Question: Please help me solve this problem. Don't copy paste from other people's answers because I've seen wrong answers. Thank you. 2. (6 points) a. Given

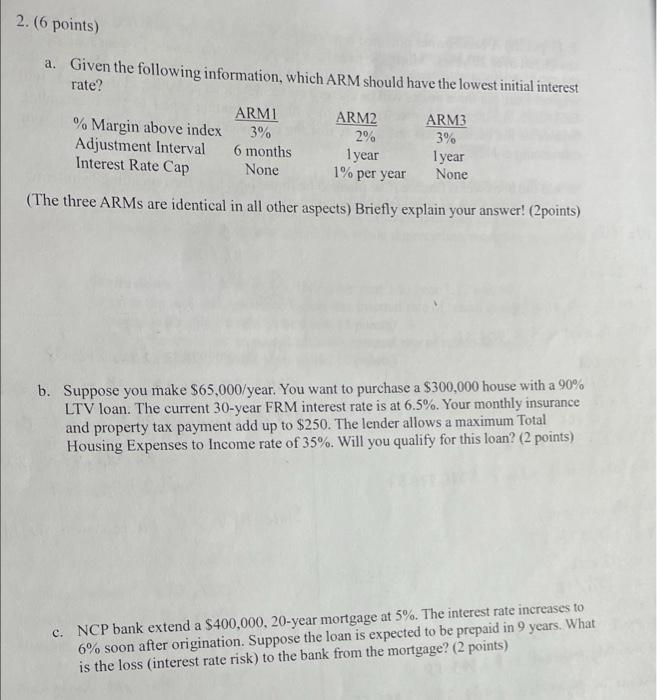

2. (6 points) a. Given the following information, which ARM should have the lowest initial interest rate? ARMI ARM2 ARM3 % Margin above index 3% 2% 3% Adjustment Interval 6 months 1 year 1 year Interest Rate Cap None 1% per year None (The three ARMs are identical in all other aspects) Briefly explain your answer! (2points) b. Suppose you make $65.000/year. You want to purchase a $300,000 house with a 90% LTV loan. The current 30-year FRM interest rate is at 6.5%. Your monthly insurance and property tax payment add up to $250. The lender allows a maximum Total Housing Expenses to Income rate of 35%. Will you qualify for this loan? (2 points) c. NCP bank extend a $400,000, 20-year mortgage at 5%. The interest rate increases to 6% soon after origination. Suppose the loan is expected to be prepaid in 9 years. What is the loss (interest rate risk) to the bank from the mortgage? (2 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts