Question: PLEASE HELP ME! THE ANSWER ALREADY ON CHEGGS IS INCORRECT. PLEASE SHOW WORK At the time of his death in 2022 , Donald owned a

PLEASE HELP ME! THE ANSWER ALREADY ON CHEGGS IS INCORRECT. PLEASE SHOW WORK

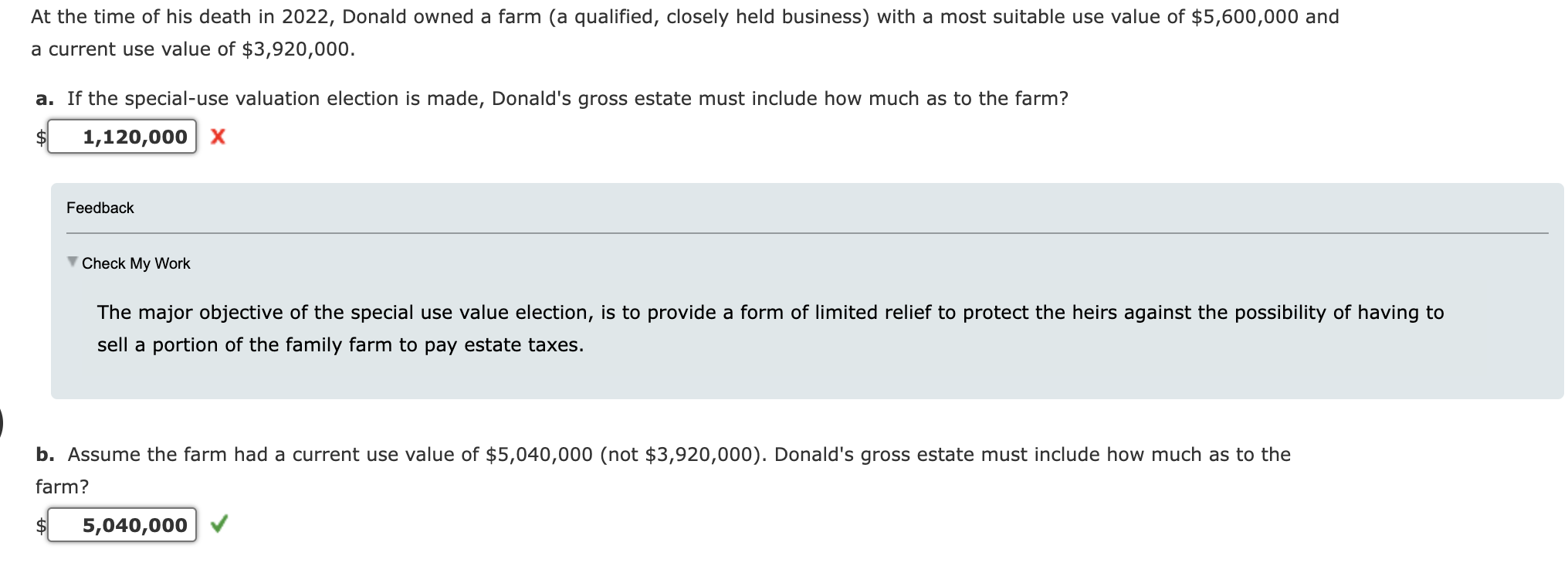

At the time of his death in 2022 , Donald owned a farm (a qualified, closely held business) with a most suitable use value of $5,600,000 and a current use value of $3,920,000. a. If the special-use valuation election is made, Donald's gross estate must include how much as to the farm? X Feedback Check My Work The major objective of the special use value election, is to provide a form of limited relief to protect the heirs against the possibility of having to sell a portion of the family farm to pay estate taxes. b. Assume the farm had a current use value of $5,040,000 (not $3,920,000 ). Donald's gross estate must include how much as to the farm

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts