Question: Please Help me solve this Question 5 [31] Progress Manufacturing (Pty) Ltd has to replace one of its machines because the machine currently in use

![Please Help me solve this Question 5 [31] Progress Manufacturing (Pty) Ltd](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/6702648e673bd_0616702648dd1954.jpg)

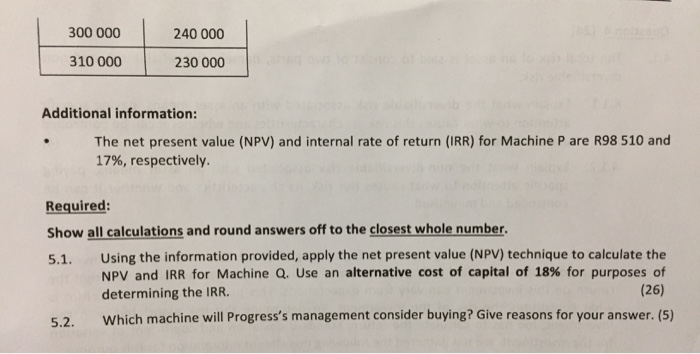

Question 5 [31] Progress Manufacturing (Pty) Ltd has to replace one of its machines because the machine currently in use is more than ten years old and its maintenance costs are becoming unaffordable. The company is considering two different machines from two different suppliers. Machine P will require an initial investment of R800 000 and Machine Q an initial investment of R900 000. The company's cost of capital is 12% and the estimated net cash flows for each machine for a five-year period are included in the table below. Machine P Machine Q 200 000 260 000 220 000 320 000 250 000 270 000 300 000 310 000 240 000 230 000 Additional information: The net present value (NPV) and internal rate of return (IRR) for Machine P are R98 510 and 17%, respectively. Required: Show all calculations and round answers off to the closest whole number. 5.1. Using the information provided, apply the net present value (NPV) technique to calculate the NPV and IRR for Machine Q. Use an alternative cost of capital of 18% for purposes of determining the IRR. (26) 5.2. Which machine will Progress's management consider buying? Give reasons for your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts