Question: Please help me solve this I can't figure this out A European multinational firm has subsidiaries based in France, Germany, Poland, and Italy. The subsidiaries

Please help me solve this I can't figure this out

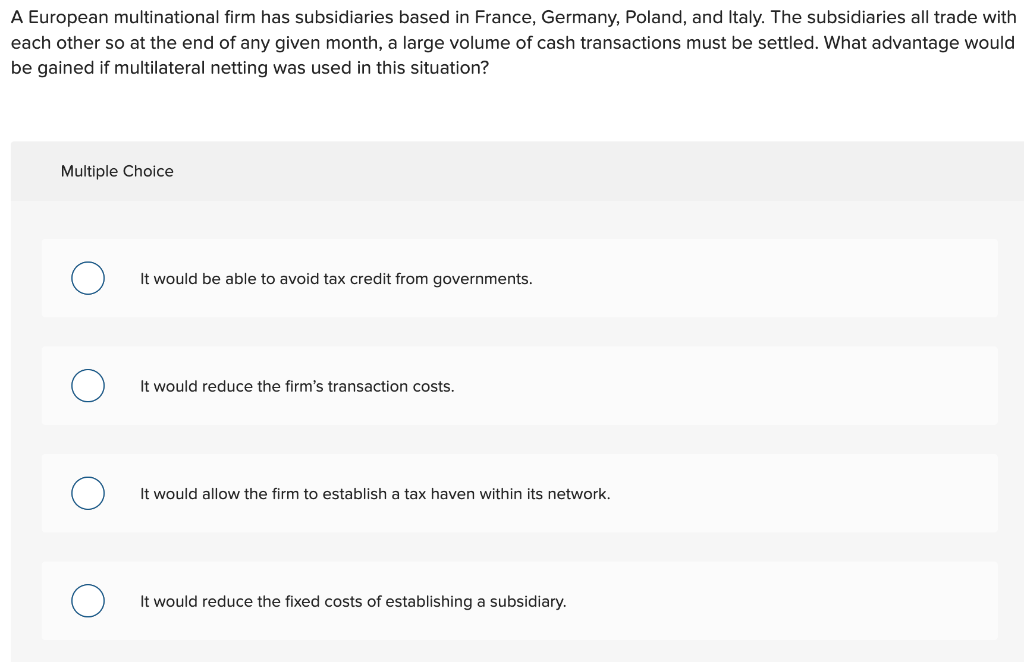

A European multinational firm has subsidiaries based in France, Germany, Poland, and Italy. The subsidiaries all trade with each other so at the end of any given month, a large volume of cash transactions must be settled. What advantage would be gained if multilateral netting was used in this situation? Multiple Choice It would be able to avoid tax credit from governments. It would reduce the firm's transaction costs. It would allow the firm to establish a tax haven within its network. It would reduce the fixed costs of establishing a subsidiary

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts