Question: Please help me solve this! I have been struggling a while and mainly I need the PROCESS. Give right answer with proper explanation kudos! Show

Please help me solve this! I have been struggling a while and mainly I need the PROCESS. Give right answer with proper explanation kudos!

Show your process to get the number, thanks!

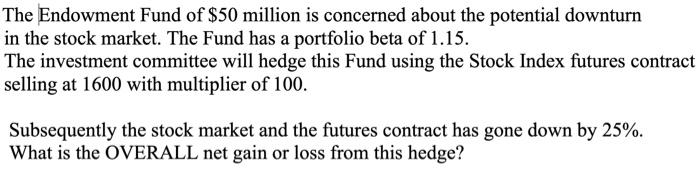

The Endowment Fund of $50 million is concerned about the potential downturn in the stock market. The Fund has a portfolio beta of 1.15. The investment committee will hedge this Fund using the Stock Index futures contract selling at 1600 with multiplier of 100. Subsequently the stock market and the futures contract has gone down by 25%. What is the OVERALL net gain or loss from this hedge

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock