Question: please help me solve this problem 10. The company has 2 divisions, which capital for 35% consists of long-term liabilities, for 5% for preferred shares,

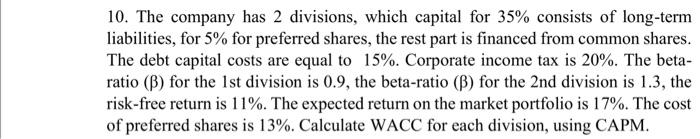

10. The company has 2 divisions, which capital for 35% consists of long-term liabilities, for 5% for preferred shares, the rest part is financed from common shares. The debt capital costs are equal to 15%. Corporate income tax is 20%. The betaratio () for the 1st division is 0.9 , the beta-ratio () for the 2 nd division is 1.3 , the risk-free return is 11%. The expected return on the market portfolio is 17%. The cost of preferred shares is 13%. Calculate WACC for each division, using CAPM. 10. The company has 2 divisions, which capital for 35% consists of long-term liabilities, for 5% for preferred shares, the rest part is financed from common shares. The debt capital costs are equal to 15%. Corporate income tax is 20%. The betaratio () for the 1st division is 0.9 , the beta-ratio () for the 2 nd division is 1.3 , the risk-free return is 11%. The expected return on the market portfolio is 17%. The cost of preferred shares is 13%. Calculate WACC for each division, using CAPM

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts