Question: Read the following statements regarding financial statement analysis and select the correct statement(s). A. The current ratio of a company, and how it changes from

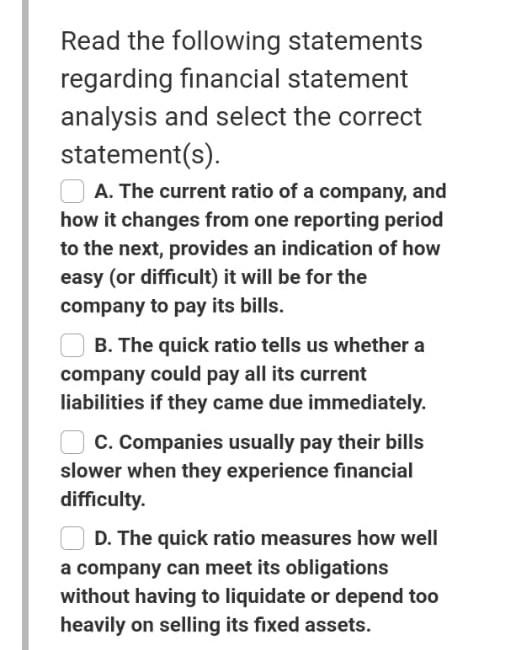

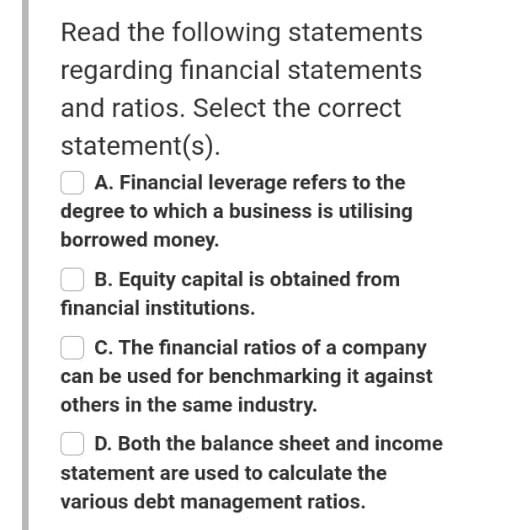

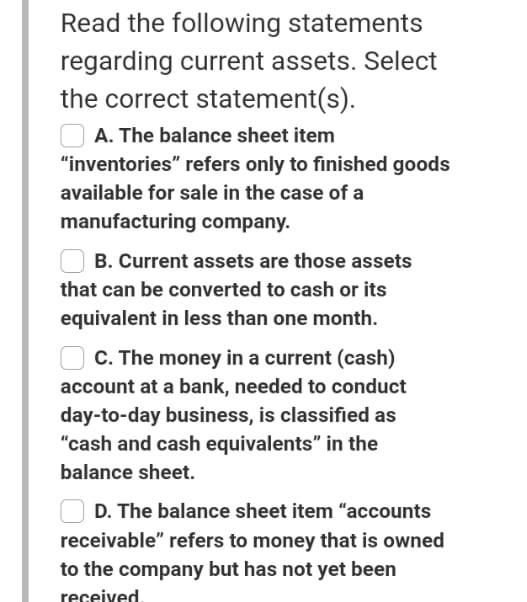

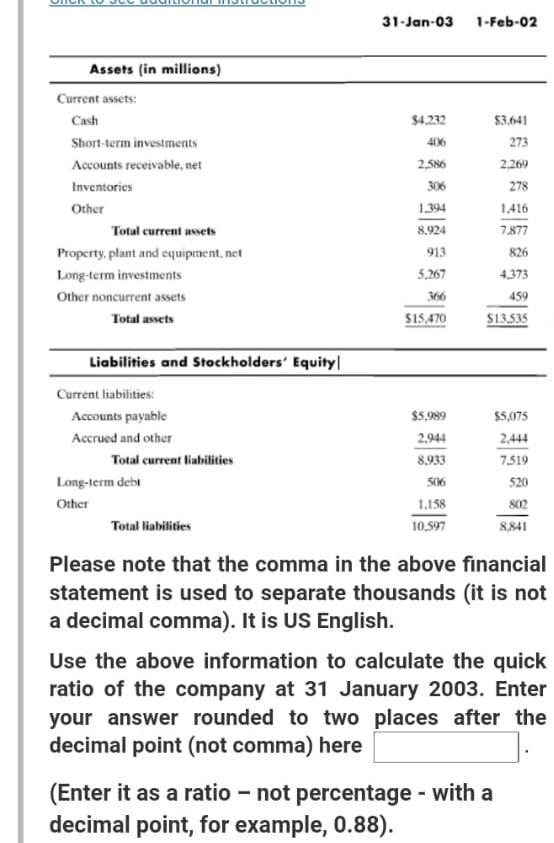

Read the following statements regarding financial statement analysis and select the correct statement(s). A. The current ratio of a company, and how it changes from one reporting period to the next, provides an indication of how easy (or difficult) it will be for the company to pay its bills. B. The quick ratio tells us whether a company could pay all its current liabilities if they came due immediately. C. Companies usually pay their bills slower when they experience financial difficulty. D. The quick ratio measures how well a company can meet its obligations without having to liquidate or depend too heavily on selling its fixed assets. Read the following statements regarding financial statements and ratios. Select the correct . statement(s). A. Financial leverage refers to the degree to which a business is utilising borrowed money. B. Equity capital is obtained from financial institutions. C. The financial ratios of a company can be used for benchmarking it against others in the same industry. D. Both the balance sheet and income statement are used to calculate the various debt management ratios. Read the following statements regarding current assets. Select the correct statement(s). A. The balance sheet item "inventories" refers only to finished goods available for sale in the case of a manufacturing company. B. Current assets are those assets that can be converted to cash or its equivalent in less than one month. C. The money in a current (cash) account at a bank, needed to conduct day-to-day business, is classified as "cash and cash equivalents in the balance sheet. D. The balance sheet item "accounts receivable refers to money that is owned to the company but has not yet been received 31-Jan-03 1-Feb-02 Assets (in millions) Current assets: Cash Short-term investments Accounts receivable, net Inventories Other Total current assets Property, plant and equipment, net Long-term investments Other noncurrent assets Total assets $4.232 40% 2,586 306 1.394 8.924 913 5.267 366 $15.470 $3.641 273 2,260 278 1.416 7877 826 4.373 459 $13.535 Liabilities and Stockholders' Equity Current liabilities: Accounts payable Accrued and other Total current liabilities Long-term debt Other Total liabilities $5.989 2.944 8,933 506 1.158 10.597 $5,075 2.444 7.519 520 802 8.841 Please note that the comma in the above financial statement is used to separate thousands (it is not a decimal comma). It is US English. Use the above information to calculate the quick ratio of the company at 31 January 2003. Enter your answer rounded to two places after the decimal point (not comma) here (Enter it as a ratio - not percentage - with a decimal point, for example, 0.88)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts