Question: Please help me solve this Within the relevant range of output, you determine that the following factory overhead costs per month should occur: engineering support,

Please help me solve this

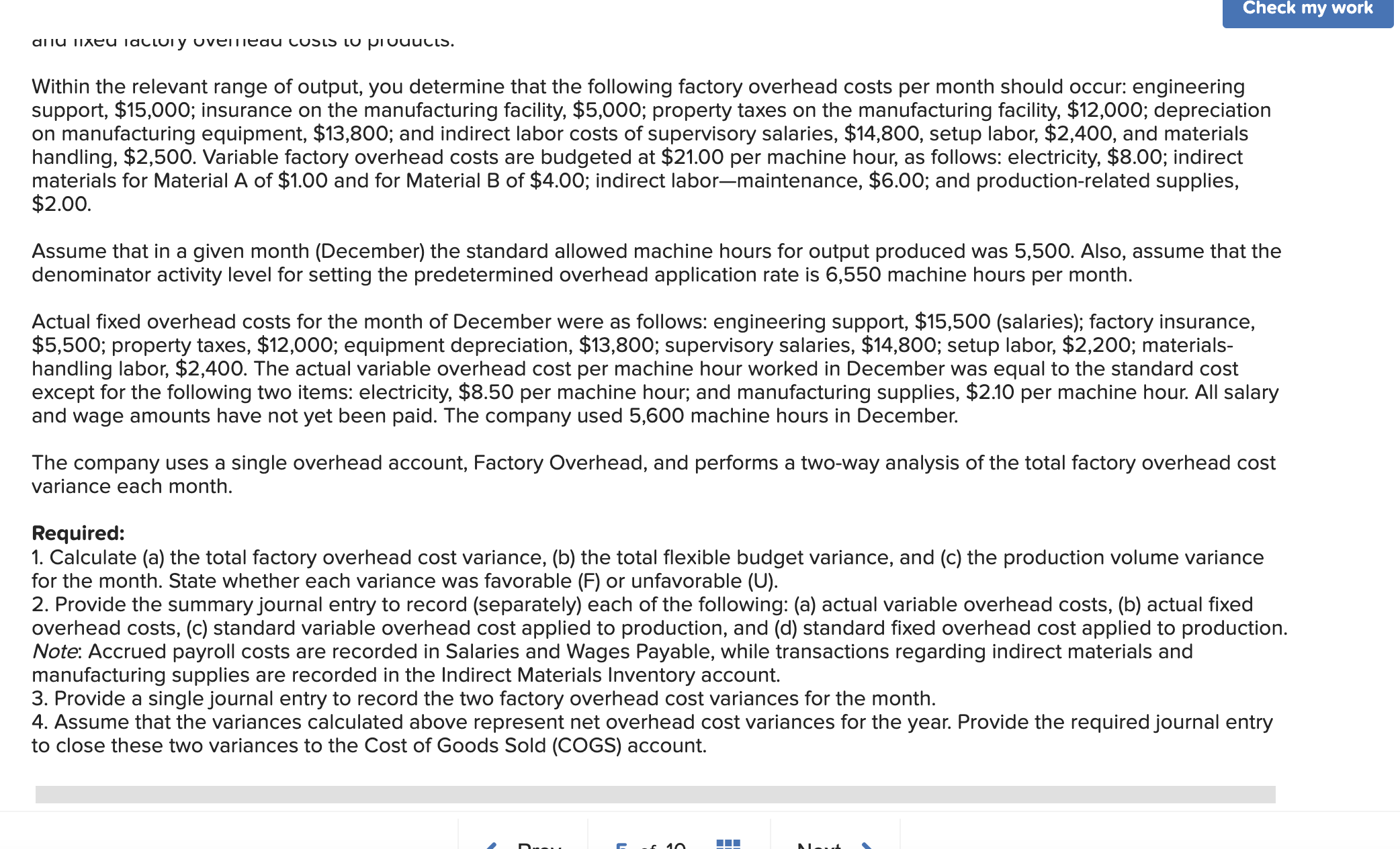

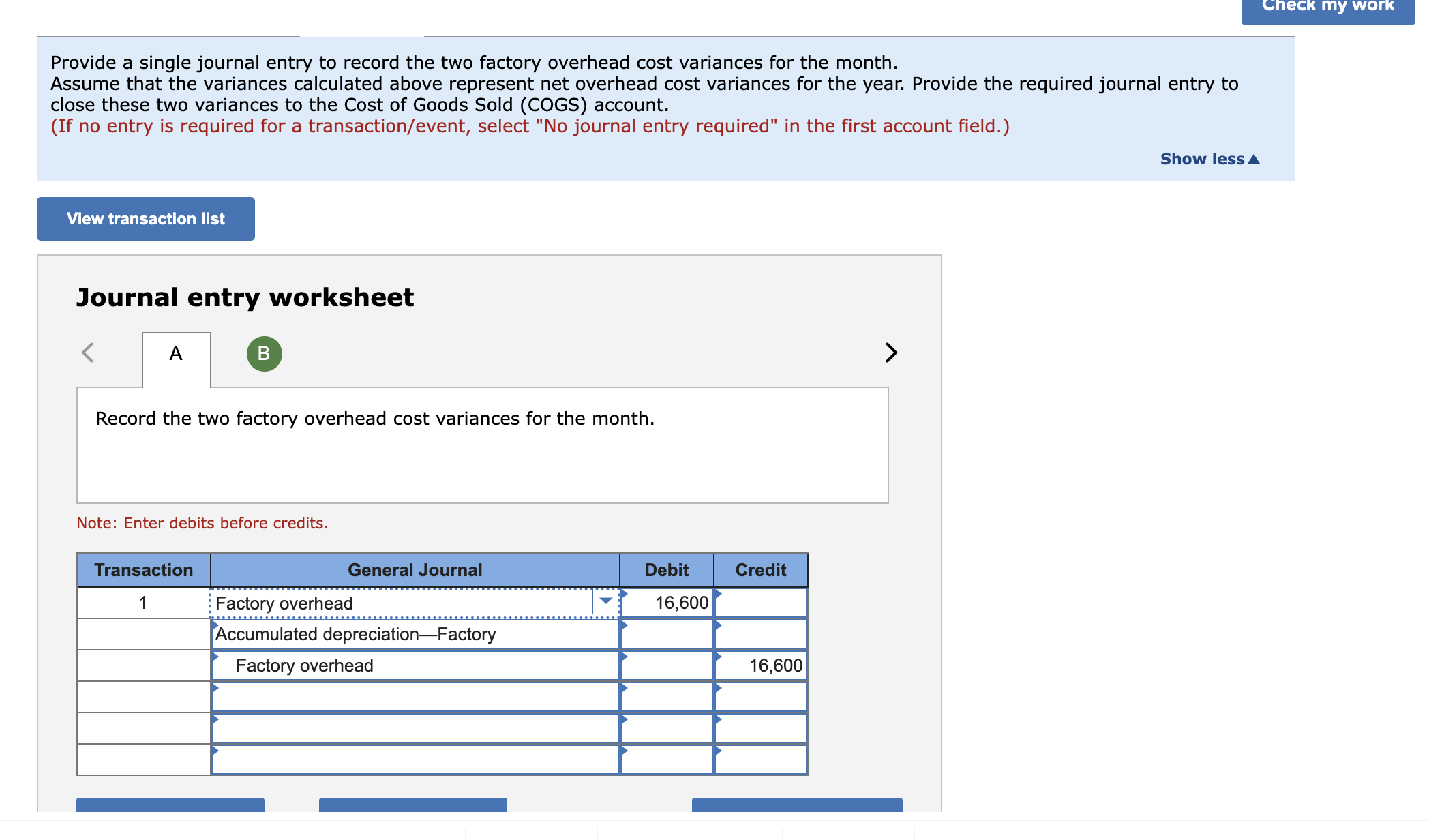

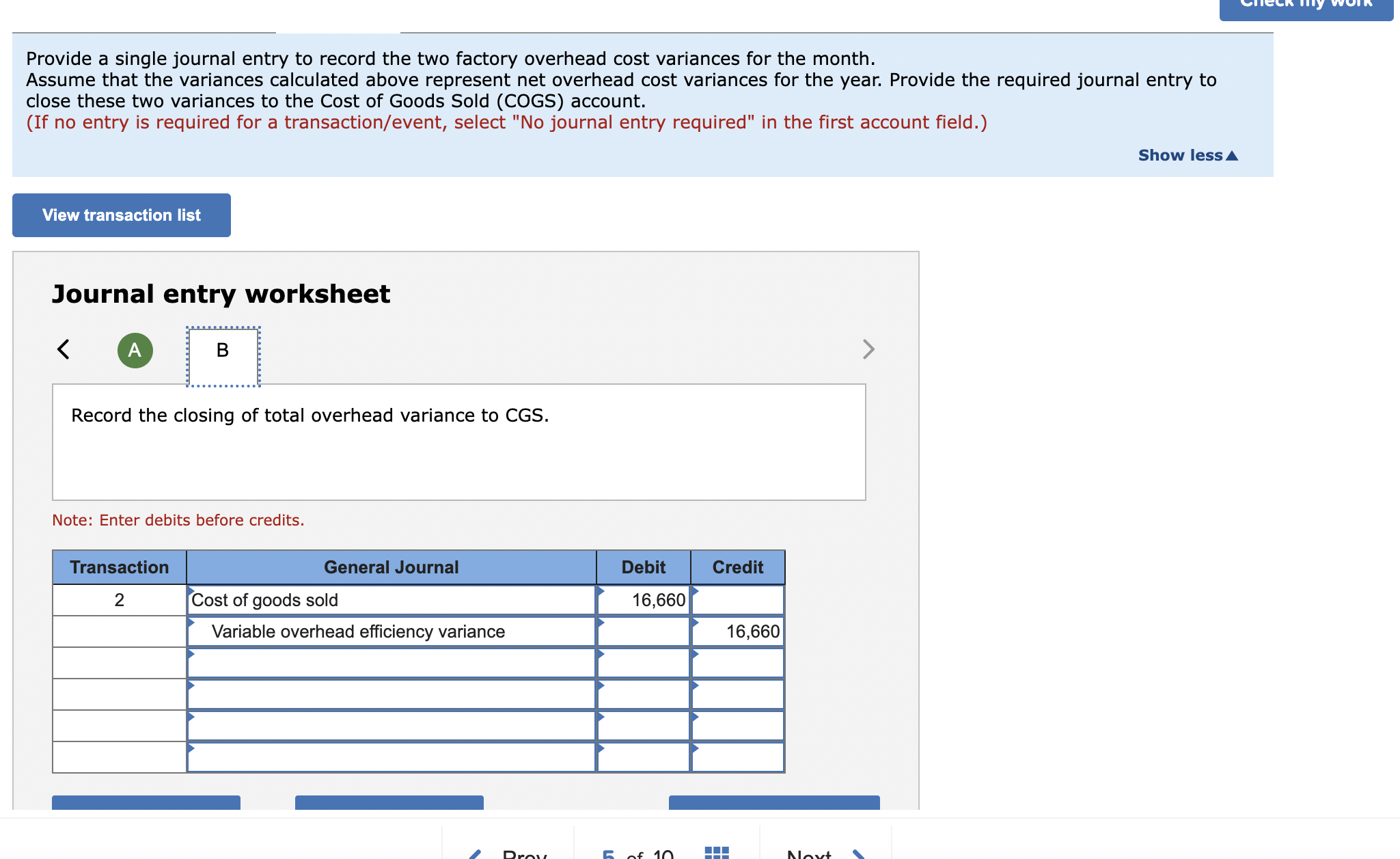

Within the relevant range of output, you determine that the following factory overhead costs per month should occur: engineering support, \$15,000; insurance on the manufacturing facility, $5,000; property taxes on the manufacturing facility, $12,000; depreciation on manufacturing equipment, $13,800; and indirect labor costs of supervisory salaries, $14,800, setup labor, $2,400, and materials handling, $2,500. Variable factory overhead costs are budgeted at $21.00 per machine hour, as follows: electricity, $8.00; indirect materials for Material A of $1.00 and for Material B of $4.00; indirect labor-maintenance, $6.00; and production-related supplies, $2.00. Assume that in a given month (December) the standard allowed machine hours for output produced was 5,500. Also, assume that the denominator activity level for setting the predetermined overhead application rate is 6,550 machine hours per month. Actual fixed overhead costs for the month of December were as follows: engineering support, $15,500 (salaries); factory insurance, $5,500; property taxes, $12,000; equipment depreciation, $13,800; supervisory salaries, $14,800; setup labor, $2,200; materialshandling labor, $2,400. The actual variable overhead cost per machine hour worked in December was equal to the standard cost except for the following two items: electricity, $8.50 per machine hour; and manufacturing supplies, \$2.10 per machine hour. All salary and wage amounts have not yet been paid. The company used 5,600 machine hours in December. The company uses a single overhead account, Factory Overhead, and performs a two-way analysis of the total factory overhead cost variance each month. Required: 1. Calculate (a) the total factory overhead cost variance, (b) the total flexible budget variance, and (c) the production volume variance for the month. State whether each variance was favorable (F) or unfavorable (U). 2. Provide the summary journal entry to record (separately) each of the following: (a) actual variable overhead costs, (b) actual fixed overhead costs, (c) standard variable overhead cost applied to production, and (d) standard fixed overhead cost applied to production. Note: Accrued payroll costs are recorded in Salaries and Wages Payable, while transactions regarding indirect materials and manufacturing supplies are recorded in the Indirect Materials Inventory account. 3. Provide a single journal entry to record the two factory overhead cost variances for the month. 4. Assume that the variances calculated above represent net overhead cost variances for the year. Provide the required journal entry to close these two variances to the Cost of Goods Sold (COGS) account. Provide a single journal entry to record the two factory overhead cost variances for the month. Assume that the variances calculated above represent net overhead cost variances for the year. Provide the required journal entry to close these two variances to the Cost of Goods Sold (COGS) account. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Show less A Journal entry worksheet Record the two factory overhead cost variances for the month. Note: Enter debits before credits. Provide a single journal entry to record the two factory overhead cost variances for the month. Assume that the variances calculated above represent net overhead cost variances for the year. Provide the required journal entry to close these two variances to the Cost of Goods Sold (COGS) account. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet Record the closing of total overhead variance to CGS. Note: Enter debits before credits

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts