Question: Please Help me solve this question, to help assist you below are options for the MC part i) Gain/ Loss ii) Fully / Partly /

Please Help me solve this question, to help assist you below are options for the MC part

i) Gain/ Loss

ii) Fully / Partly / Not

iii) Increases / reduce

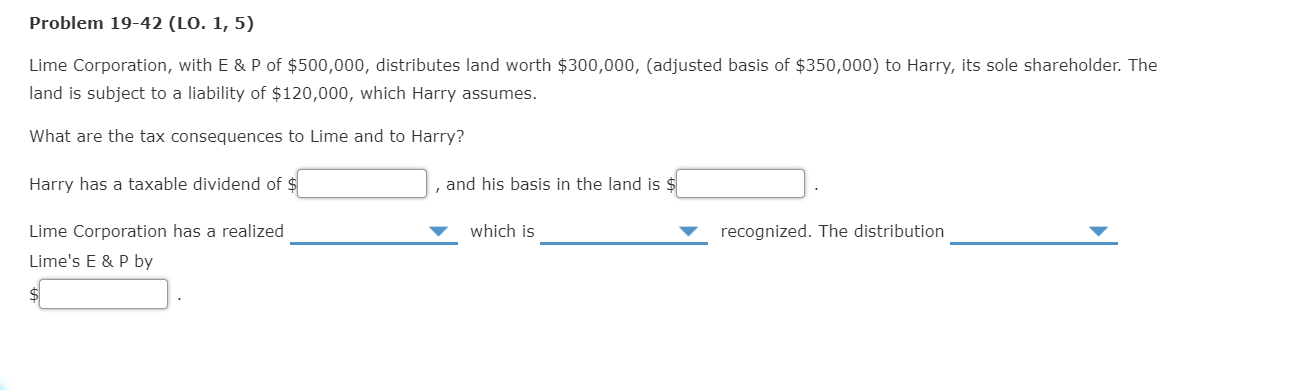

Problem 19-42 (LO. 1, 5) Lime Corporation, with E & P of $500,000, distributes land worth $300,000, (adjusted basis of $350,000) to Harry, its sole shareholder. The land is subject to a liability of $120,000, which Harry assumes. What are the tax consequences to Lime and to Harry? Harry has a taxable dividend of $ and his basis in the land is $ which is recognized. The distribution Lime Corporation has a realized Lime's E&P by

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts