Question: Please help me understand how to apply the binomial tree model to determine the fair value of an Asian option. Valuing an Exotic Option The

Please help me understand how to apply the binomial tree model to determine the fair value of an Asian option.

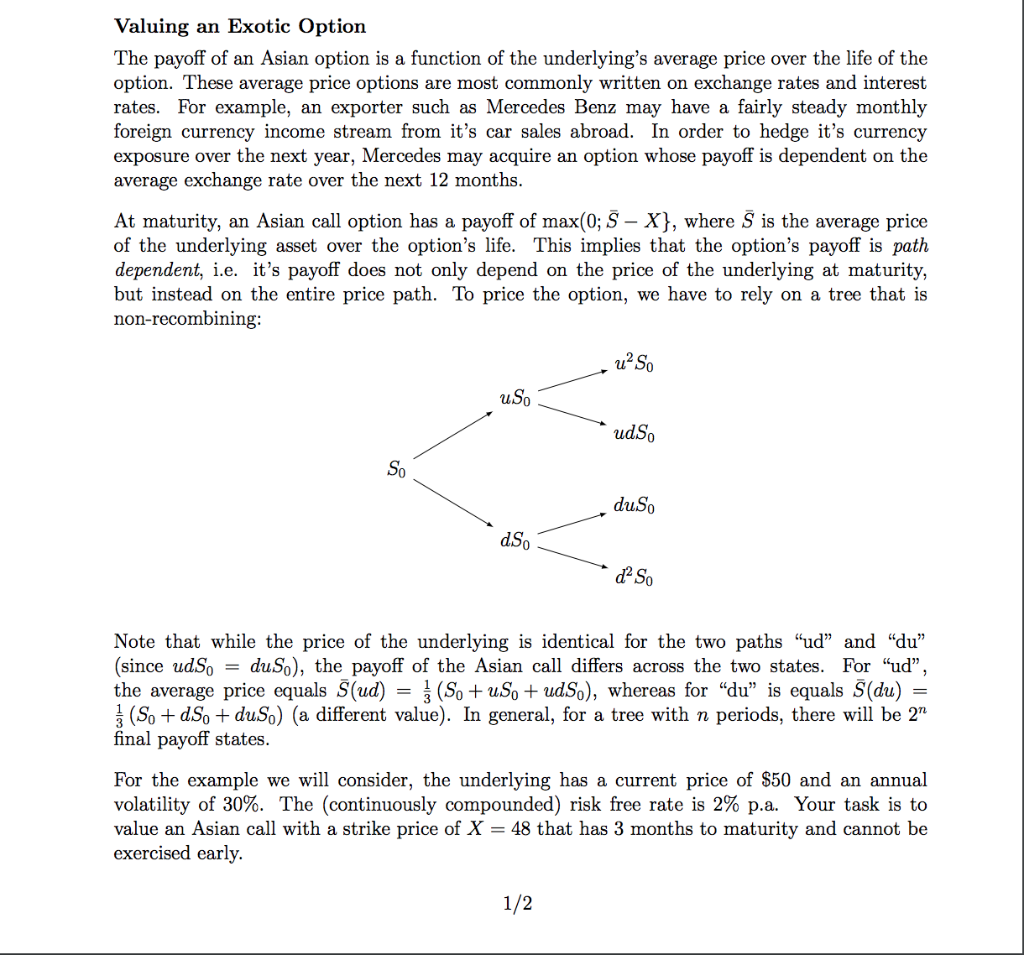

Valuing an Exotic Option The payoff of an Asian option is a function of the underlying's average price over the life of the option. These average price options are most commonly written on exchange rates and interest rates. For example, an exporter such as Mercedes Benz may have a fairly steady monthly foreign currency income stream from it's car sales abroad. In order to hedge it's currency exposure over the next year, Mercedes may acquire an option whose payoff is dependent on the average exchange rate over the next 12 months. At maturity, an Asian call option has a payoff of max(0; S - X}, where S is the average price of the underlying asset over the option's life. This implies that the option's payoff is path dependent, i.e. it's payoff does not only depend on the price of the underlying at maturity, but instead on the entire price path. To price the option, we have to rely on a tree that is non-recombining: , uS uso dus ds

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts