Question: Please help me solve this question 6 x Chapter 1 to 5 Assignment - Excel (Product Activation failed) Tell me what you want to do

Please help me solve this question

Please help me solve this question

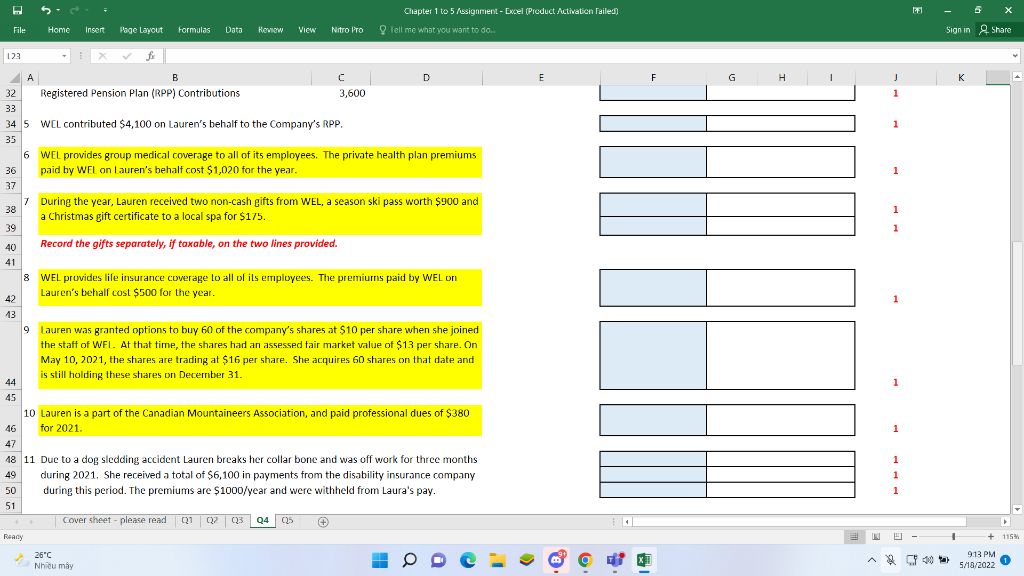

6 x Chapter 1 to 5 Assignment - Excel (Product Activation failed) Tell me what you want to do File Home Insert Page Layout Formulas Data Review View Nitro Pro Sign in Share 123 E F G H H 1 J K 1 1 1 1 1 B C D 32 Registered Pension Plan (RPP) Contributions 3,600 33 34 5 WEL contributed $4,100 on Lauren's behalf to the Company's RPP. 35 6 WEL provides group medical coverage to all of its employees. The private health plan premiums 36 paid by WEL on Lauren's behalf cost $1,020 for the year. 37 7 During the year, Lauren received two non-cash gifts from WEL, a season skipass worth $900 and 38 a Christmas gift certificate to a local spa for $175. 39 40 Record the gifts separately, if taxable, on the two lines provided. 41 8 WEL provides life insurance coverage lo all of ils employees. The premiums paid by WEL on Lauren's behall cost $500 for the year. 42 13 9 Lauren was granted options to buy 60 of the company's shares at $10 per share when she joined the staff of WEL. At that time, the shares had an assessed fair market value of $13 per share. On May 10, 2021, the shares are trading at $16 per share. She acquires 60 shares on that date and is still holding these shares on December 31. 44 45 10 Lauren is a part of the Canadian Mountaineers Association, and paid professional dues of $380 46 for 2021 47 48 11 Due to a dog sledding accident Lauren breaks her collar bone and was off work for three months 49 during 2021. She received a total of $6,100 in payments from the disability insurance company 50 during this period. The premiums are $1000/year and were withheld from Laura's pay. 51 Cover sheet - please read Q1 Q2 Q3 04 05 Q5 1 1 1 1 Ready + 115 7 26"C Nhiu my a 9.13 PM 1 5/18/2022 6 x Chapter 1 to 5 Assignment - Excel (Product Activation failed) Tell me what you want to do File Home Insert Page Layout Formulas Data Review View Nitro Pro Sign in Share 123 E F G H H 1 J K 1 1 1 1 1 B C D 32 Registered Pension Plan (RPP) Contributions 3,600 33 34 5 WEL contributed $4,100 on Lauren's behalf to the Company's RPP. 35 6 WEL provides group medical coverage to all of its employees. The private health plan premiums 36 paid by WEL on Lauren's behalf cost $1,020 for the year. 37 7 During the year, Lauren received two non-cash gifts from WEL, a season skipass worth $900 and 38 a Christmas gift certificate to a local spa for $175. 39 40 Record the gifts separately, if taxable, on the two lines provided. 41 8 WEL provides life insurance coverage lo all of ils employees. The premiums paid by WEL on Lauren's behall cost $500 for the year. 42 13 9 Lauren was granted options to buy 60 of the company's shares at $10 per share when she joined the staff of WEL. At that time, the shares had an assessed fair market value of $13 per share. On May 10, 2021, the shares are trading at $16 per share. She acquires 60 shares on that date and is still holding these shares on December 31. 44 45 10 Lauren is a part of the Canadian Mountaineers Association, and paid professional dues of $380 46 for 2021 47 48 11 Due to a dog sledding accident Lauren breaks her collar bone and was off work for three months 49 during 2021. She received a total of $6,100 in payments from the disability insurance company 50 during this period. The premiums are $1000/year and were withheld from Laura's pay. 51 Cover sheet - please read Q1 Q2 Q3 04 05 Q5 1 1 1 1 Ready + 115 7 26"C Nhiu my a 9.13 PM 1 5/18/2022

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts