Question: Can someone please help me out with this question, i am really struggling. the bale Income Statement Balance Sheet Additional Financial Information 1. Market price

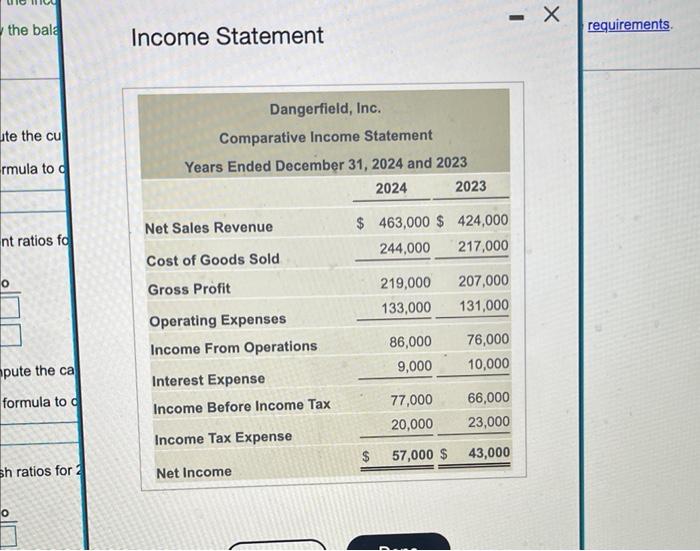

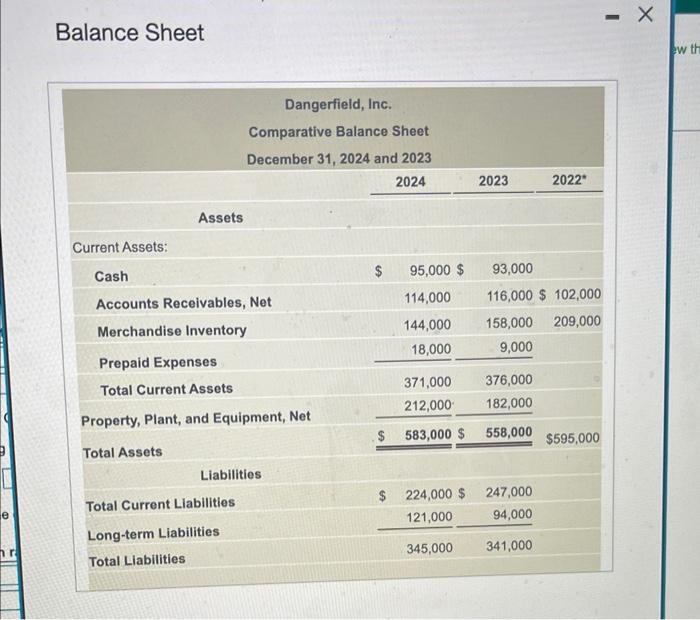

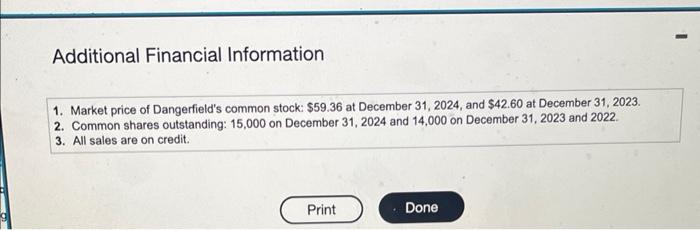

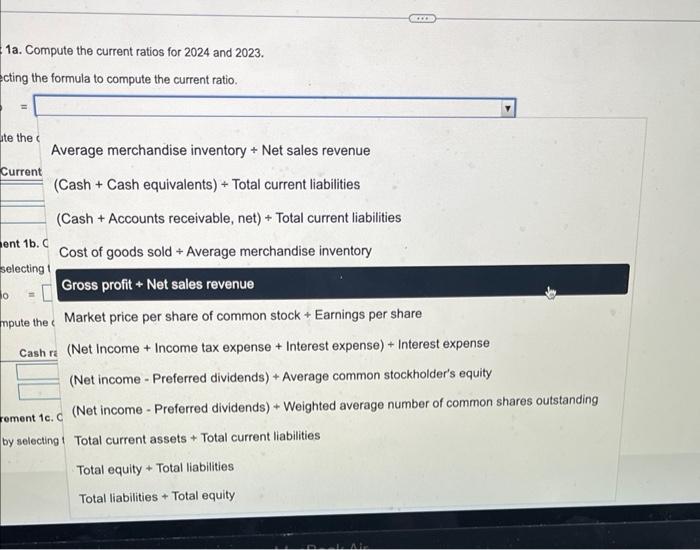

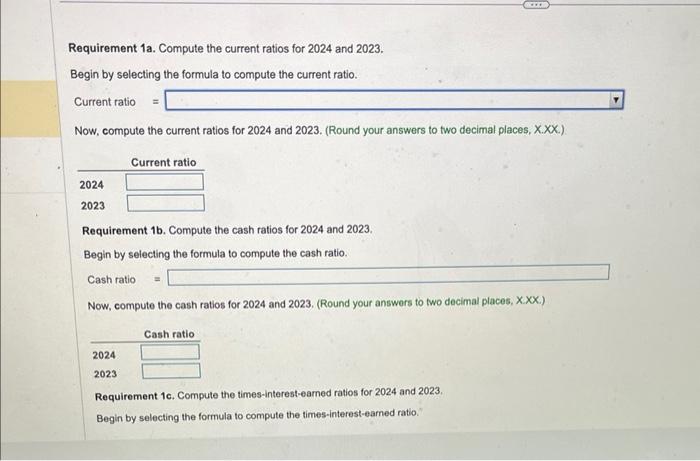

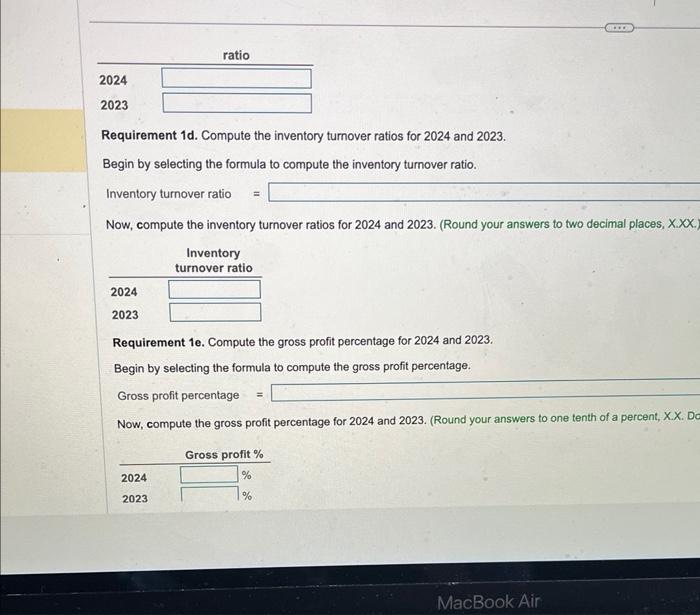

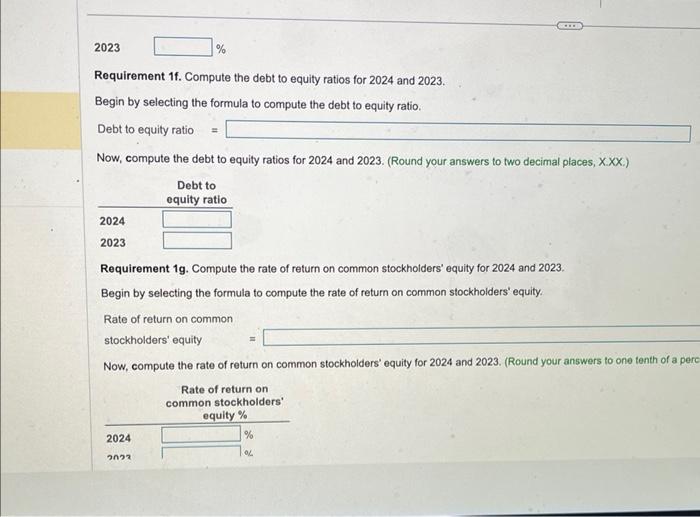

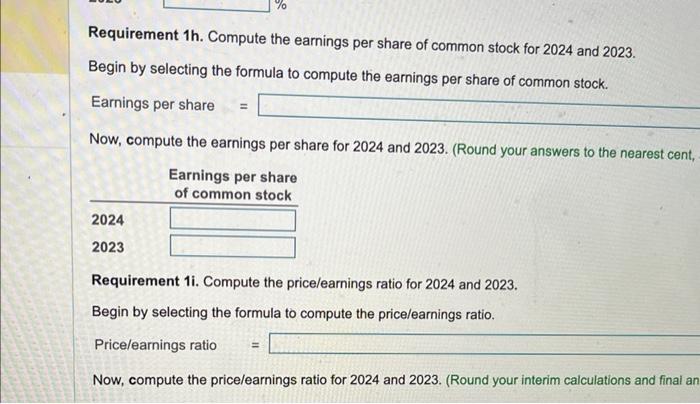

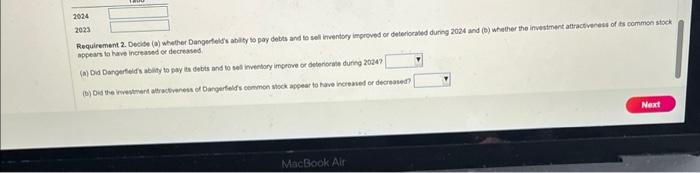

the bale Income Statement Balance Sheet Additional Financial Information 1. Market price of Dangerfield's common stock: $59.36 at December 31, 2024, and $42.60 at December 31,2023. 2. Common shares outstanding: 15,000 on December 31, 2024 and 14,000 on December 31, 2023 and 2022. 3. All sales are on credit. 1a. Compute the current ratios for 2024 and 2023. icting the formula to compute the current ratio. =[ the Average merchandise inventory + Net sales revenue Current (Cash + Cash equivalents )+ Total current liabilities ( Cash + Accounts receivable, net )+ Total current liabilities ient 1b. C Cost of goods sold Average merchandise inventory Gelecting 1 mpute the profit + Net sales revenue Market price per share of common stock + Earnings per share (Net Income + Income tax expense + Interest expense) + Interest expense (Net income - Preferred dividends) + Average common stockholder's equity (Net income - Preferred dividends) + Weighted average number of common shares outstanding by selecting 1 Total current assets + Total current liabilities Total equity + Total liabilities Total liabilities + Total equity Requirement 1a. Compute the current ratios for 2024 and 2023. Begin by selecting the formula to compute the current ratio. Current ratio = Now, compute the current ratios for 2024 and 2023 . (Round your answers to two decimal places, X.XX.). Requirement 1b. Compute the cash ratios for 2024 and 2023. Begin by selecting the formula to compute the cash ratio. Cash ratio = Now, compute the cash ratios for 2024 and 2023, (Round your answers to two decimal places, X.XX.) Requirement 1c. Compute the times-interest-eamed ratios for 2024 and 2023. Begin by selecting the formula to compute the times-interest-earned ratio. Requirement 1d. Compute the inventory turnover ratios for 2024 and 2023. Begin by selecting the formula to compute the inventory turnover ratio. Inventory turnover ratio = Now, compute the inventory turnover ratios for 2024 and 2023. (Round your answers to two decimal places, X.XX. Requirement 1e. Compute the gross profit percentage for 2024 and 2023. Begin by selecting the formula to compute the gross profit percentage. Gross profit percentage = Now, compute the gross profit percentage for 2024 and 2023. (Round your answers to one tenth of a percent, XX. Do Requirement 1f. Compute the debt to equity ratios for 2024 and 2023. Begin by selecting the formula to compute the debt to equity ratio. Debt to equity ratio Now, compute the debt to equity ratios for 2024 and 2023. (Round your answers to two decimal places, X.XX.) Requirement 1g. Compute the rate of return on common stockholders' equity for 2024 and 2023. Begin by selecting the formula to compute the rate of return on common stockholders' equity. Rate of return on common stockholders' equity =1 Now, compute the rate of return on common stockholders' equity for 2024 and 2023. (Round your answers to one tenth of a per Requirement 1h. Compute the earnings per share of common stock for 2024 and 2023. Begin by selecting the formula to compute the earnings per share of common stock. Earnings per share = Now, compute the earnings per share for 2024 and 2023. (Round your answers to the nearest cent, Requirement 1i. Compute the price/earnings ratio for 2024 and 2023. Begin by selecting the formula to compute the price/earnings ratio. Price/earnings ratio =1 Now, compute the price/earnings ratio for 2024 and 2023. (Round your interim calculations and final ar Requirement 2. Decide (a) whwther Dangentelss atilty to poy debts and to sell imentoy iefproves or deteriorakd durng 2024 and (b) whather the investment attractiveness of ts common stack appears ia have increased or decreased. (a) Dad Dongerfedds ablity to bay ts debts and to sed imetetory improve of detenocaie during ato24

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts