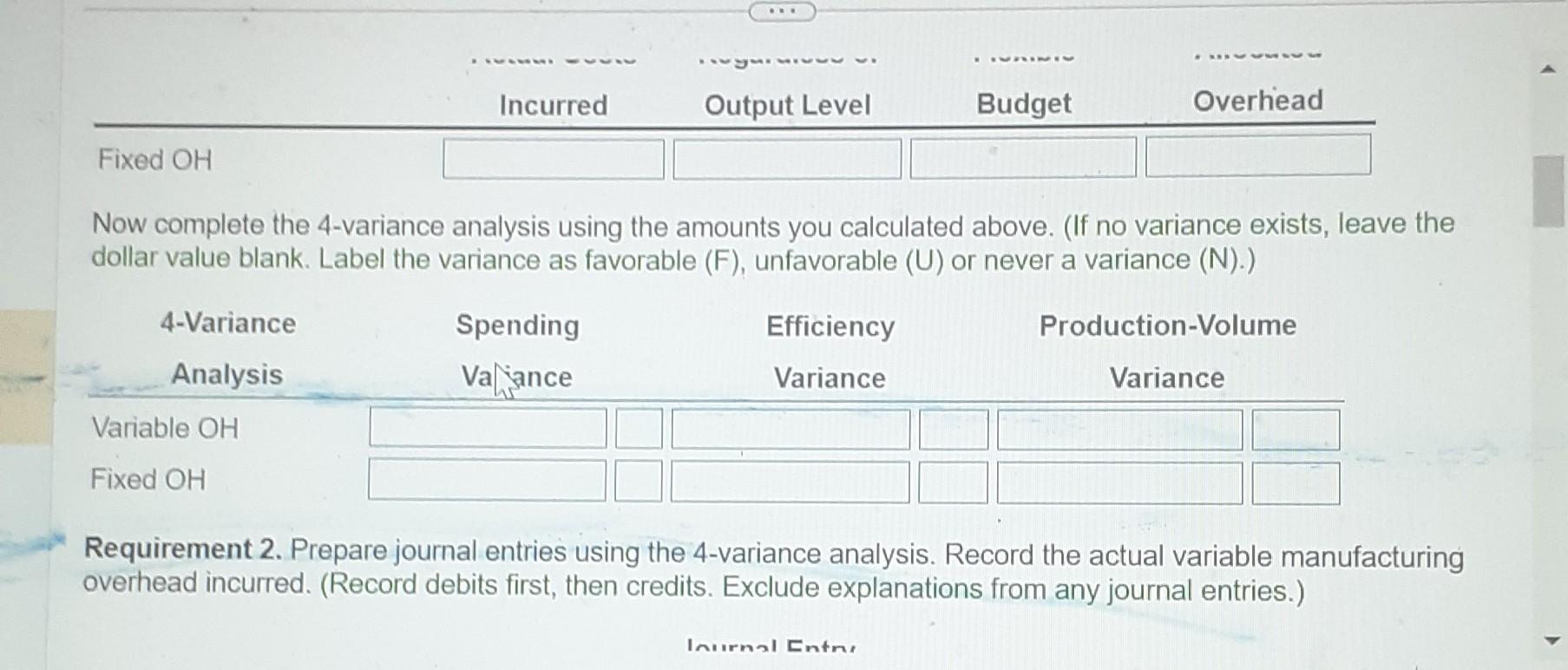

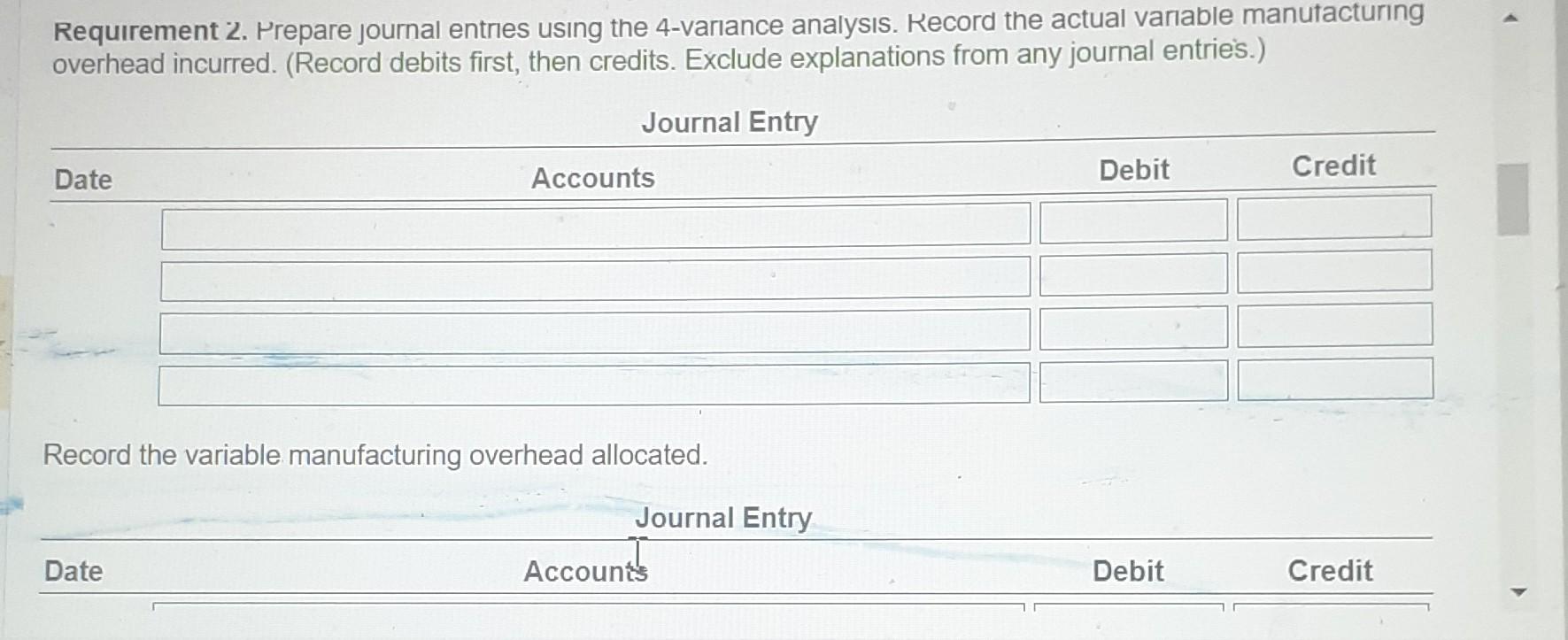

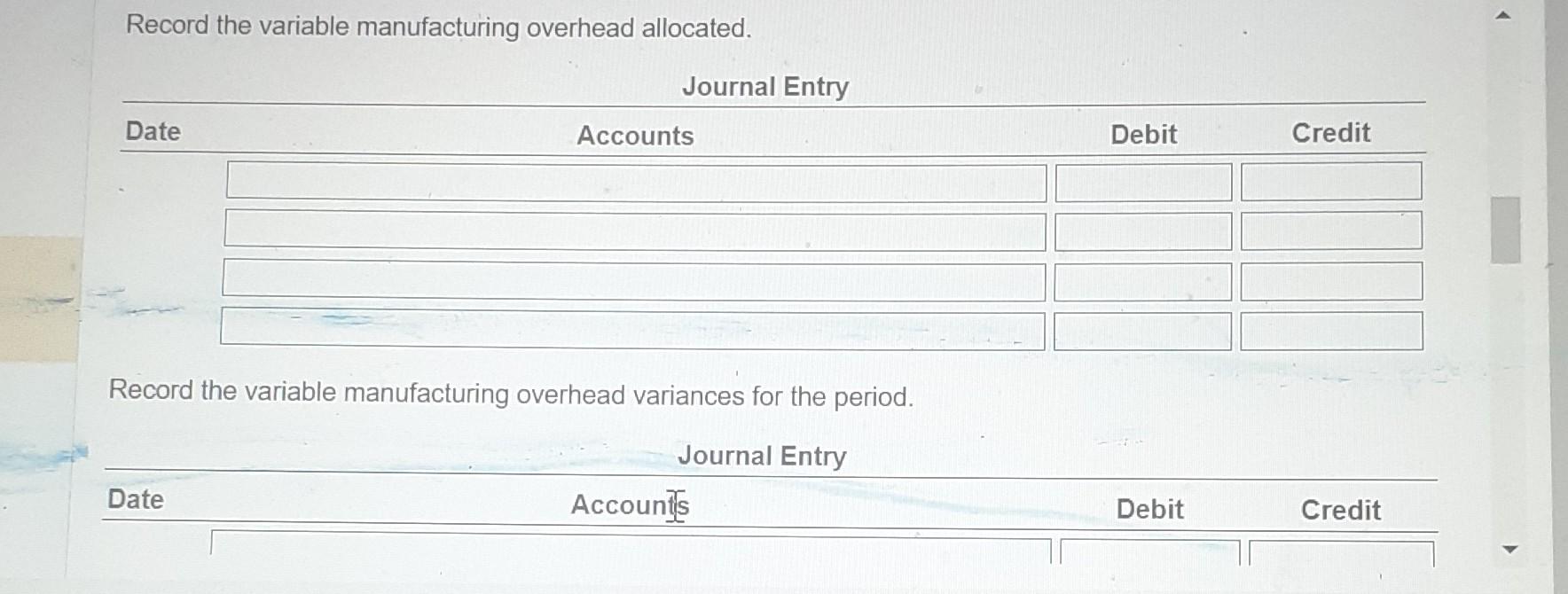

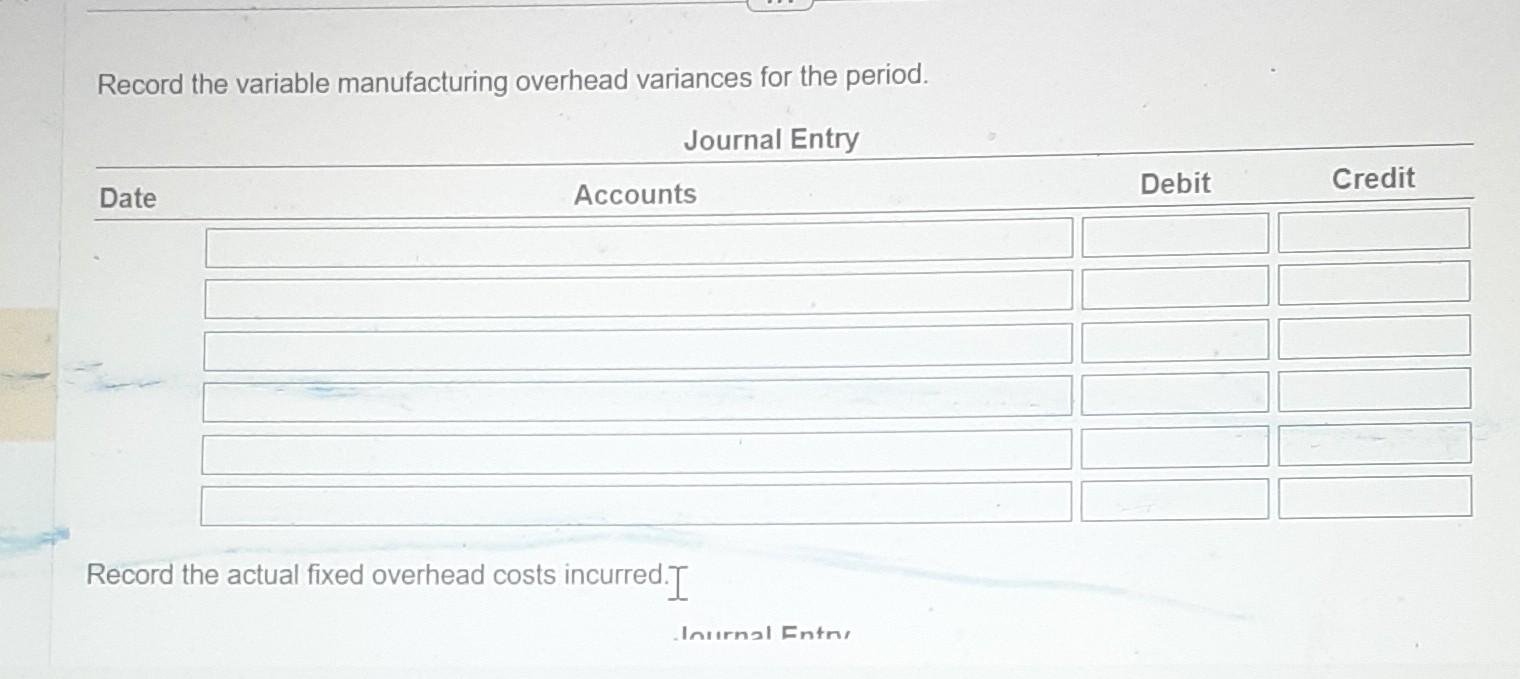

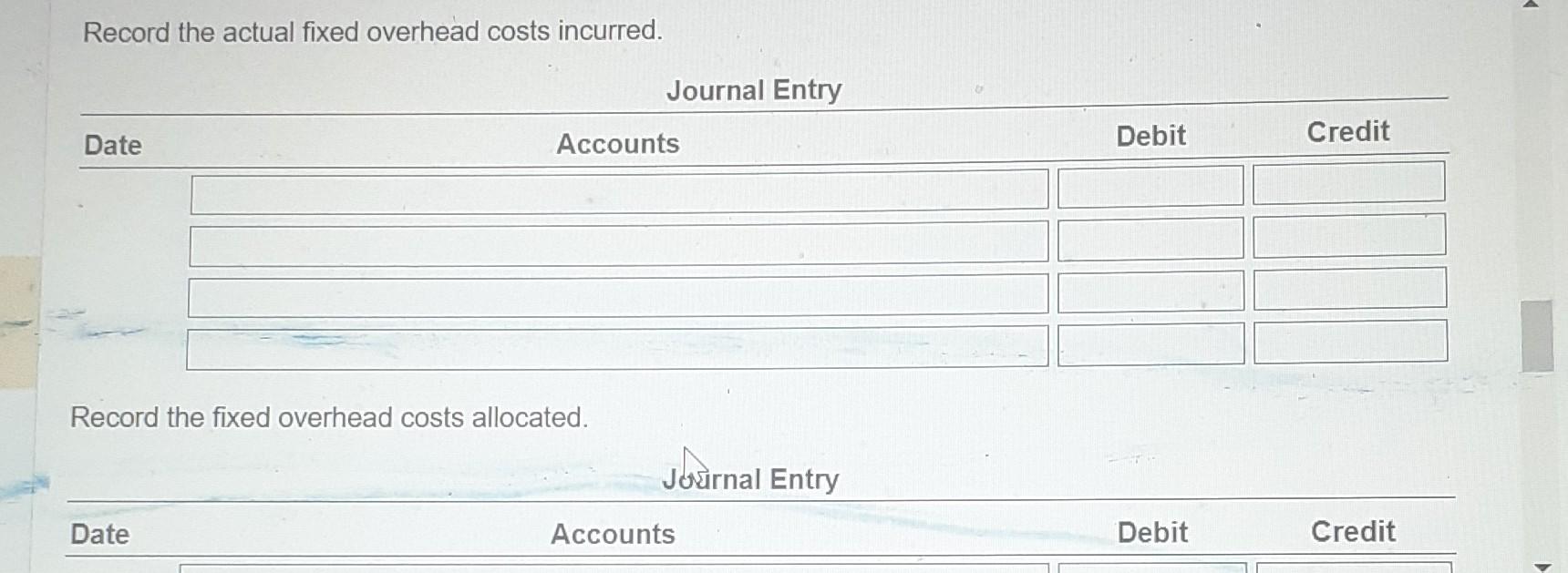

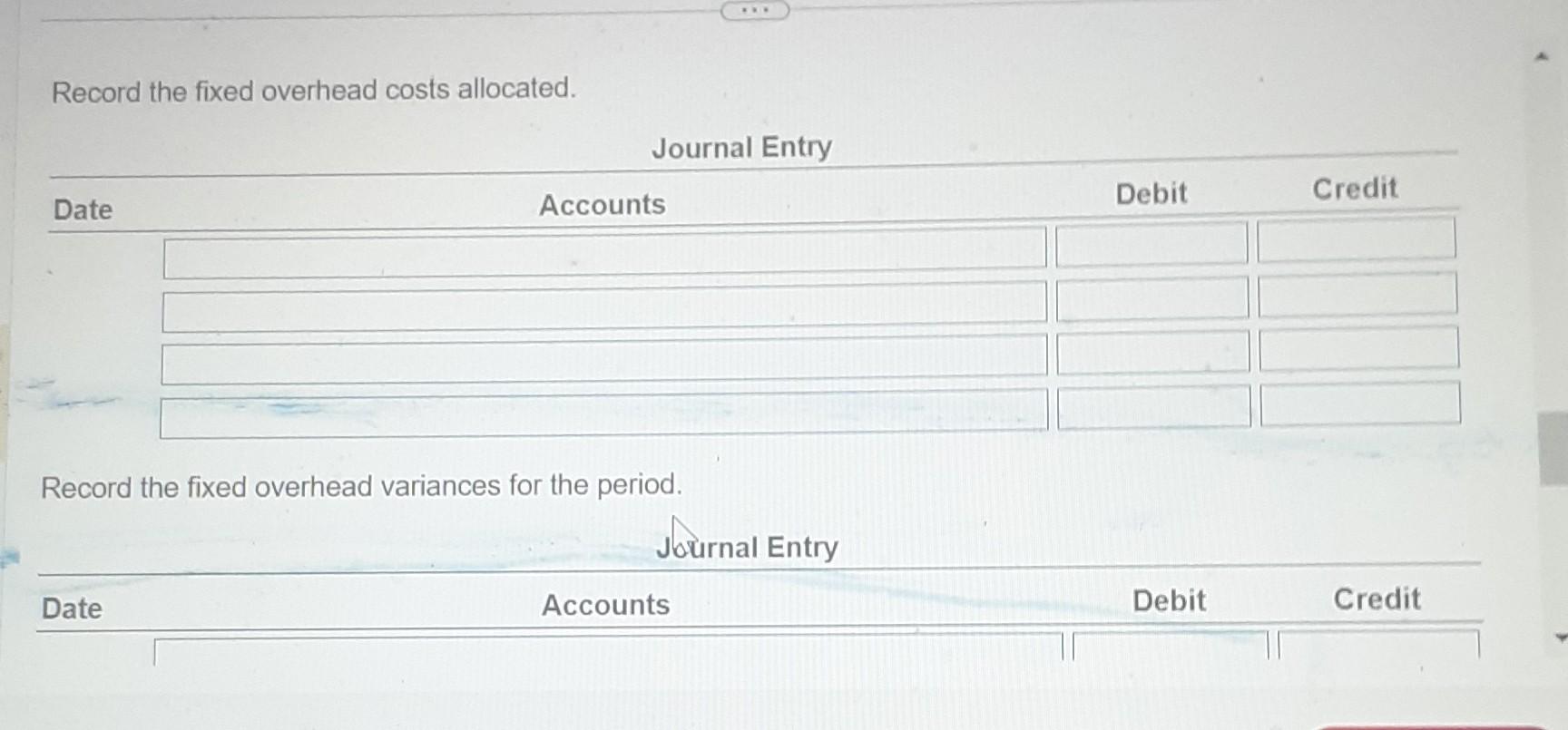

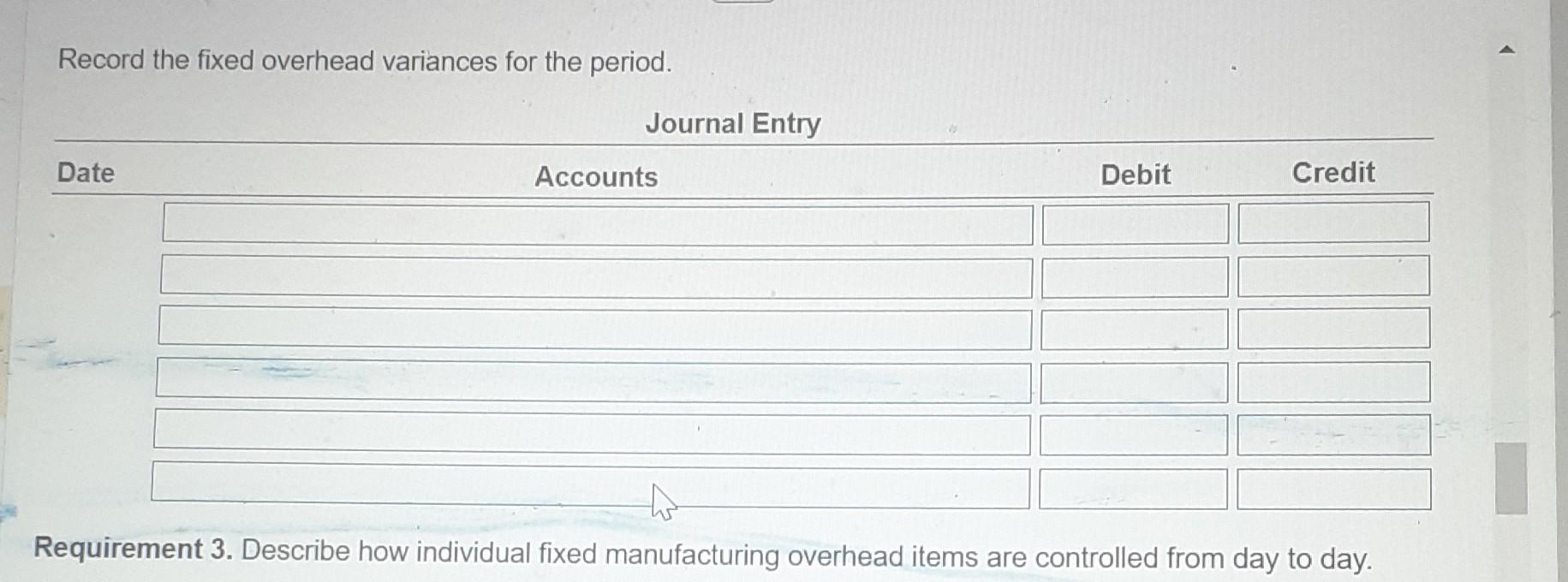

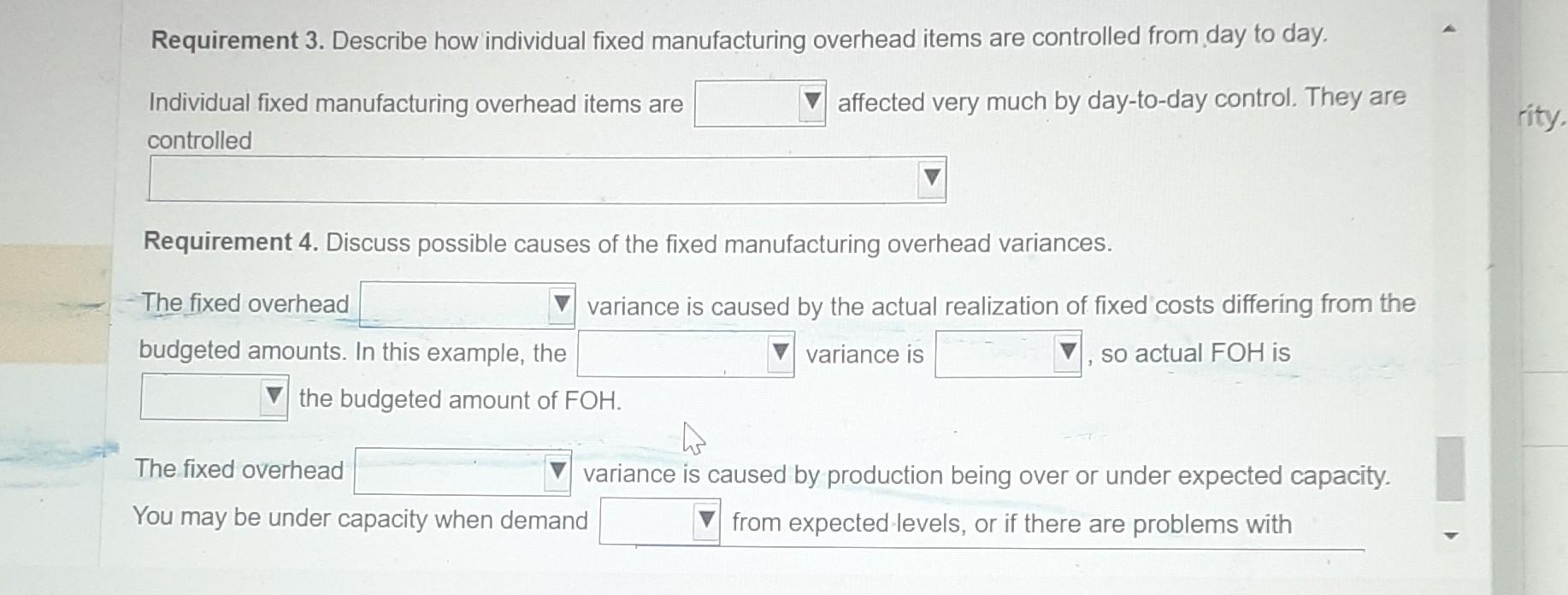

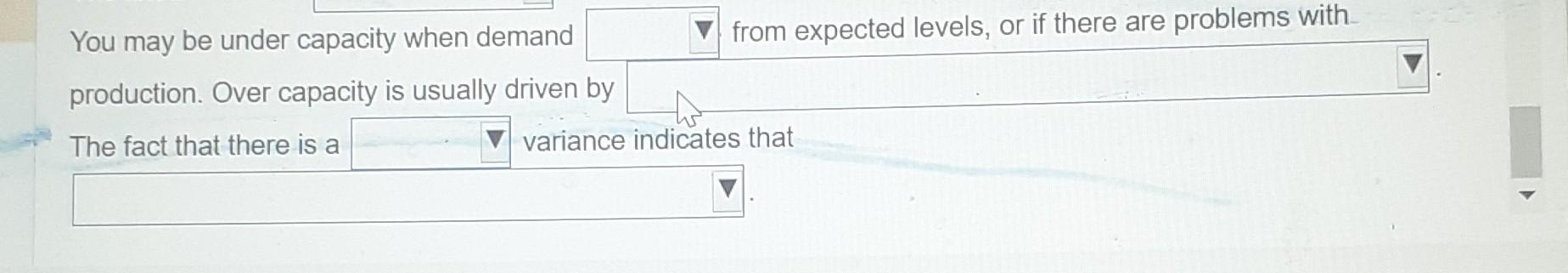

Record the variable manufacturing overhead allocated. Record the variable manufacturing overhead variances for the period. Record the fixed overhead costs allocated. Record the fixed overhead variances for the period. Requirement 1. Prepare an analysis of all variable manufacturing overhead and fixed manufacturing overhead variances, using the 4-variance analysis. Begin by calculating the following amounts for the variable overhead. Requirements 1. Prepare an analysis of all variable manufacturing overhead and fixed manufacturing overhead variances, using the 4 -variance analysis. 2. Prepare journal entries using the 4 -variance analysis. 3. Describe how individual fixed manufacturing overhead items are controlled from day to day. 4. Discuss possible causes of the fixed manufacturing overhead variances. Record the actual fixed overhead costs incurred. Record the fixed overhead costs allocated. Requirement 3. Describe how individual fixed manufacturing overhead items are controlled from day to day. Individual fixed manufacturing overhead items are affected very much by day-to-day control. They are controlled Requirement 4. Discuss possible causes of the fixed manufacturing overhead variances. The fixed overhead variance is caused by the actual realization of fixed costs differing from the budgeted amounts. In this example, the variance is so actual FOH is the budgeted amount of FOH. The fixed overhead variance is caused by production being over or under expected capacity. You may be under capacity when demand from expected levels, or if there are problems with Requirement 2 . Hrepare journal entries using the 4 -variance analysis. Record the actual variable manutacturing overhead incurred. (Record debits first, then credits. Exclude explanations from any journal entries.) Record the variable manufacturing overhead allocated. Now complete the 4-variance analysis using the amounts you calculated above. (If no variance exists, leave the dollar value blank. Label the variance as favorable (F), unfavorable (U) or never a variance (N).) Requirement 2. Prepare journal entries using the 4 -variance analysis. Record the actual variable manufacturing overhead incurred. (Record debits first, then credits. Exclude explanations from any journal entries.) The Tavarez Company uses standard costing in its manufacturing plant for auto parts. The standard cost of a particular auto part, based on a denominator level of 3,800 output units per year, included 5 machine-hours of variable manufacturing overhead at $7 per hour and 5 machine-hours of fixed manufacturing overhead at $13 per hour. Actual output produced was 4,100 units. Variable manufacturing overhead incurred was $265,000. Fixed manufacturing overhead incurred was $385,000. Actual machine-hours were 30,000 . Record the fixed overhead variances for the period. Record the variable manufacturing overhead variances for the period. Record the actual fixed overhead costs incurred.] You may be under capacity when demand from expected levels, or if there are problems with production. Over capacity is usually driven by The fact that there is a variance indicates that

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts