Question: ----Please help me to using EXCEL sheet and show/explain detail solution--- -. Thank you very much for your help. It helps me a lot to

----Please help me to using EXCEL sheet and show/explain detail solution----. Thank you very much for your help.

It helps me a lot to learn this course. This way I can study myself. I really appreciate for your help.

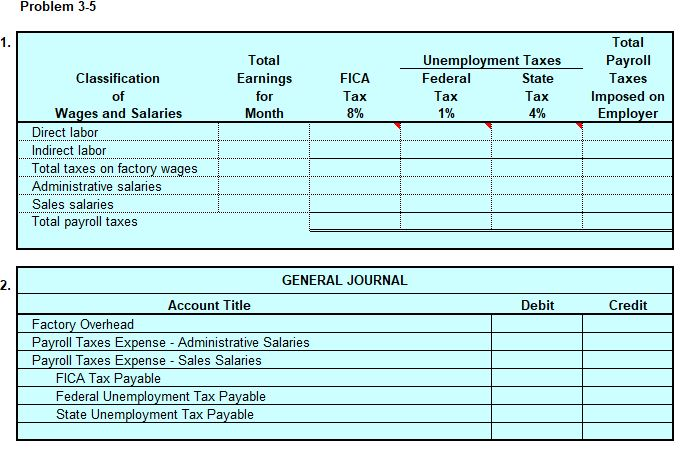

I need to answer bottom of excel sheet on by one. Thank you so much.

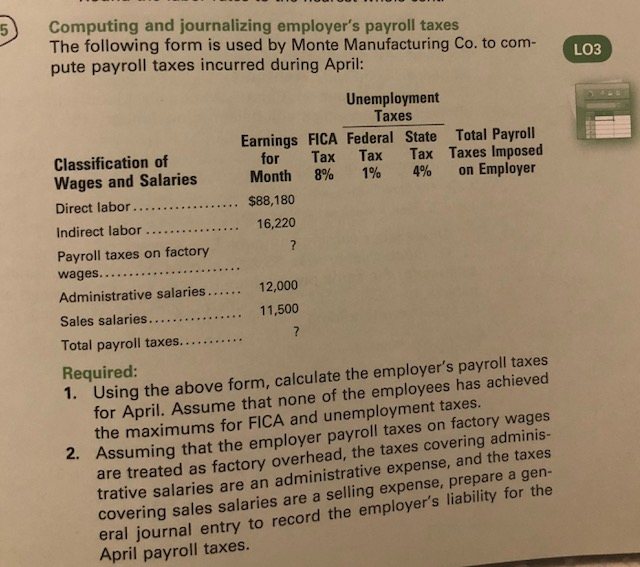

Computing and journalizing employer's payroll taxes The following form is used by Monte Manufacturing Co. to com- pute payroll taxes incurred during April: LO3 Unemployment Taxes Earnings FICA Federal State Total Payroll Classification of for Tax Tax Tax Taxes Imposed Wages and Salaries Month 8% 1% 4% on Employer Direct labor.. $88,180 Indirect labor. 16,220 Payroll taxes on factory wages........ Administrative salaries ...... 12,000 11,500 Sales salaries.... Total payroll taxes..... Required: 1. Using the above form, calculate the employer's payroll taxes for April. Assume that none of the employees has achieved the maximums for FICA and unemployment taxes. Assuming that the employer payroll taxes on factory wages are treated as factory overhead, the taxes covering adminis- trative salaries are an administrative expense, and the taxes Covering sales salaries are a selling expense, prepare a gen- eral journal entry to record the employer's liability for the April payroll taxes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts