Question: please help me solve this Note: for this section, assume your discussions will be posted in a journal, which targets readers with lowmoderate investment knowledge.

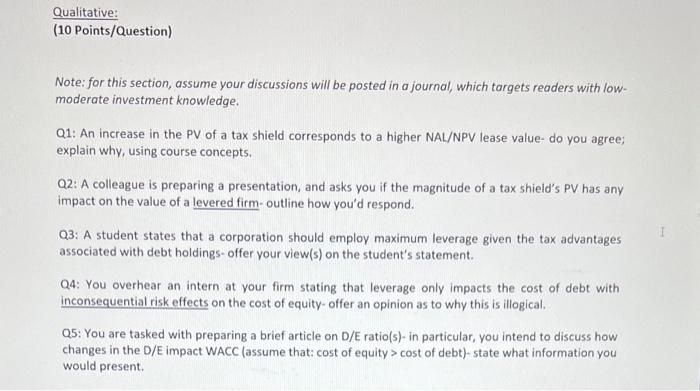

Note: for this section, assume your discussions will be posted in a journal, which targets readers with lowmoderate investment knowledge. Q1: An increase in the PV of a tax shield corresponds to a higher NAL/NPV lease value-do you agree; explain why, using course concepts. Q2: A colleague is preparing a presentation, and asks you if the magnitude of a tax shield's PV has any impact on the value of a levered firm-outline how you'd respond. Q3: A student states that a corporation should employ maximum leverage given the tax advantages associated with debt holdings- offer your view(s) on the student's statement. Q4: You overhear an intern at your firm stating that leverage only impacts the cost of debt with inconsequential risk effects on the cost of equity-offer an opinion as to why this is illogical. Q5: You are tasked with preparing a brief article on D/E ratio(s)- in particular, you intend to discuss how changes in the D/E impact WACC (assume that: cost of equity > cost of debt)-state what information you would present

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts