Question: Please help me to answer this question 1 to 4 and when you answer it can you answer it according how I also put like

Please help me to answer this question 1 to 4 and when you answer it can you answer it according how I also put like

Answer1(Question 1)

Answer2(Question 2)

Answer3(Question 3)

Answer4(Question 4)

Thank you.

Question 1

Question 2

Question 3

Question 4

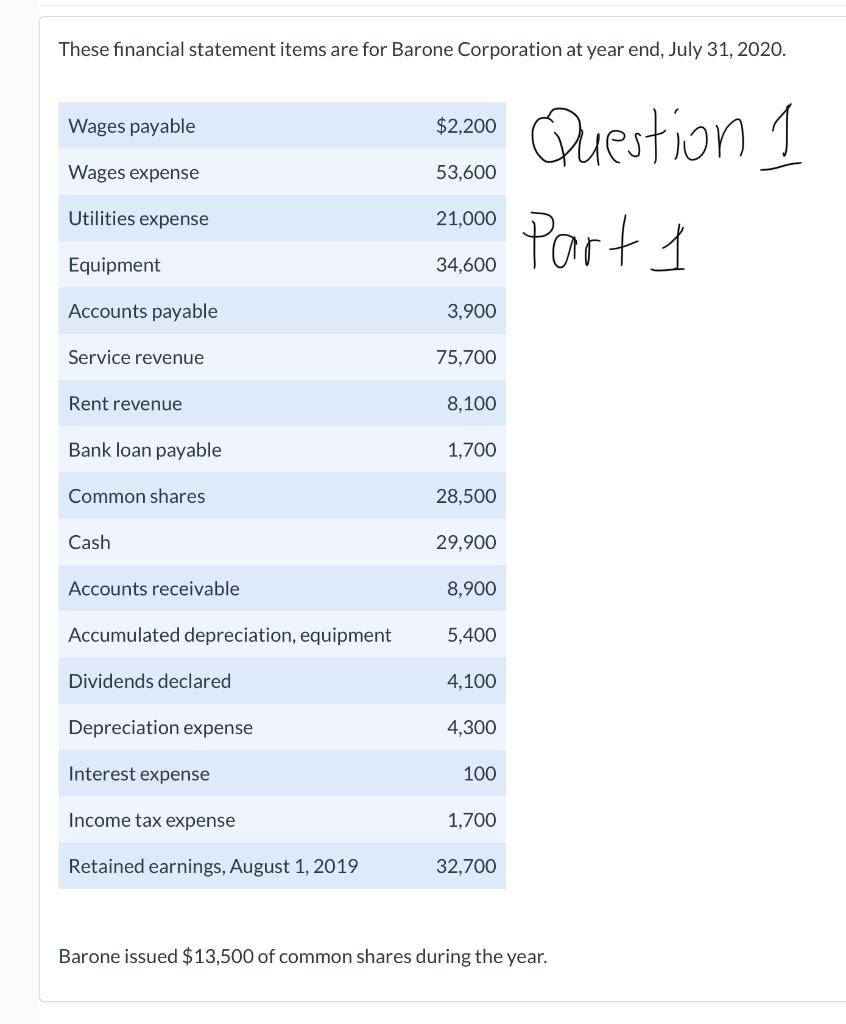

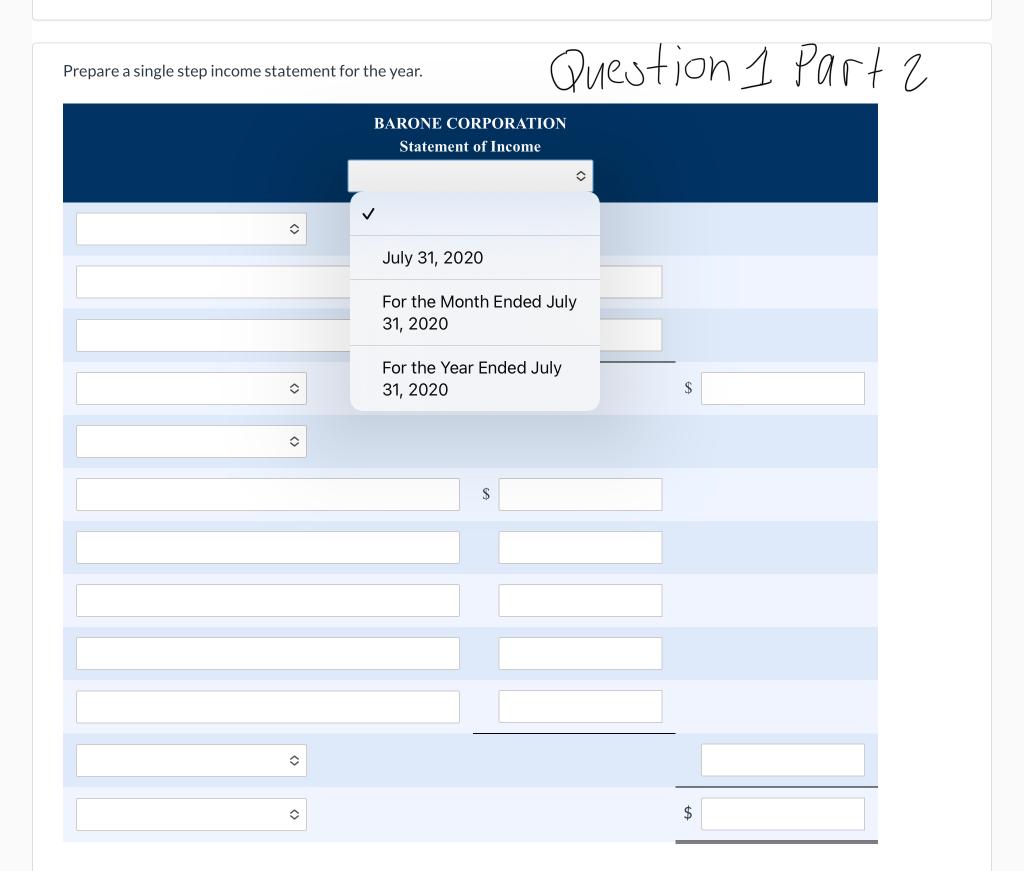

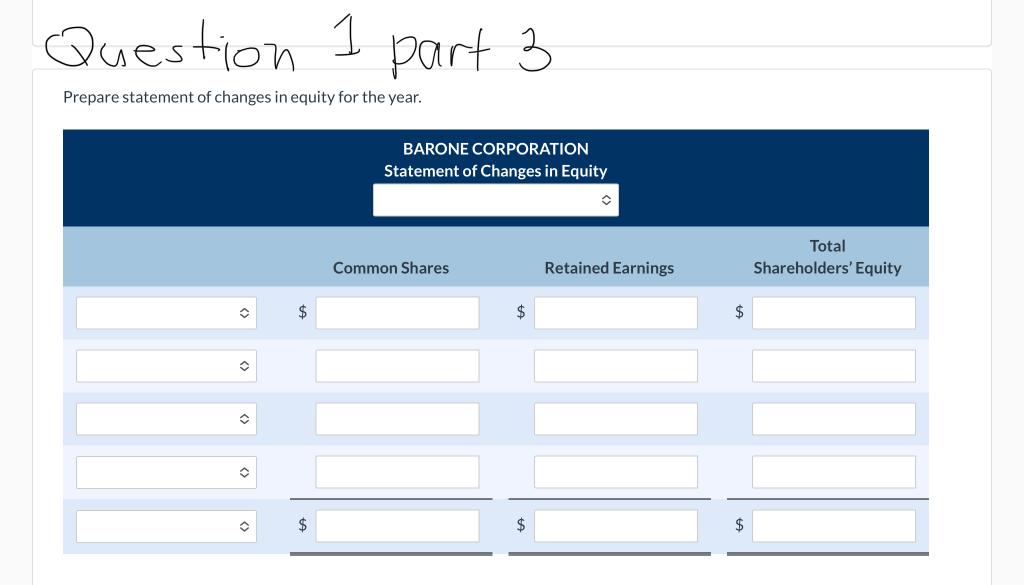

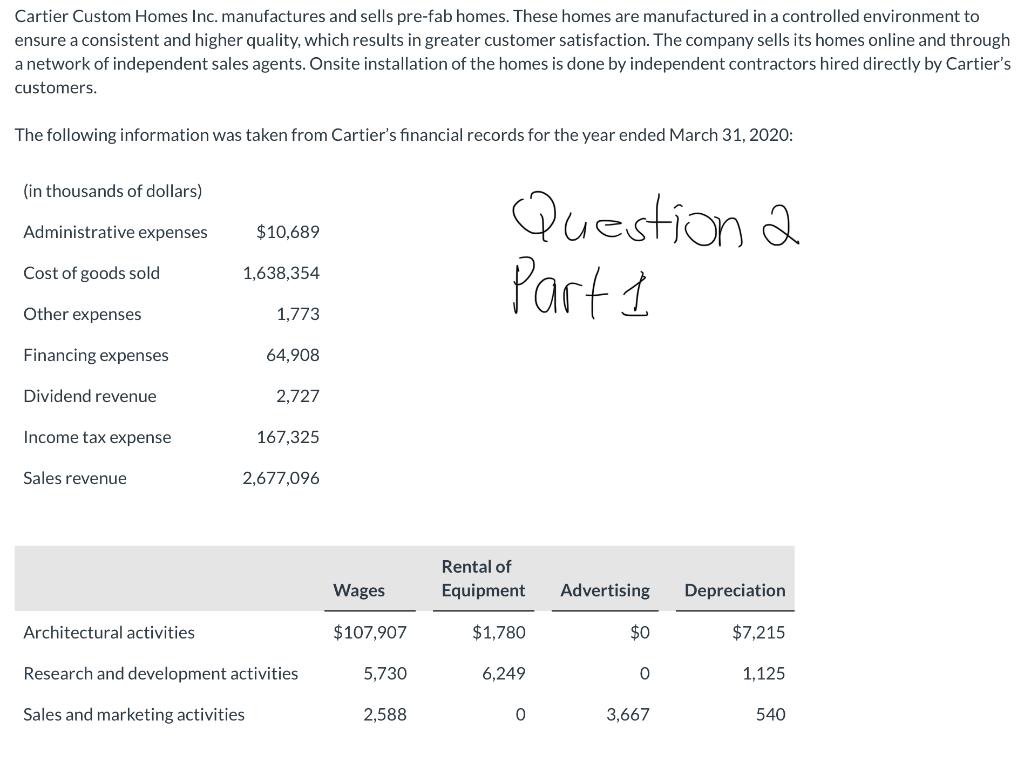

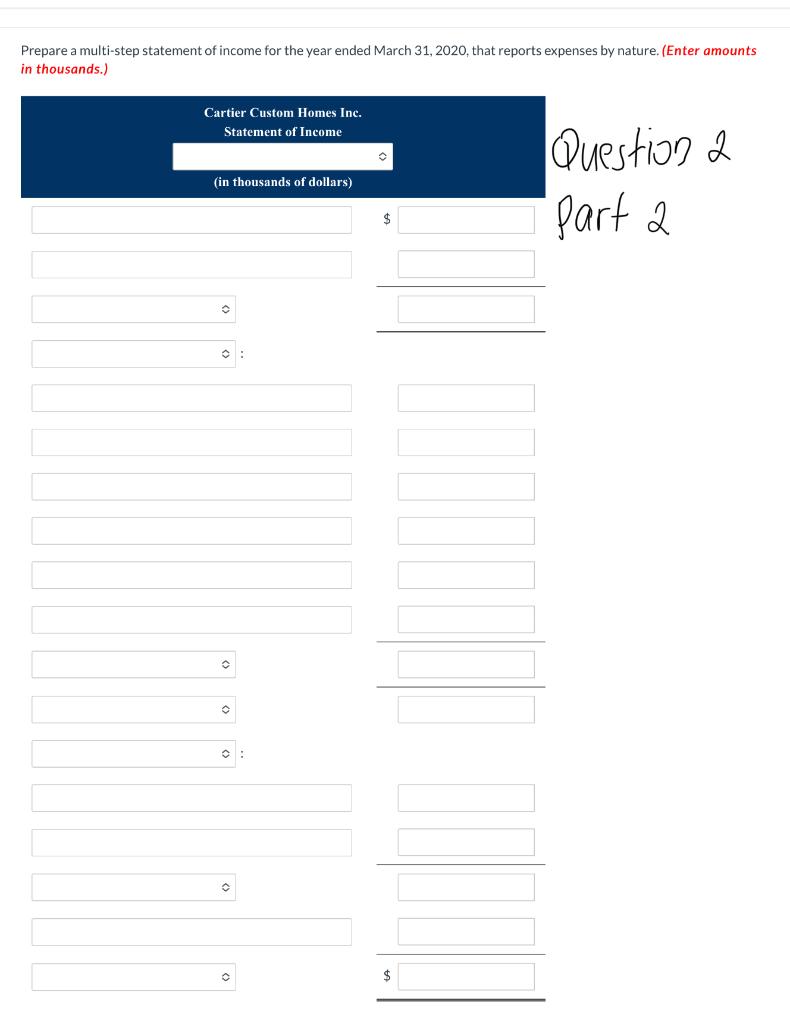

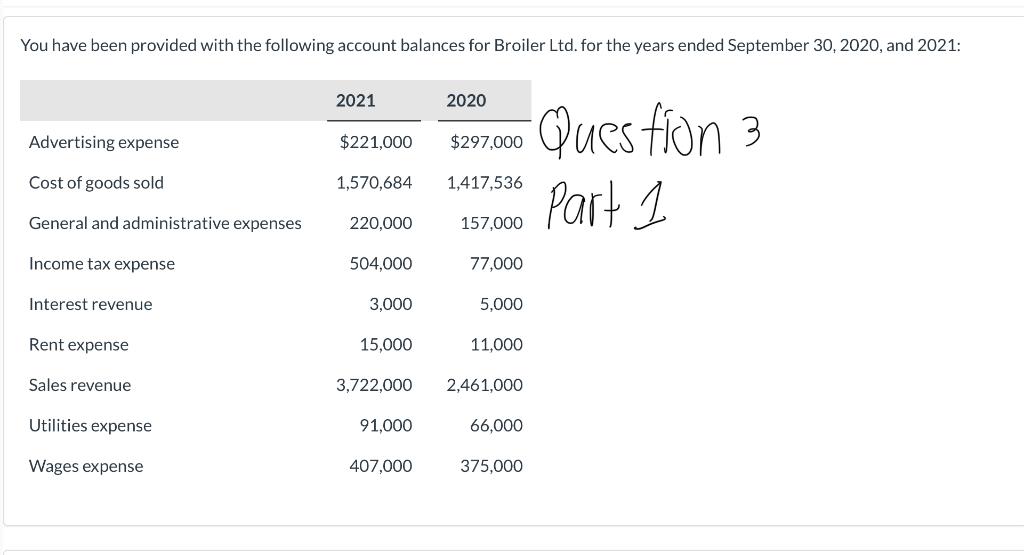

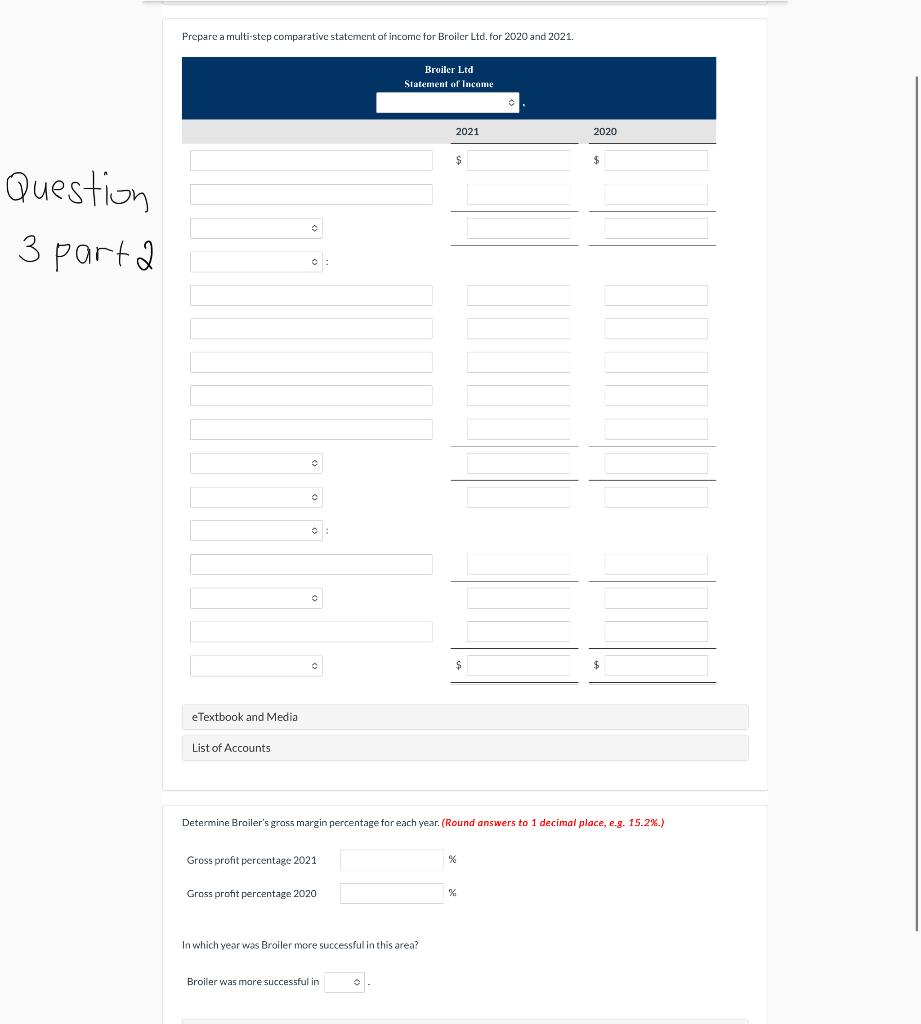

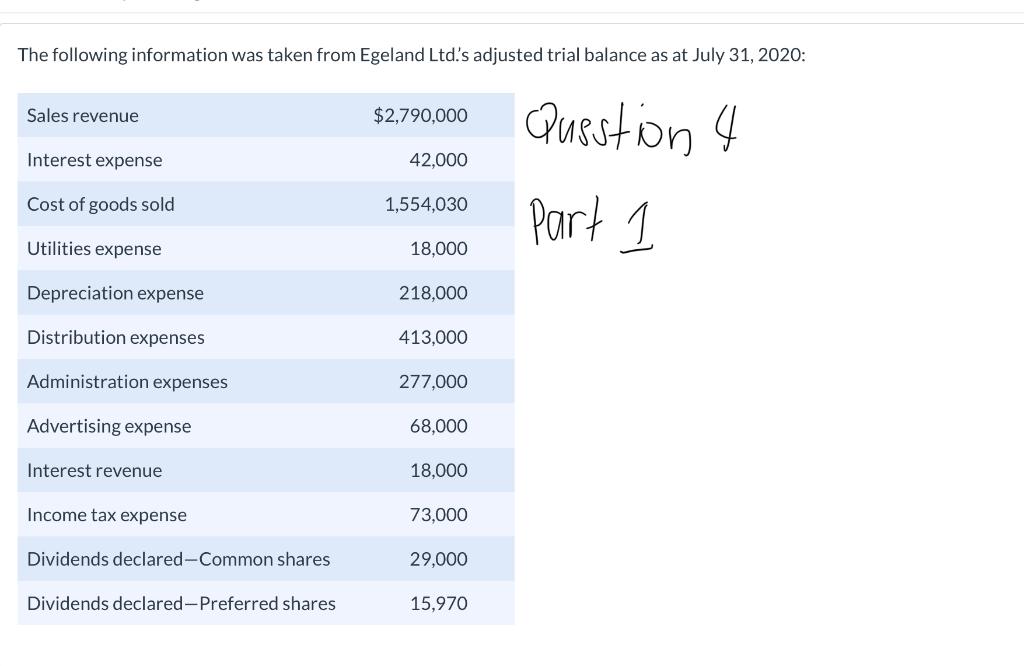

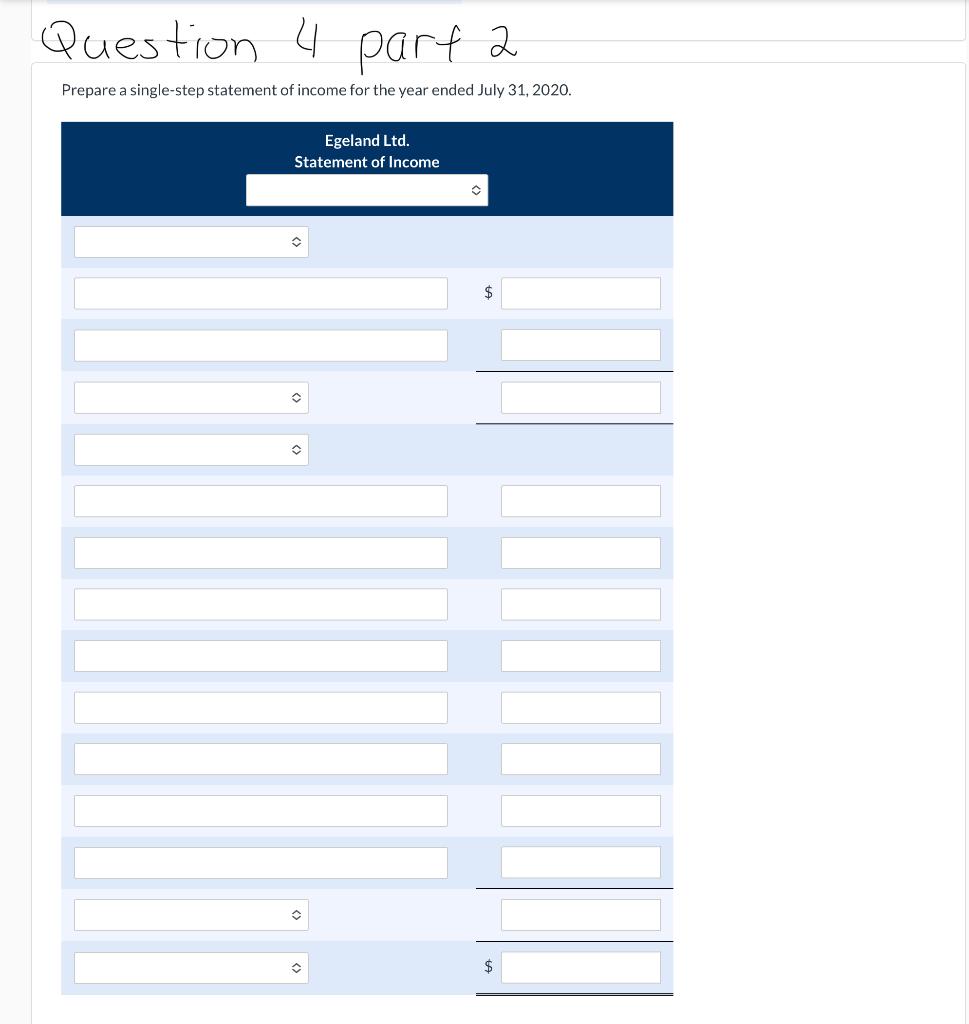

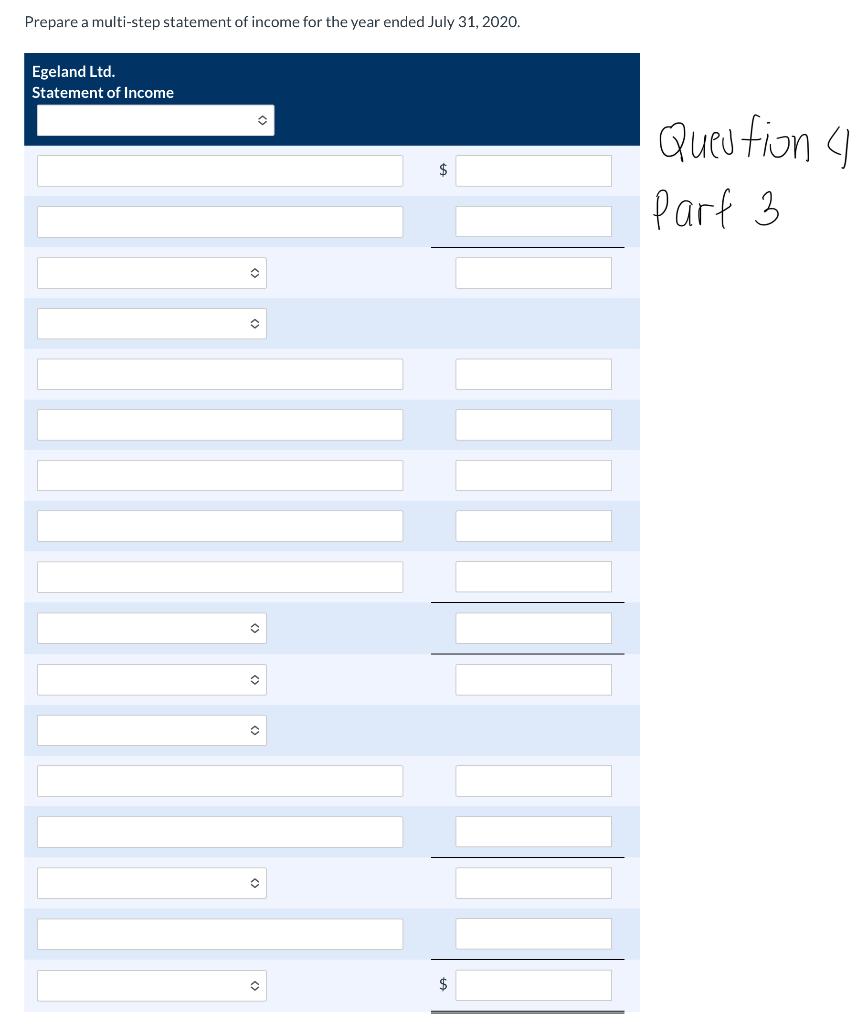

These financial statement items are for Barone Corporation at year end, July 31, 2020. Wages payable $2,200 Wages expense 53,600 Question 1 Part 1 Utilities expense 21,000 Equipment 34,600 Accounts payable 3,900 Service revenue 75,700 Rent revenue 8,100 Bank loan payable 1,700 Common shares 28,500 Cash 29.900 Accounts receivable 8,900 Accumulated depreciation, equipment 5,400 Dividends declared 4,100 Depreciation expense 4,300 Interest expense 100 Income tax expense 1,700 Retained earnings, August 1, 2019 32,700 Barone issued $13,500 of common shares during the year. Prepare a single step income statement for the year. Question 1 Part 2 BARONE CORPORATION Statement of Income > July 31, 2020 For the Month Ended July 31, 2020 For the Year Ended July 31, 2020 S $ Question 1 part 3 Prepare statement of changes in equity for the year. BARONE CORPORATION Statement of Changes in Equity Total Shareholders' Equity Common Shares Retained Earnings $ $ $ Cartier Custom Homes Inc. manufactures and sells pre-fab homes. These homes are manufactured in a controlled environment to ensure a consistent and higher quality, which results in greater customer satisfaction. The company sells its homes online and through a network of independent sales agents. Onsite installation of the homes is done by independent contractors hired directly by Cartier's customers. The following information was taken from Cartier's financial records for the year ended March 31, 2020: (in thousands of dollars) Administrative expenses $10,689 Question a Part 1 Cost of goods sold 1,638,354 Other expenses 1,773 Financing expenses 64,908 Dividend revenue 2,727 Income tax expense 167,325 Sales revenue 2,677,096 Rental of Equipment Wages Advertising Depreciation Architectural activities $107,907 $1,780 $0 $7,215 Research and development activities 5,730 6,249 0 1,125 Sales and marketing activities 2,588 0 3,667 540 Prepare a multi-step statement of income for the year ended March 31, 2020, that reports expenses by nature. (Enter amounts in thousands.) Cartier Custom Homes Inc. Statement of Income (in thousands of dollars) Question a part a $ . $ You have been provided with the following account balances for Broiler Ltd. for the years ended September 30, 2020, and 2021: 2021 2020 Advertising expense $221,000 $297,000 Question 3 Part 1 Cost of goods sold 1,570,684 1,417,536 General and administrative expenses 220,000 157,000 Income tax expense 504,000 77,000 Interest revenue 3,000 5,000 Rent expense 15,000 11,000 Sales revenue 3,722,000 2,461,000 Utilities expense 91,000 66,000 Wages expense 407,000 375,000 Prepare a multi-step comparative statement of income for Broiler Ltd. for 2020 and 2021. Broiler Ltd Statement of Income 2021 2020 $ Question 3 parta o . $ e Textbook and Media List of Accounts Determine Broiler's grass margin percentage for each year. (Round answers to 1 decimal place, e.g. 15.2%.) Gross profit percentage 2021 % Gross profit percentage 2020 In which year was Broiler more successful in this area? Broiler was more successful in The following information was taken from Egeland Ltd's adjusted trial balance as at July 31, 2020: Sales revenue $2,790,000 Question 4 Interest expense 42,000 Cost of goods sold 1,554,030 part Utilities expense 18,000 Depreciation expense 218,000 Distribution expenses 413,000 Administration expenses 277,000 Advertising expense 68,000 Interest revenue 18,000 Income tax expense 73,000 Dividends declared-Common shares 29,000 Dividends declared-Preferred shares 15,970 Question 4 part 2 Prepare a single-step statement of income for the year ended July 31, 2020. Egeland Ltd. Statement of Income $ $ Prepare a multi-step statement of income for the year ended July 31, 2020. Egeland Ltd. Statement of Income $ Question 4 part 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts