Question: Please Help me solve this question, to help assist you below are options for the MC part i) Gain/ Loss ii) Fully / Partly /

Please Help me solve this question, to help assist you below are options for the MC part

i) Gain/ Loss

ii) Fully / Partly / Not

iii) Increases / reduce

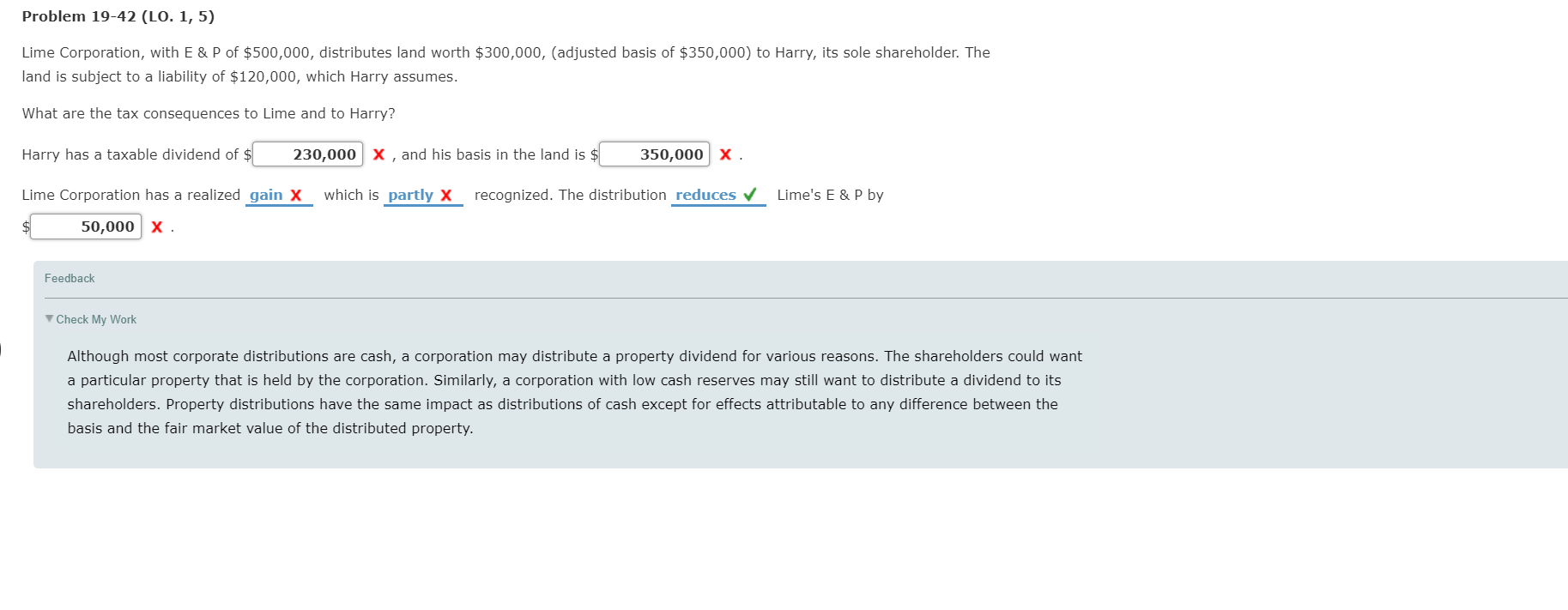

Problem 19-42 (LO. 1, 5) Lime Corporation, with E & P of $500,000, distributes land worth $300,000, (adjusted basis of $350,000) to Harry, its sole shareholder. The land is subject to a liability of $120,000, which Harry assumes. What are the tax consequences to Lime and to Harry? Harry has a taxable dividend of $ 230,000 x , and his basis in the land is $ 350,000 X. which is partly x recognized. The distribution reduces Lime's E&P by Lime Corporation has a realized gain X $ 50,000 x Feedback Check My Work Although most corporate distributions are cash, a corporation may distribute a property dividend for various reasons. The shareholders could want a particular property that is held by the corporation. Similarly, a corporation with low cash reserves may still want to distribute a dividend to its shareholders. Property distributions have the same impact as distributions of cash except for effects attributable to any difference between the basis and the fair market value of the distributed property

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts