Question: please help me the second and third questions (b) and (c) 2. The income statement and balance sheet of S&S Air, and the industry median

please help me the second and third questions (b) and (c)

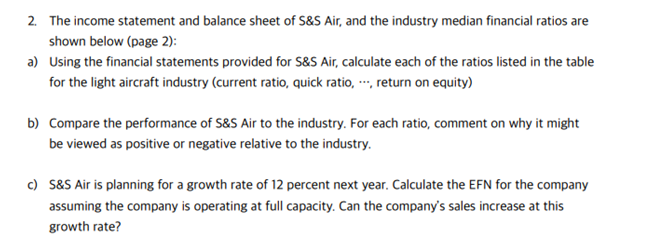

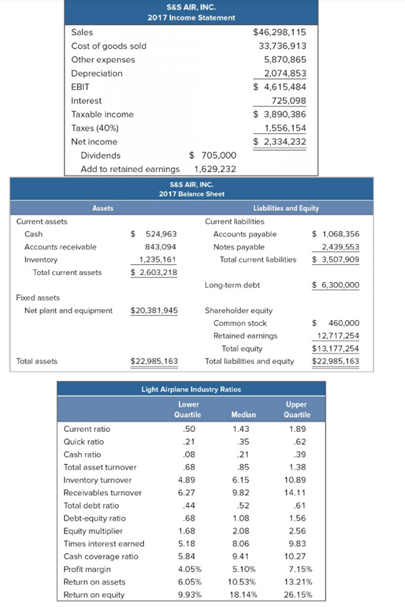

2. The income statement and balance sheet of S&S Air, and the industry median financial ratios are shown below (page 2): a) Using the financial statements provided for S&S Air, calculate each of the ratios listed in the table for the light aircraft industry (current ratio, quick ratio, -, return on equity) b) Compare the performance of S&S Air to the industry. For each ratio, comment on why it might be viewed as positive or negative relative to the industry. c) S&S Air is planning for a growth rate of 12 percent next year. Calculate the EFN for the company assuming the company is operating at full capacity. Can the company's sales increase at this growth rate? S&S AIR, INC. 2017 Income Statement Sales $46,298,115 Cost of goods sold 33.736.913 Other expenses 5,870,865 Depreciation 2,074,853 EBIT $ 4,615,484 Interest 725,098 Taxable income $ 3,890.386 Taxes (40%) 1,556,154 Net Income $ 2,334,232 Dividends $ 705.000 Add to retained earnings 1.629,232 SLS AIR, INC. 2017 Balance Sheet Assets Liabilities and Equity Current assets Current liabilities Cash $ 524,963 Accounts payable $ 1,068,356 Accounts receivable 843.094 Notes payable 2,439,553 Inventory 1,235,161 Total current liabilities $ 3,507.909 Total current assets $ 2,603,218 Long-term debt $ 6,300.000 Fored assets Net plant and equipment $20,381,945 Shareholder equity Common stock $ 460.000 Retained earnings 12.717.254 Total equity $13.177.254 Total assets $22,985,163 Total liabilities and equity $22,985,163 Light Airplane Industry Ratios Lower Quartile Median Current ratio .50 1.43 Quick ratio 21 .35 Cash ratio 08 21 Total asset turnover .68 85 Inventory turnover 4.89 6.15 Receivables turnover 6.27 9.82 Total debt ratio .44 .52 Debt-equity ratio .68 1.08 Equity multiplier 1.68 2.08 Times interest earned 5.18 8.06 Cash coverage ratio 5.84 9.41 Profit margin 4.05% 5.10% Return on assets 6.05% 10.53% Return on equity 9.93% 18.14% Upper Quartile 1.89 .62 39 1.38 10.89 14.11 .61 1.56 2.56 9.83 10.27 7.15% 13.21% 26.15%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts