Question: Please help me to solve the last Quantitative Problem with the red X. I have provided all the info that was given to me. Financial

Please help me to solve the last Quantitative Problem with the red X. I have provided all the info that was given to me.

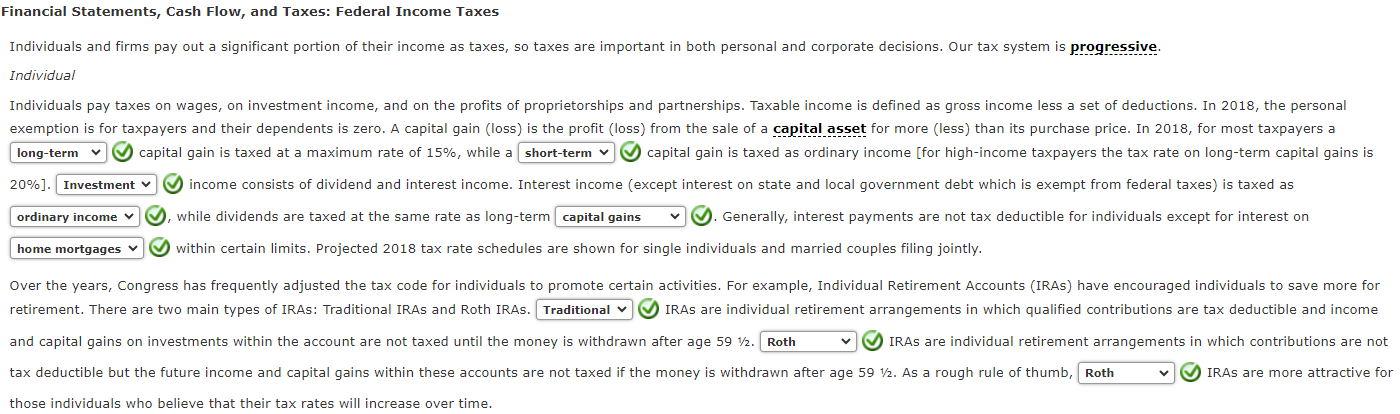

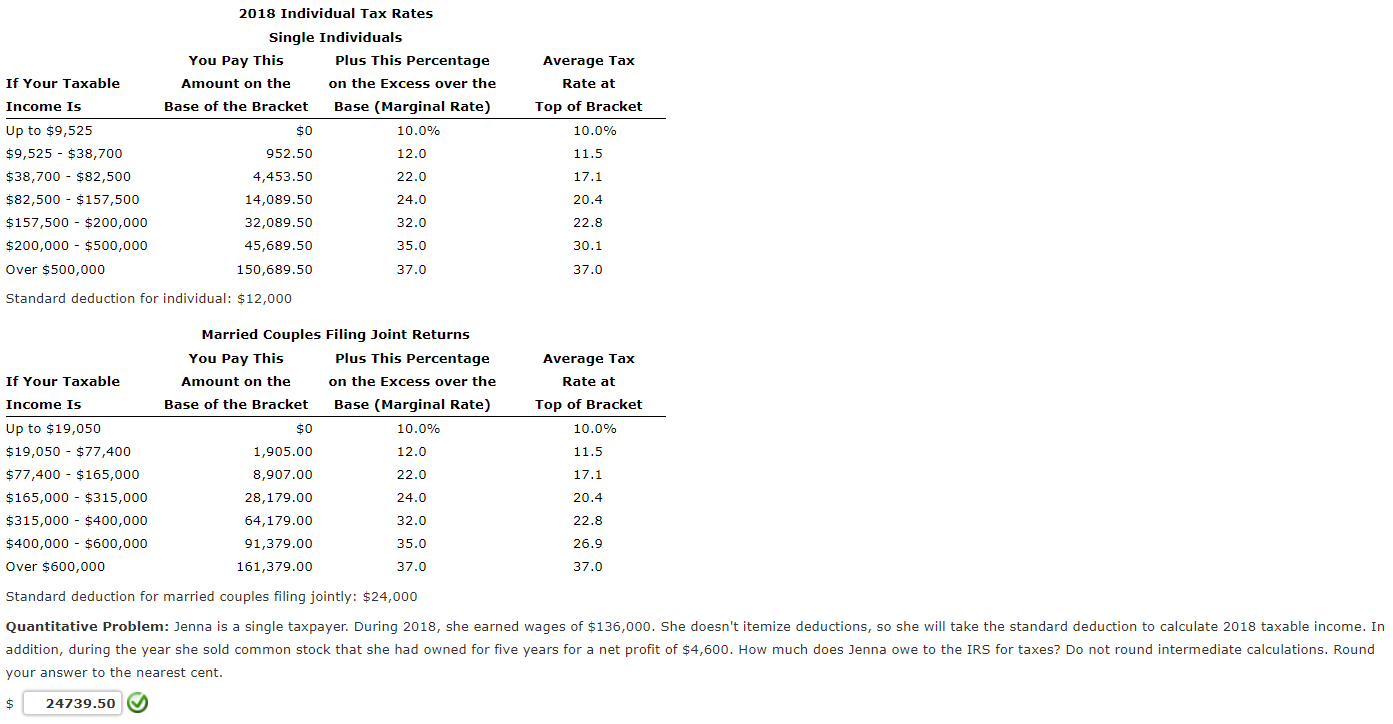

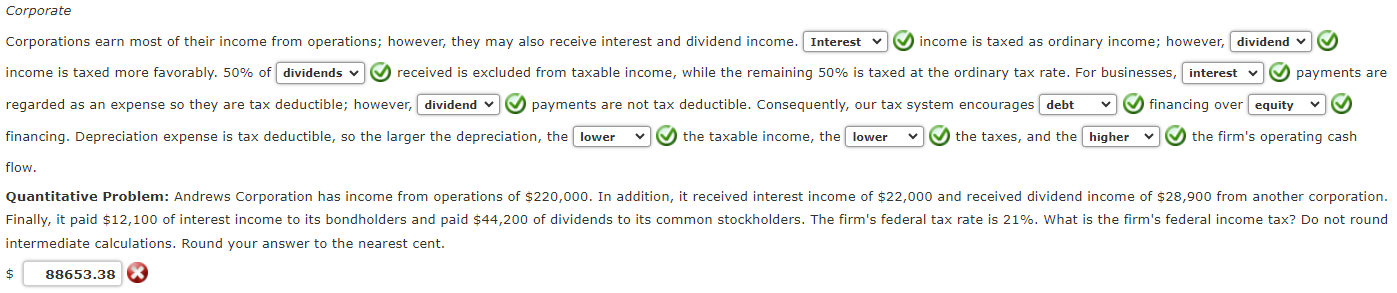

Financial Statements, Cash Flow, and Taxes: Federal Income Taxes Individuals and firms pay out a significant portion of their income as taxes, so taxes are important in both personal and corporate decisions. Our tax system is progressive. Individual capital gain is taxed at a maximum rate of 15%, while a capital gain is taxed as ordinary income [for high-income taxpayers the tax rate on long-term capital gains is 20%]. income consists of dividend and interest income. Interest income (except interest on state and local government debt which is exempt from federal taxes) is taxed as , while dividends are taxed at the same rate as long-term V. Generally, interest payments are not tax deductible for individuals except for interest on within certain limits. Projected 2018 tax rate schedules are shown for single individuals and married couples filing jointly. retirement. There are two main types of IRAs: Traditional IRAs and Roth IRAs. IRAs are individual retirement arrangements in which qualified contributions are tax deductible and income and capital gains on investments within the account are not taxed until the money is withdrawn after age 591212. IRAs are individual retirement arrangements in which contributions are not tax deductible but the future income and capital gains within these accounts are not taxed if the money is withdrawn after age 591/2. As a rough rule of thumb, IRAs are more attractive for those individuals who believe that their tax rates will increase over time. Standard deduction for married couples filing jointly: $24,000 your answer to the nearest cent. $ Corporations earn most of their income from operations; however, they may also receive interest and dividend income. income is taxed as ordinary income; however, ncome is taxed more favorably. 50% of received is excluded from taxable income, while the remaining 50% is taxed at the ordinary tax rate. For businesses, egarded as an expense so they are tax deductible; however, payments are not tax deductible. Consequently, our tax system encourages inancing. Depreciation expense is tax deductible, so the larger the depreciation, the the taxable income, the the taxes, and the financing over low. ntermediate calculations. Round your answer to the nearest cent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts