Question: Please help me solve this problem step by step with a Financial Calculator: Up to this point this point, we have learned how to calculate

Please help me solve this problem step by step with a Financial Calculator:

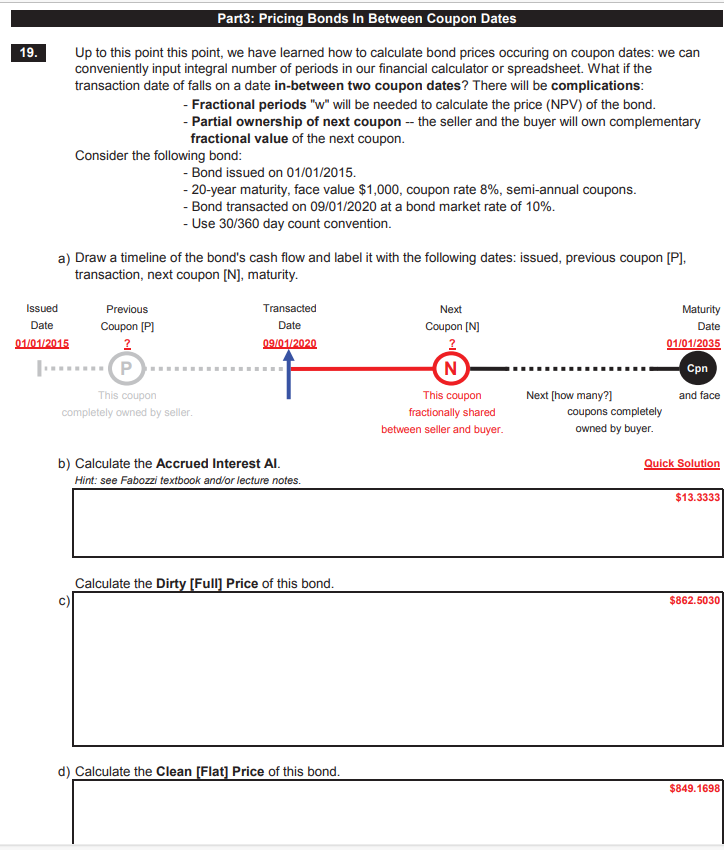

Up to this point this point, we have learned how to calculate bond prices occuring on coupon dates: we can conveniently input integral number of periods in our financial calculator or spreadsheet. What if the transaction date of falls on a date in-between two coupon dates? There will be complications: - Fractional periods " w " will be needed to calculate the price (NPV) of the bond. - Partial ownership of next coupon -- the seller and the buyer will own complementary fractional value of the next coupon. Consider the following bond: - Bond issued on 01/01/2015. - 20-year maturity, face value $1,000, coupon rate 8%, semi-annual coupons. - Bond transacted on 09/01/2020 at a bond market rate of 10%. - Use 30/360 day count convention. a) Draw a timeline of the bond's cash flow and label it with the following dates: issued, previous coupon [P], transaction, next coupon [N], maturity. b) Calculate the Accrued Interest Al. Quick Solutior Hint' see Fahnori texthonk and/hr lerture notes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts