Question: please help me Solve this! Note: for this section, assume your discussions will be posted in a journal, which targets readers with lowmoderate investment knowledge.

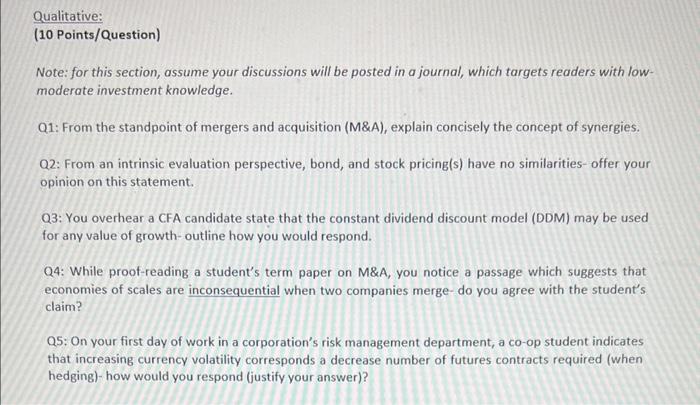

Note: for this section, assume your discussions will be posted in a journal, which targets readers with lowmoderate investment knowledge. Q1: From the standpoint of mergers and acquisition (M\&A), explain concisely the concept of synergies. Q2: From an intrinsic evaluation perspective, bond, and stock pricing(s) have no similarities- offer your opinion on this statement. Q3: You overhear a CFA candidate state that the constant dividend discount model (DDM) may be used for any value of growth-outline how you would respond. Q4: While proof-reading a student's term paper on M\&A, you notice a passage which suggests that economies of scales are inconsequential when two companies merge-do you agree with the student's claim? Q5: On your first day of work in a corporation's risk management department, a co-op student indicates that increasing currency volatility corresponds a decrease number of futures contracts required (when hedging)- how would you respond (justify your answer)? Note: for this section, assume your discussions will be posted in a journal, which targets readers with lowmoderate investment knowledge. Q1: From the standpoint of mergers and acquisition (M\&A), explain concisely the concept of synergies. Q2: From an intrinsic evaluation perspective, bond, and stock pricing(s) have no similarities- offer your opinion on this statement. Q3: You overhear a CFA candidate state that the constant dividend discount model (DDM) may be used for any value of growth-outline how you would respond. Q4: While proof-reading a student's term paper on M\&A, you notice a passage which suggests that economies of scales are inconsequential when two companies merge-do you agree with the student's claim? Q5: On your first day of work in a corporation's risk management department, a co-op student indicates that increasing currency volatility corresponds a decrease number of futures contracts required (when hedging)- how would you respond (justify your answer)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts