Question: Please help me to solve ROIC and give me calculation details. Thank you. 2008 Forecast FCF Operating revenue (-) Operating expense Operating income (before tax)

Please help me to solve ROIC and give me calculation details. Thank you.

Please help me to solve ROIC and give me calculation details. Thank you.

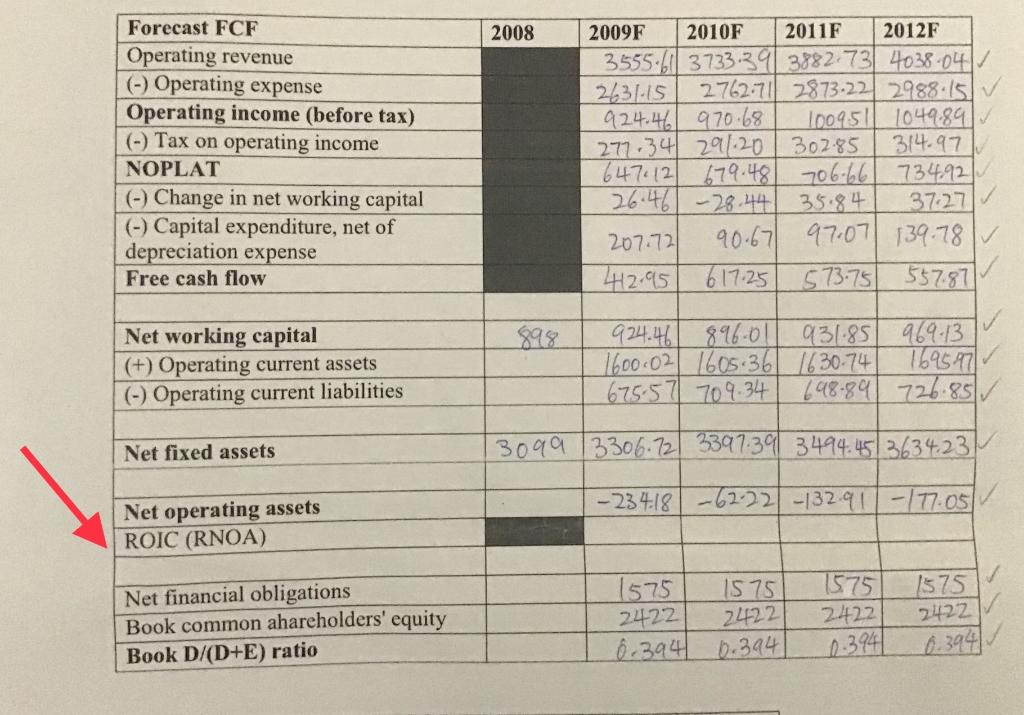

2008 Forecast FCF Operating revenue (-) Operating expense Operating income (before tax) (-) Tax on operating income NOPLAT (-) Change in net working capital (-) Capital expenditure, net of depreciation expense Free cash flow 2009F 2010F 2011F 2012F 3555.61 3733.39 3882 73 4038-04 2631-15 2762-71 2873-22 2988.15 V 924.46 970.68 100951 1049.89 277.34 291.20 30285 314.97 647.12 679.48 706 66 734.92 26.46 -28.44 35.84 207.72 90.67 97.07 139.78 V 412.95 617.25 573.75 3727 557.87/ 898 Net working capital (+) Operating current assets (-) Operating current liabilities 924.46 896-01 931.85 969-13 1600.02 1605.36 1630.74 169597 675.57 709.34 698.89 726.85 Net fixed assets 3099 3306.723397:39 3494.45.363423 -234-18 -62-22-132.91 - 177.05 Net operating assets ROIC (RNOA) 1575 2422 6.3941 1575 2422 1575 2422 Net financial obligations Book common ahareholders' equity Book D/(D+E) ratio 1575 2422 0.394 0.394 10.3941

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts