Question: Please help me to solve this problem thank you Derek has shares of UltFrisCorp that he would like to transfer, using Section 85, to a

Please help me to solve this problem thank you

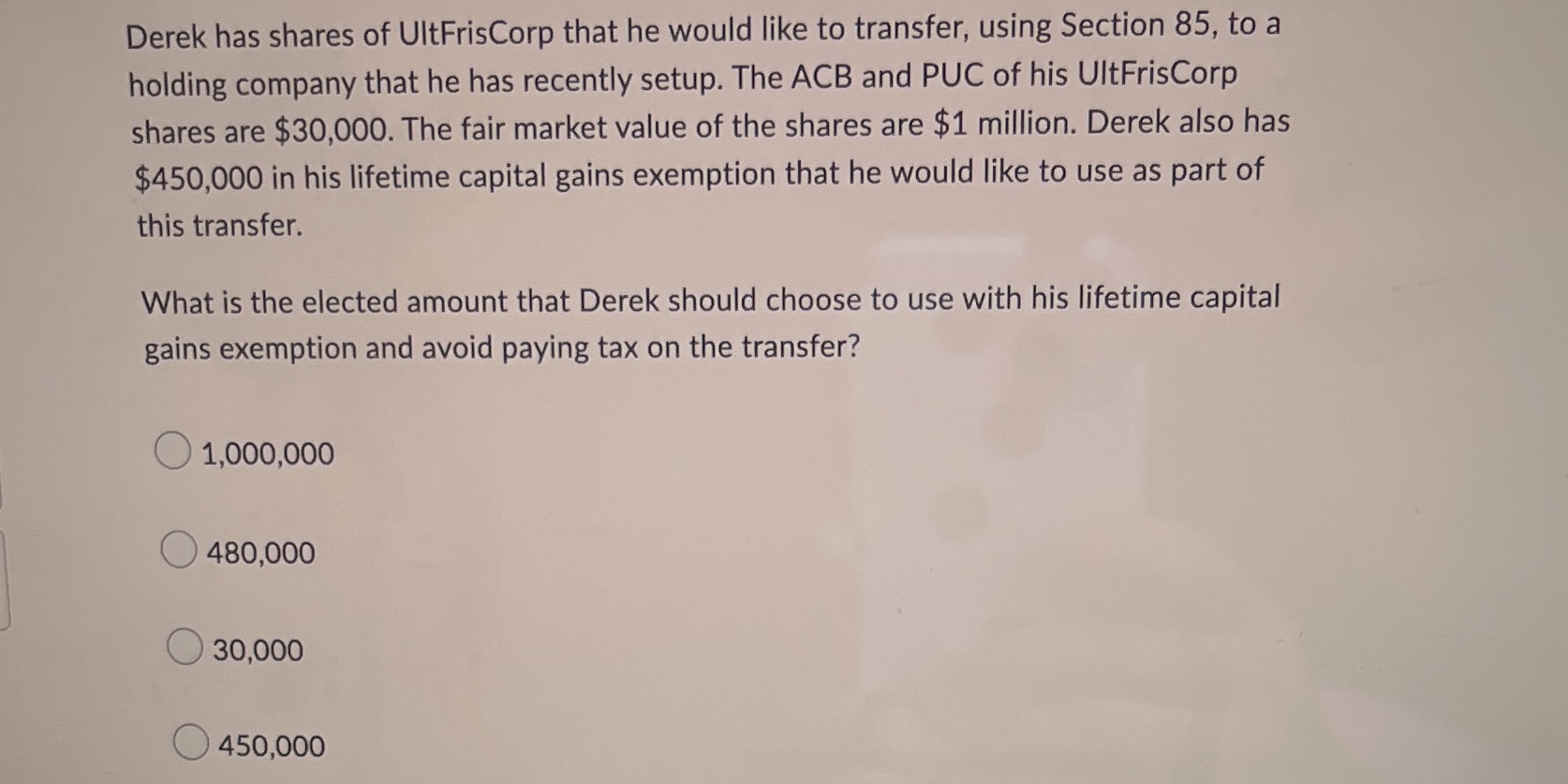

Derek has shares of UltFrisCorp that he would like to transfer, using Section 85, to a holding company that he has recently setup. The ACB and PUC of his UltFrisCorp shares are $30,000. The fair market value of the shares are $1 million. Derek also has $450,000 in his lifetime capital gains exemption that he would like to use as part of this transfer. What is the elected amount that Derek should choose to use with his lifetime capital gains exemption and avoid paying tax on the transfer? 1,000,000 480,000 30,000 450,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts