Question: Please help me solve this question from tipton ice cream case 0 SOFTWARE QUESTION 12. Hood is generally quite comfortable with the assumptions of her

Please help me solve this question from tipton ice cream case

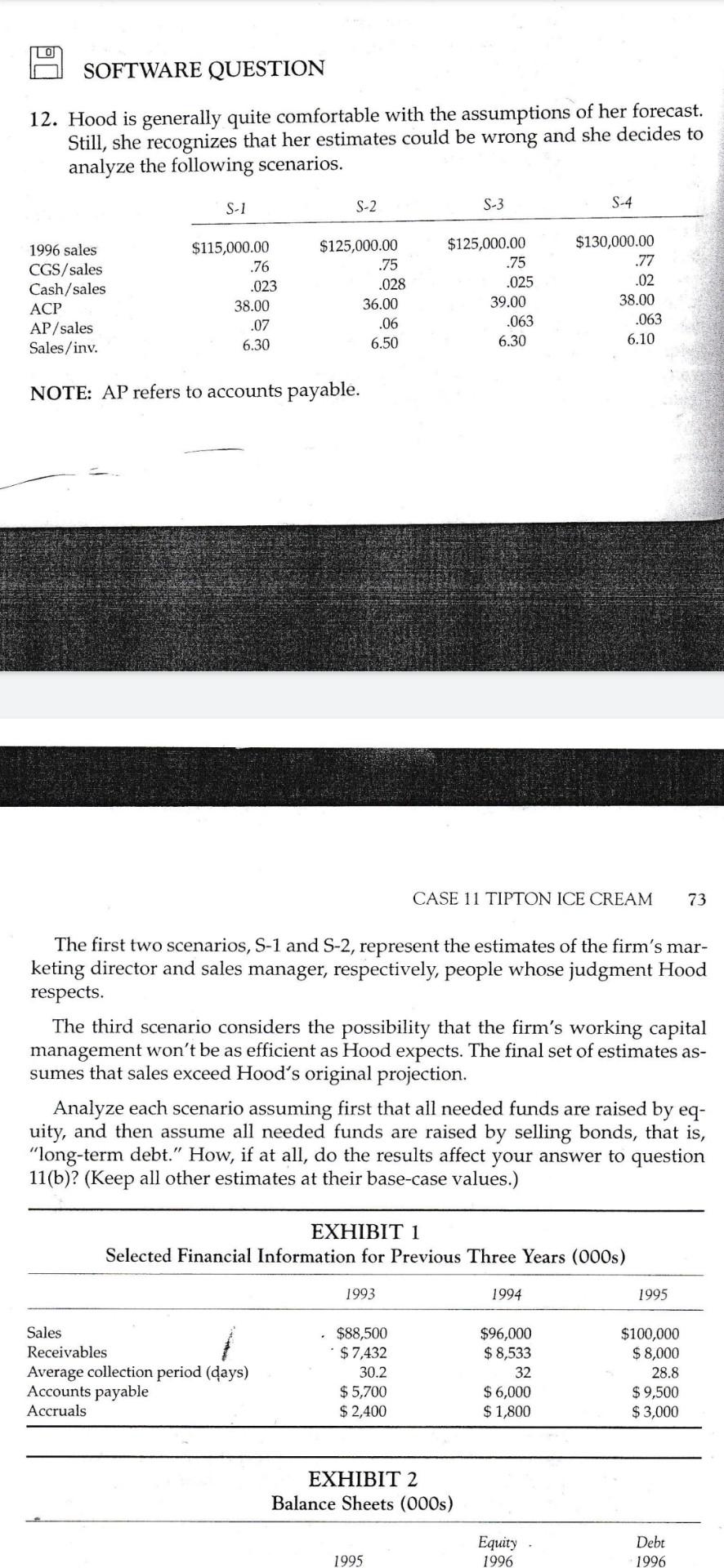

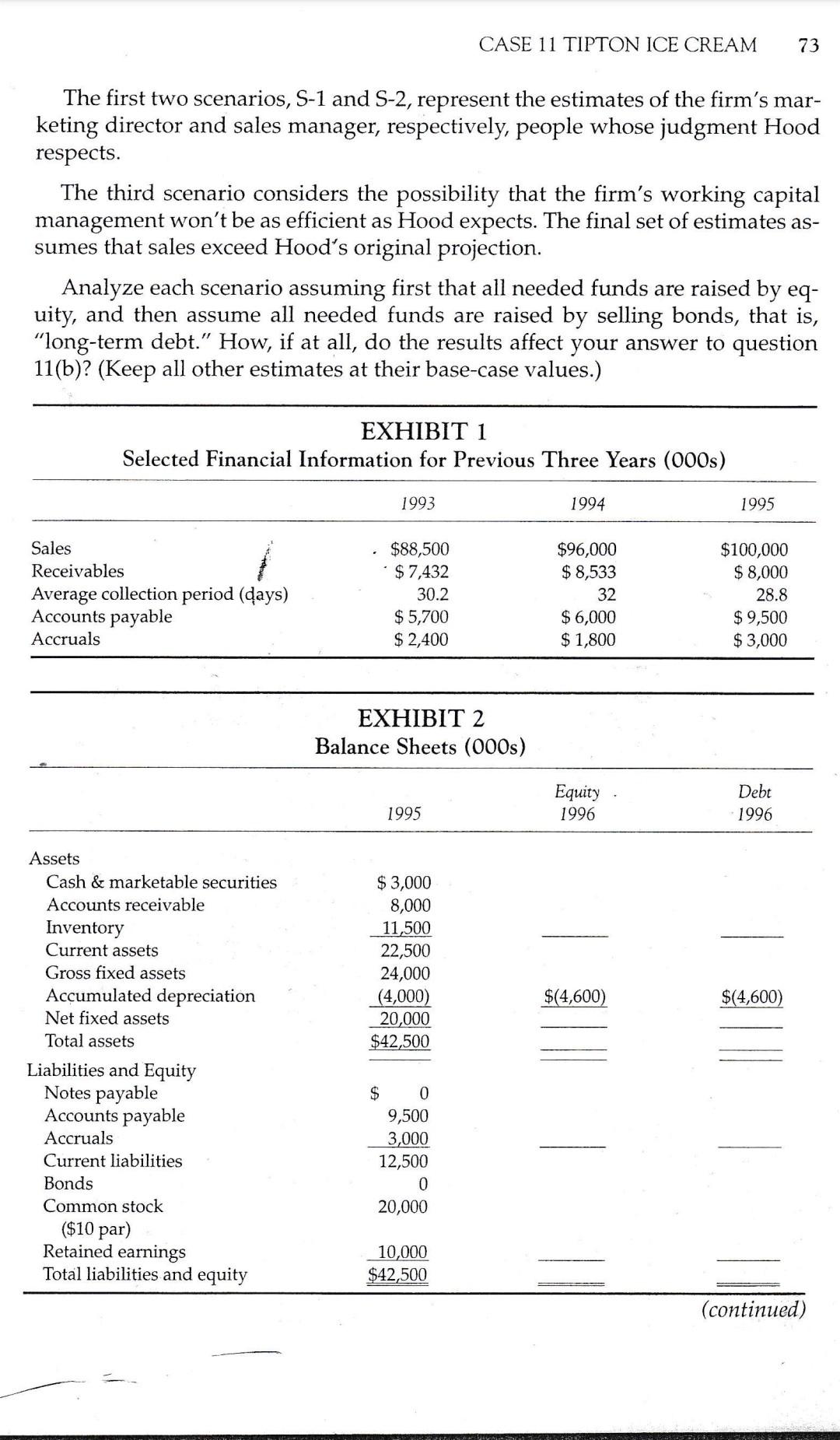

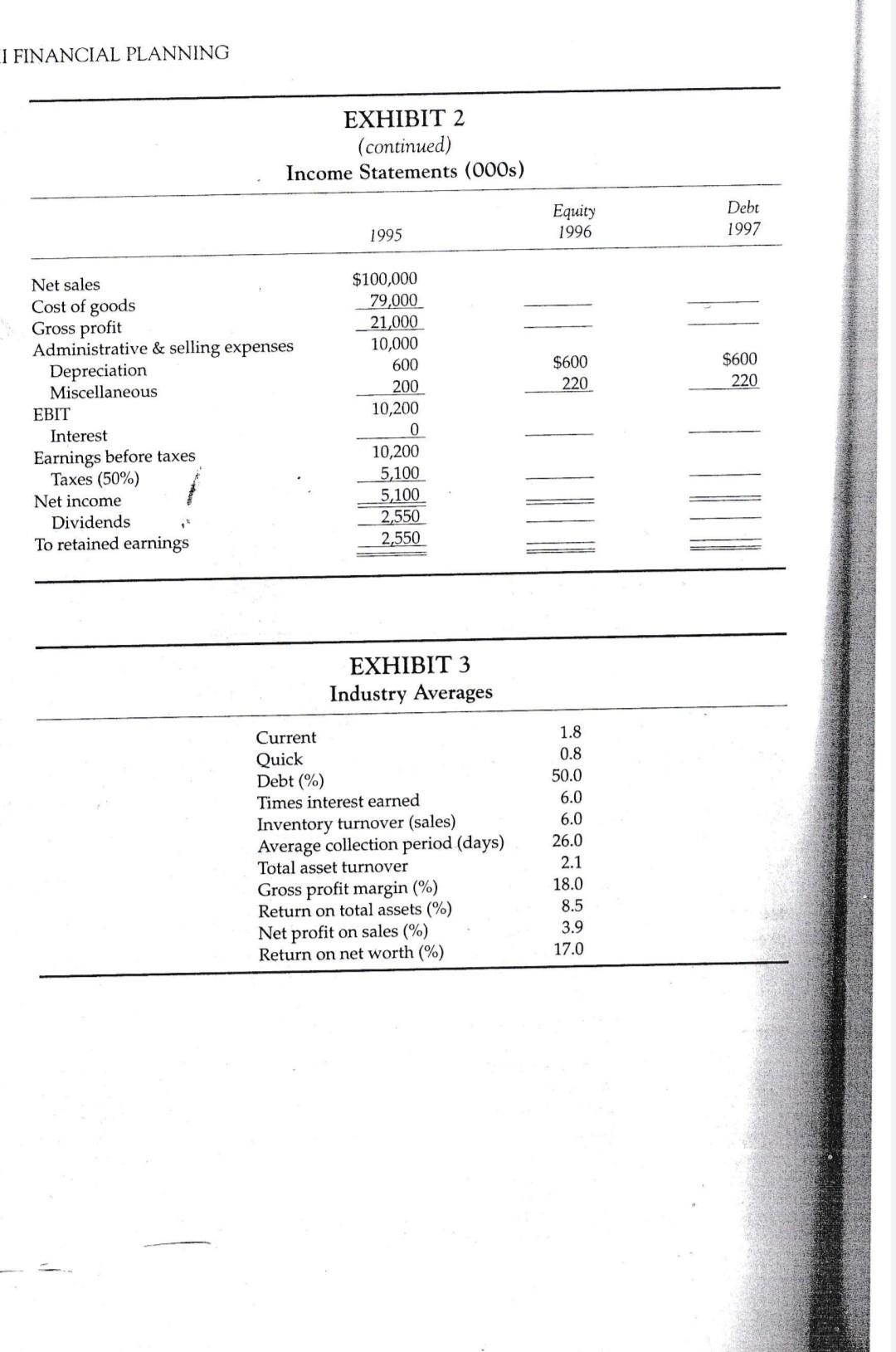

0 SOFTWARE QUESTION 12. Hood is generally quite comfortable with the assumptions of her forecast. Still, she recognizes that her estimates could be wrong and she decides to analyze the following scenarios. S-1 S-2 S-3 S-4 1996 sales CGS/ sales Cash/sales ACP AP/sales Sales/inv. $115,000.00 .76 .023 38.00 .07 6.30 $125,000.00 .75 .028 36.00 .06 6.50 $125,000.00 .75 .025 39.00 .063 6.30 $130,000.00 .77 .02 38.00 .063 6.10 NOTE: AP refers to accounts payable. CASE 11 TIPTON ICE CREAM 73 The first two scenarios, S-1 and S-2, represent the estimates of the firm's mar- keting director and sales manager, respectively, people whose judgment Hood respects. The third scenario considers the possibility that the firm's working capital management won't be as efficient as Hood expects. The final set of estimates as- sumes that sales exceed Hood's original projection. Analyze each scenario assuming first that all needed funds are raised by eq- uity, and then assume all needed funds are raised by selling bonds, that is, long-term debt." How, if at all, do the results affect your answer to question 11(b)? (Keep all other estimates at their base-case values.) EXHIBIT 1 Selected Financial Information for Previous Three Years (000s) 1993 1994 1995 Sales A Receivables Average collection period (days) Accounts payable Accruals $88,500 $ 7,432 30.2 $ 5,700 $ 2,400 $96,000 $ 8,533 32 $ 6,000 $ 1,800 $100,000 $ 8,000 28.8 $ 9,500 $ 3,000 EXHIBIT 2 Balance Sheets (000s) Equity Debt 1996 1995 1996 CASE 11 TIPTON ICE CREAM 73 The first two scenarios, S-1 and S-2, represent the estimates of the firm's mar- keting director and sales manager, respectively, people whose judgment Hood respects. The third scenario considers the possibility that the firm's working capital management won't be as efficient as Hood expects. The final set of estimates as- sumes that sales exceed Hood's original projection. Analyze each scenario assuming first that all needed funds are raised by eq- uity, and then assume all needed funds are raised by selling bonds, that is, long-term debt." How, if at all, do the results affect your answer to question 11(b)? (Keep all other estimates at their base-case values.) EXHIBIT 1 Selected Financial Information for Previous Three Years (000s) 1993 1994 1995 Sales Receivables Average collection period (days) Accounts payable Accruals $88,500 $ 7,432 30.2 $ 5,700 $ 2,400 $96,000 $ 8,533 32 $ 6,000 $ 1,800 $100,000 $ 8,000 28.8 $ 9,500 $3,000 EXHIBIT 2 Balance Sheets (000s) Equity 1996 Debt 1996 1995 $ 3,000 8,000 11,500 22,500 24,000 (4,000) 20,000 $42,500 $(4,600) $(4,600) Assets Cash & marketable securities Accounts receivable Inventory Current assets Gross fixed assets Accumulated depreciation Net fixed assets Total assets Liabilities and Equity Notes payable Accounts payable Accruals Current liabilities Bonds Common stock ($10 par) Retained earnings Total liabilities and equity $ 0 9,500 3,000 12,500 0 20,000 10,000 $42,500 (continued) I FINANCIAL PLANNING EXHIBIT 2 (continued) Income Statements (000s) Equity 1996 Debt 1997 1995 $600 220 $600 220 Net sales Cost of goods Gross profit Administrative & selling expenses Depreciation Miscellaneous EBIT Interest Earnings before taxes Taxes (50%) Net income Dividends To retained earnings $100,000 79,000 21,000 10,000 600 200 10,200 0 10,200 5,100 5,100 2,550 2,550 EXHIBIT 3 Industry Averages Current Quick Debt (%) Times interest earned Inventory turnover (sales) Average collection period (days) Total asset turnover Gross profit margin (%) Return on total assets (%) Net profit on sales (%) Return on net worth (%) 1.8 0.8 50.0 6.0 6.0 26.0 2.1 18.0 8.5 3.9 17.0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts