Question: Please help me to solve this question: (a) The company is considering producing a new chair and anticipate that the costs of machinery, in the

Please help me to solve this question:

(a) The company is considering producing a new chair and anticipate that the costs of machinery, in the first year, to be 3,000,000. They anticipate that they will continue with this product for 6 years whereby they will not be able to sell the machinery for 100,000. Assuming a six year scenario, they anticipate the business will make additional revenues each year, as in the table below. Complete the Table (inclusive of the initial cost and sale revenue) and determine whether the equipment should be purchased using an interest rate of 9%.

| Period | Amount | Discount Factor | Present Value |

| 0 | -Initial Cost | ||

| 1 | 500,000 | ||

| 2 | 700,000 | ||

| 3 | 900,000 | ||

| 4 | 800,000 | ||

| 5 | 700,000 | ||

| 6 | 400,000 + Sale Value |

(b) Now assume that there is a 40% probability that both the following will happen (with 60% probability as in part a):

(i) They will recover 0 for the machinery in year 6; and,

(ii) The interest rate will be 11%

Determine whether it is wise to continue with the project.

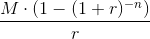

(c) The business has the opportunity to buy an annuity for 3,000,000. This annuity will yield 650,000 for 6 years in a row. Determine whether they would be better off buying this annuity relative to undertaking the investment above under the assumptions in part a). Use the formula for calculating an annuity  .

.

(d) If the company is risk averse, then will this have any impact on the conclusions above?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts